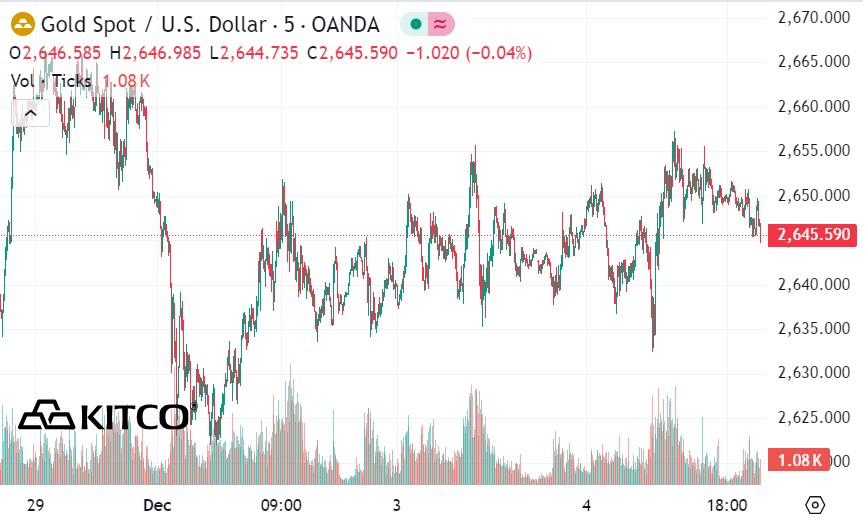

According to Kitco, the latest jobs report from Automatic Data Processing, Inc (a leading US company specializing in providing human resource management solutions, including payroll, tax and human resource management services) became a significant fundamental support factor for gold prices.

The report showed the private sector created 146,000 jobs in November, down significantly from the previous month's 233,000 and below MarketWatch's forecast of 163,000.

Investors are now waiting for the US non-farm payrolls report, due out on Friday, for further data on the health of the labor market.

Along with the jobs data, U.S. Treasury yields showed a slight decline. The yield on the 2-year note fell 6 basis points to 4.218 percent, while the 10-year note fell 3.8 basis points to 4.19 percent. The decline provided some support to gold prices.

Federal Reserve Chairman Jerome Powell’s recent remarks at an event hosted by the New York Times added further complexity to market sentiment. These were his final remarks before the year-end Federal Open Market Committee (FOMC) meeting on December 18.

Mr. Powell assessed the current economy as stronger than the Fed forecast in September and emphasized a cautious approach to normalizing interest rates.

Powell's statement highlighted the positive economic outlook: "The U.S. economy is in very good shape and there is no reason why this should not continue... Downside risks appear to be less in the labor market, growth is certainly stronger than expected and inflation is somewhat higher."

Despite the hawkish tone, the market consensus on the Fed's monetary policy path has not changed significantly. The CME FedWatch tool shows a 77.5% chance of a 25 basis point rate cut this month, up from 66.5% last week and 72.9% yesterday.

In the short term, the outlook for gold remains cautious. The strength of the US dollar is expected to play a key role in guiding gold prices, as investors focus on the upcoming jobs report.

According to Fawad Razaqzad of StoneX, if the jobs report is weaker than expected, hopes of a dovish Fed could boost gold prices. Conversely, better-than-expected data could add to the current pressure on the market.

See more news related to gold prices HERE...