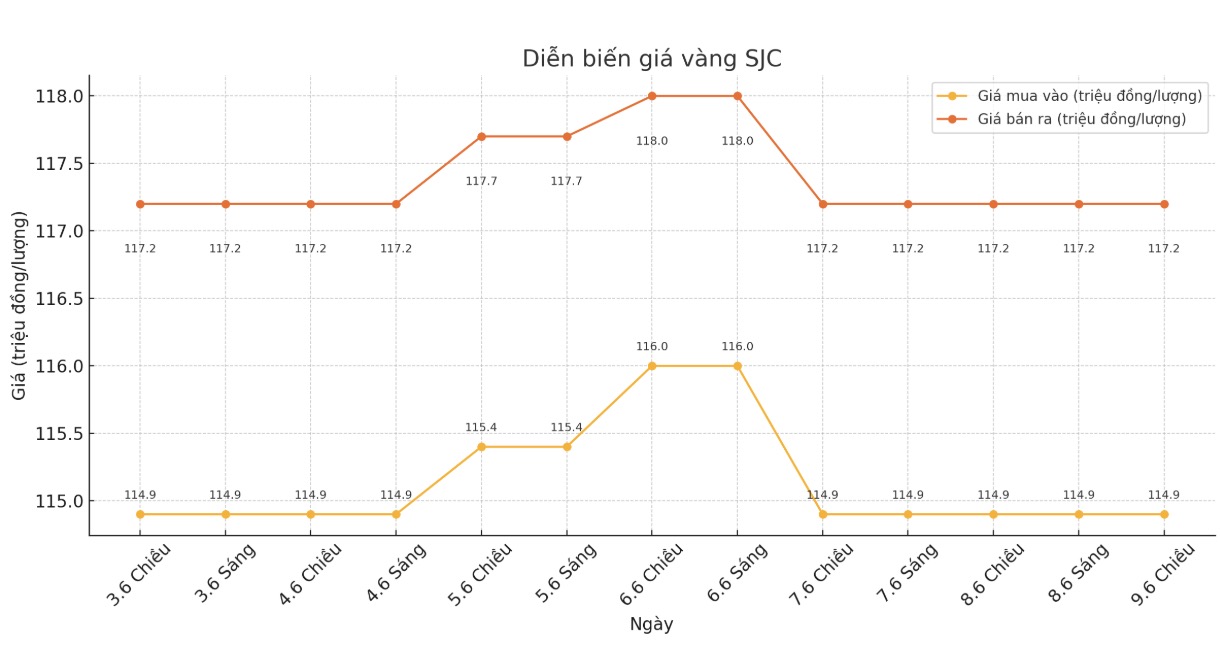

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 114.9-117.2 million/tael (buy in - sell out). The difference between buying and selling prices is at 2.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND 114.9-117.2 million/tael (buy in - sell out). The difference between buying and selling prices is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND 114.9-117.2 million/tael (buy in - sell out). The difference between buying and selling prices is at 2.3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 114.5-117.2 million/tael (buy in - sell out). The difference between buying and selling prices is at 2.7 million VND/tael.

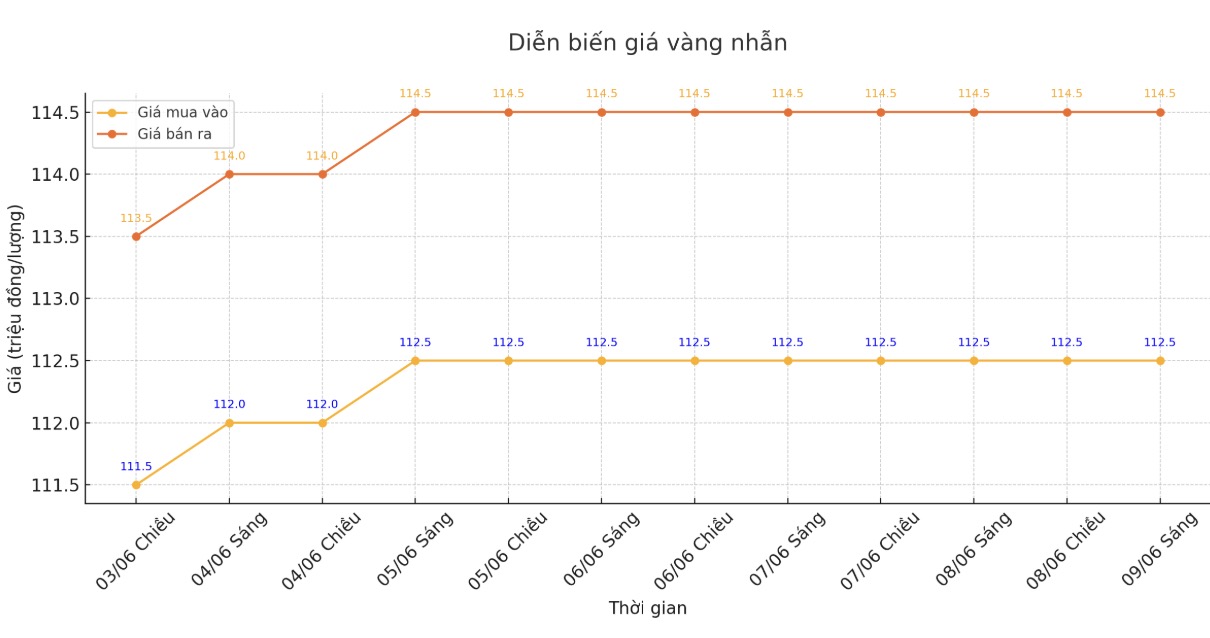

9999 gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-124.5 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113-116 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111-114 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

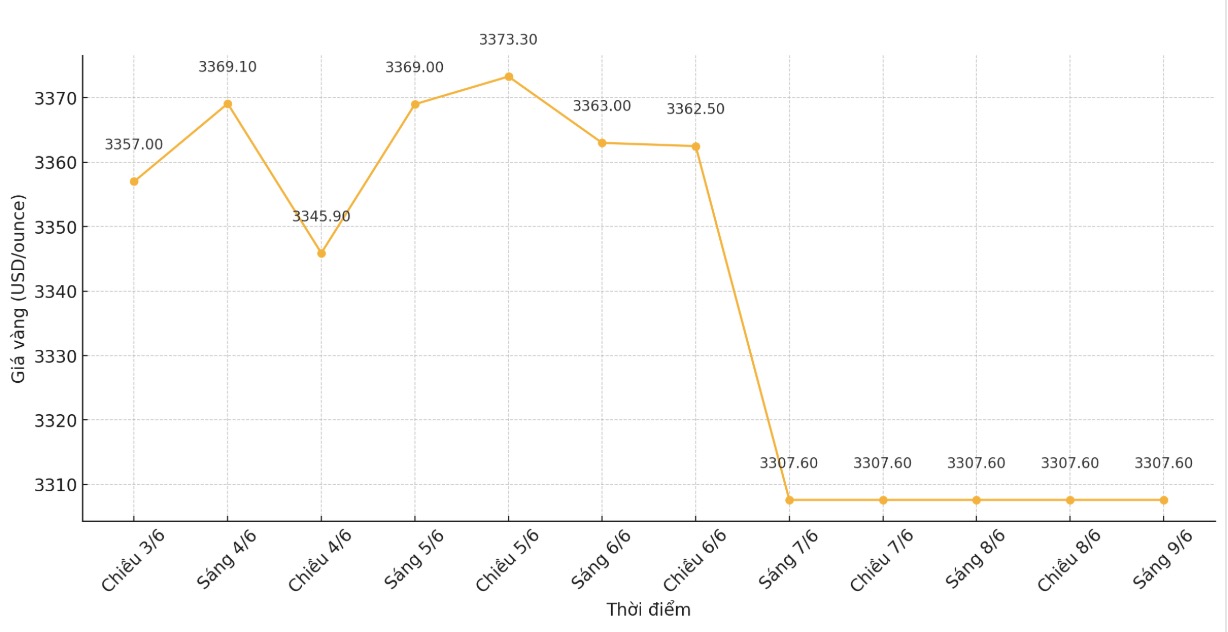

World gold price

At 6:00 a.m., the world gold price was listed at 3,307.6 USD/ounce.

Gold price forecast

Experts are giving mixed reviews about the gold price trend this week, after the precious metal fluctuated strongly last week.

Rich Checkan - Chairman and CEO of Asset Strategies International commented: "Current momentum supports gold and silver. While there may be some profit-taking, I predict gold will continue to rise next week thanks to the weakness of the US dollar, political tensions in the Middle East and Ukraine, impacts from tariffs, and the approval of major US laws that will increase public debt and lead to consumer inflation. These factors will continue to drive demand for gold as a safe asset.

Marc Chandler - CEO at Bannockburn Global Forex gave a more cautious view: "Gold may face some selling pressure in the coming days as the USD may stabilize after better-than-expected jobs data and expect a strong CPI next week. This could see gold face a slight decline and could retreat to $3,300/ounce.

Kevin Grady - Chairman of Phoenix Futures and Options said: "The decrease in gold prices on Friday may just be a normal profit-taking.

Gold has maintained support from concerns about a decline in US credit ratings, although no one expected bankruptcy to occur. Gold continues to be an attractive asset, especially as investors seek safety amid economic uncertainty," the expert said.

Meanwhile, Michael Moor - Founder of Moor Analytics said that for a longer period of time, the gold market is still in an uptrend since August 2018 and is currently in the final stage of this increase. He predicted that gold will see an adjustment and may decrease to 3,150 USD/ounce in the near future.

With mixed reviews, the outlook for gold prices continues to be a topic of interest this week. The market will focus on key metrics such as the US Consumer Price Index (CPI) for May on Wednesday, the Producer Price Index (PPI) on Thursday and unemployment rate data. These factors will significantly affect the US Federal Reserve's (FED) decision on interest rate policy and may affect gold prices in the short term.

Economic data to watch this week

Wednesday: US Consumer Price Index (CPI)

Thursday: US producer price index, weekly jobless claims

Friday: University of Michigan Consumer Psychology Index

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...