According to Reuters, gold prices increased again in the trading session on Tuesday, as investors took advantage of buying after the precious metal hit a nearly 4-week low. This comes amid strong market fluctuations and concerns about widespread trade tensions.

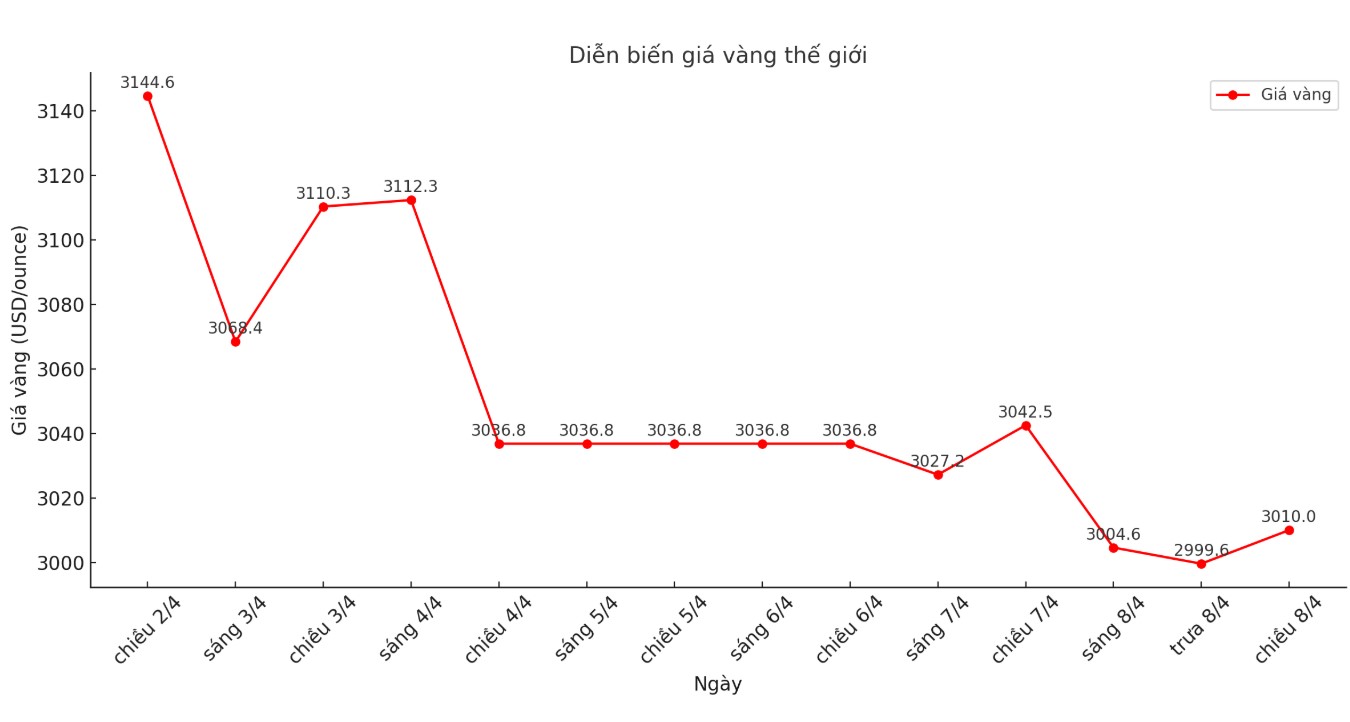

Spot gold increased by 0.8%, to $3,005.38/ounce as of 6:05 a.m. GMT. Earlier on Monday, gold prices fell to their lowest level since March 13.

US President Donald Trump announced the possibility of additional tariffs on China on Monday, while the European Union announced a plan to impose retaliatory tariffs. This raises concerns about a prolonged trade war that could affect the stability of the global economy.

Despite declines in previous sessions, gold has maintained its strength and is likely to continue its uptrend. Market sentiment is still quite optimistic, said Jigar Trivedi, senior analyst at Reliance Securities.

Since the beginning of the year, gold prices have increased by about 15%, thanks to strong buying activities from central banks and the role of gold as a safe haven against economic and geopolitical instability.

Meanwhile, Mr. Trump continued to defend a tough stance on tariffs, affirming that he had no intention of delaying negotiations, but was ready to discuss with China, Japan and some other countries.

The market is closely monitoring the minutes of the latest policy meeting of the US Federal Reserve (FED), scheduled to be released on Wednesday.

Investors are also waiting for US data such as the US Consumer Price Index (CPI) on Thursday and the Producer Price Index (PPI) on Friday to predict the Fed's next move on interest rates. Gold often benefits in a low interest rate environment.

Current contracts show that the FED is likely to cut interest rates by a total of about 96 basis points from now until December.

In other metals, spot silver prices have been flat at $30.1 an ounce, platinum has risen 1.6% to $12.74, while palladium has fallen slightly by 0.1% to $917.78.

See more news related to gold prices HERE...