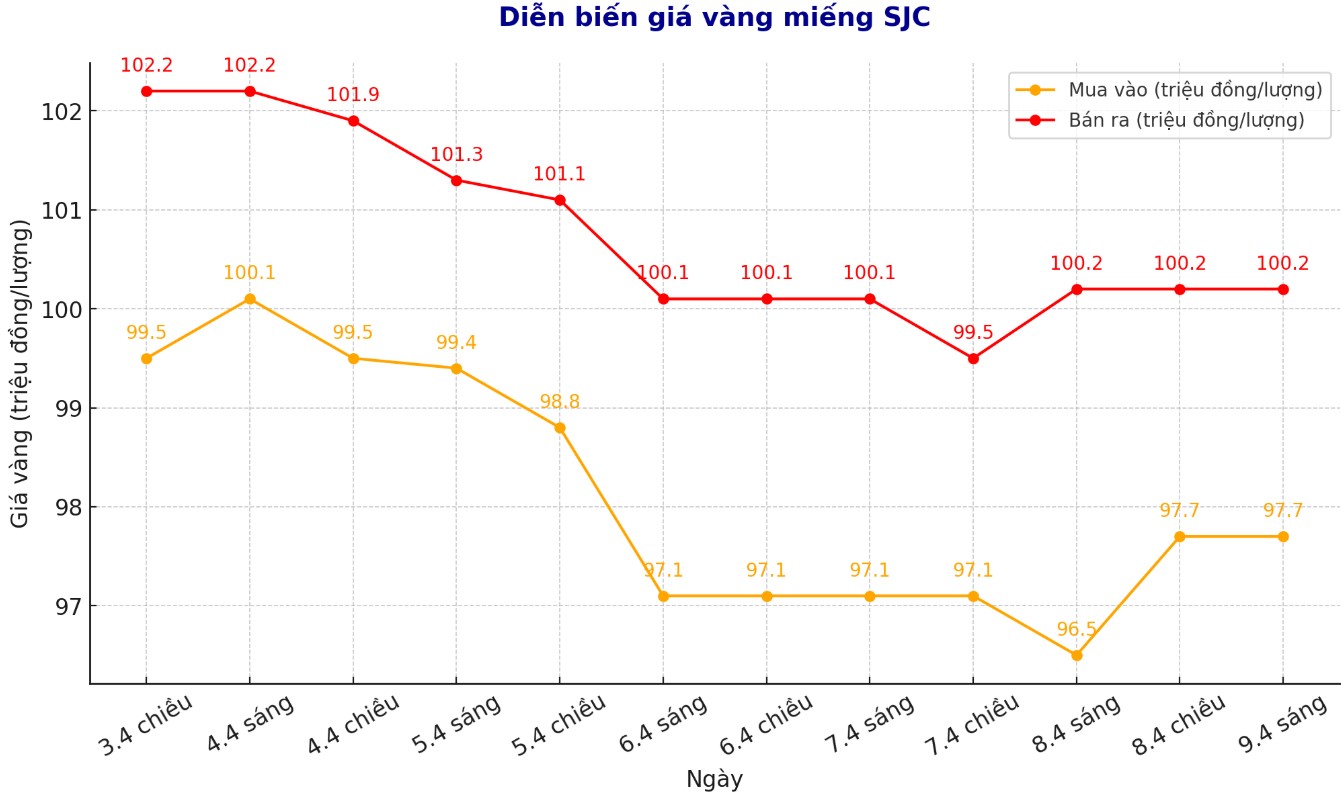

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND97.700.2 million/tael (buy - sell), an increase of VND600,000/tael for buying and an increase of VND100,000/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 97.7-100 million VND/tael (buy - sell), an increase of 600,000 VND/tael for buying and an increase of 100,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 97.8-100.2 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and an increase of 100,000 VND/tael for selling. The difference between buying and selling prices is at 2.4 million VND/tael.

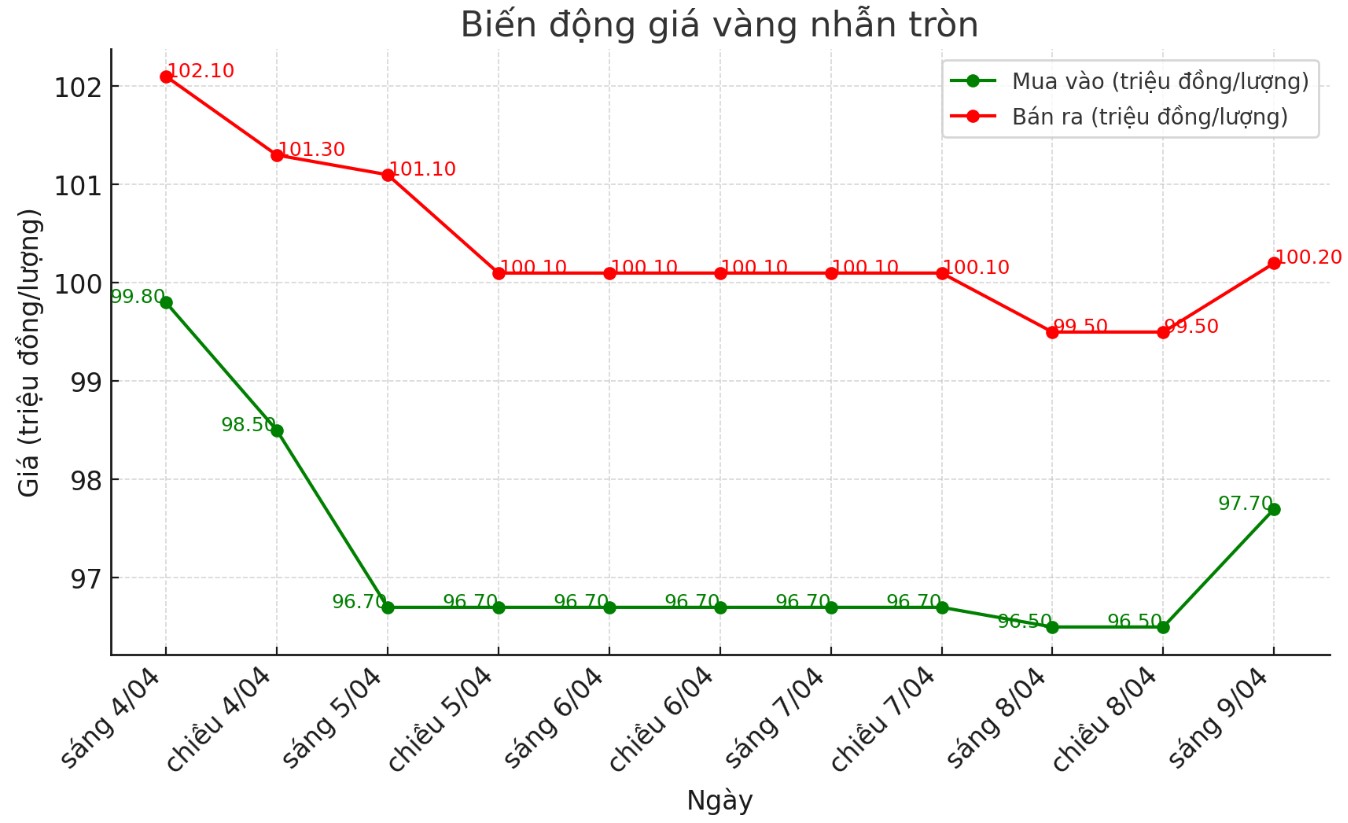

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 97.7/00.2 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 100,000 VND/tael for selling. The difference between buying and selling is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98-100.3 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and kept the same for selling. The difference between buying and selling is 2.3 million VND/tael.

As world gold prices fluctuate strongly, the gap between domestic and domestic prices is widening, showing very clear risks. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

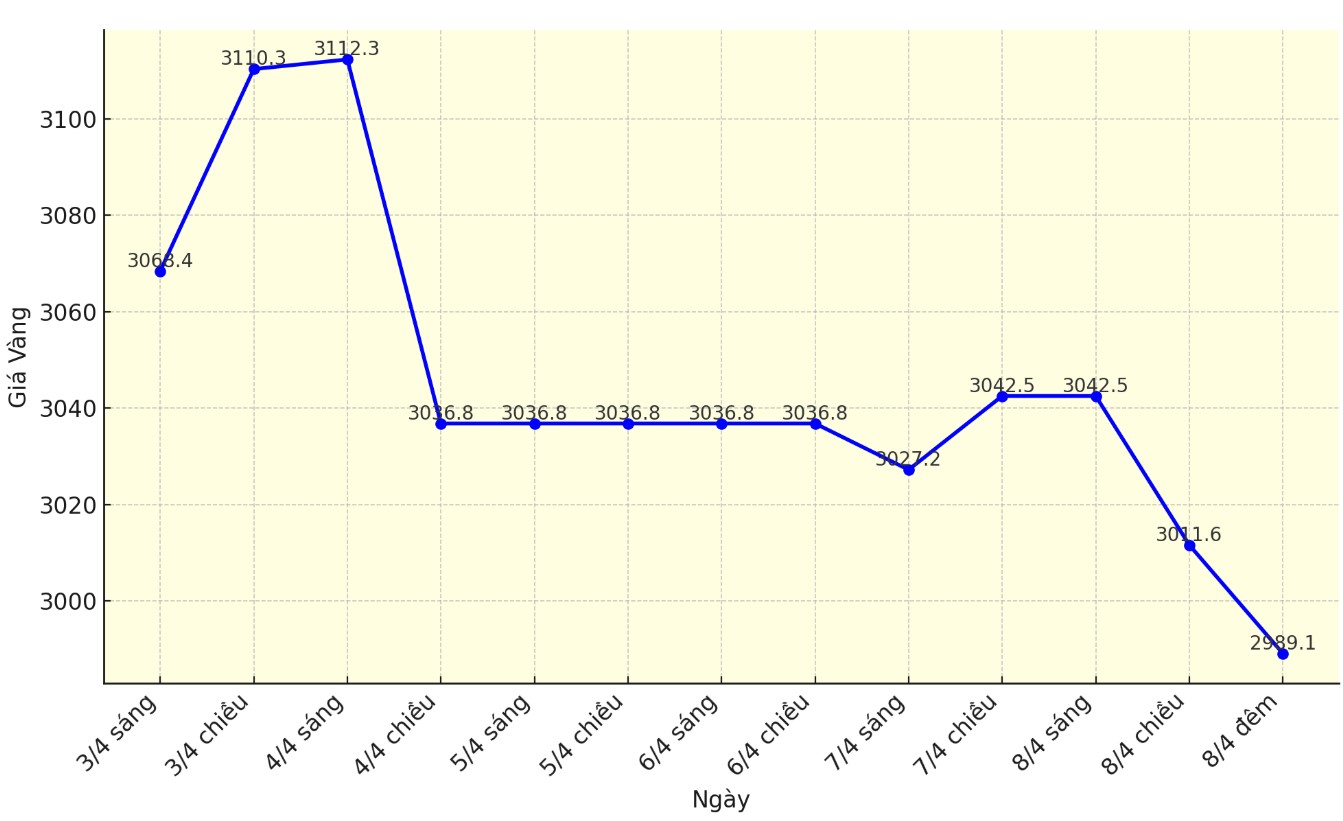

World gold price

As of 11:40 p.m. on April 8, the world gold price was listed at 2,989.1 USD/ounce.

Gold price forecast

Although the world gold price fell last night, Jim Wyckoff - senior analyst at Kitco said that the selling side is gradually exhausted. The bullish momentum has strongly participated in buying when prices have decreased. This shows that both metals have established a short-term price bottom.

June gold futures rose 57.1 USD to 3,030.7 USD/ounce. The price of silver futures for May increased by 0.721 USD to 30.325 USD/ounce.

The Asian and European stock markets mainly increased their scores in overnight trading. US stock indexes may open with a strong increase in New York today.

Risk-off sentiment seemed to have eased somewhat overnight. However, it seems unlikely to expect confidence to return to normal in the near future. New daily tariff statements from the White House or other major countries will keep traders and investors worried and keep risk avoidance levels high.

Today's Wall Street Journal summarizes why the market is currently struggling: "Whether global trade will collapse as it did in the 1930s depends on whether other countries retaliate and whether Donald Trump negotiates.

China and the US continue to face tariffs, with neither side conceding. Some market watchers are paying attention to the possibility of China adjusting the price of the yuan to improve its position in international trade.

Reports say the Chinese Central Bank has adjusted its daily benchmark to below 7.2 against the USD. The yuan exchange rate against the USD is currently at its weakest level since September 2023.

Key outside markets today saw the USD index slightly decrease. Nymex crude oil prices increased slightly and traded around $61/barrel. The yield on the 10-year US Treasury note is currently at 4.13%.

US Treasury yields are rising this week despite risk-off sentiment still popular in the general market. This will often attract demand for "hunting" for US Treasury bonds, reducing their yields.

The increase in bond yields suggests two scenarios, one of which is that bond traders think that the worst stock and financial market crisis has passed. Two is that the financial crisis may have peaked or not yet, but bond traders predict global economic growth will slow down and inflation may increase, which could lead to deflation.

See more news related to gold prices HERE...