USD Index

On November 24, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies maintained an increase of 0.02%, anchored at 100.18 points.

Looking back at the week from November 17 to November 23, 2025, USD prices on the international market reversed and increased sharply after the US announced the September employment report.

At the end of the session on November 21, the USD Index (DXY) increased by 0.91 points compared to the end of last week, to 100.11 points. This is also the highest level in nearly 5 months.

According to a report from the US Department of Labor - which was delayed due to government shutdowns, the economy created 119,000 more jobs in September 2025, more than double the forecast (50,000).

This data reinforces the US Federal Reserve's (FED) view that the labor market is slowing but remains stable, reducing expectations of interest rate cuts in December 2025, thereby supporting the strength of the USD.

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 24, the State Bank announced that Vietnam's central exchange rate is currently at VND 25,136.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office is currently at: VND 23,930 - VND 26,342.

International developments in the past week have affected domestic exchange rates. On November 21, the central exchange rate announced by the State Bank reached 25.136 VND/USD, up 14 VND compared to the end of last week and marked 3 consecutive weeks of increase. With a margin of ±5%, the exchange rate at commercial banks is allowed to fluctuate in the range of VND 23,879 - VND 26,393/USD.

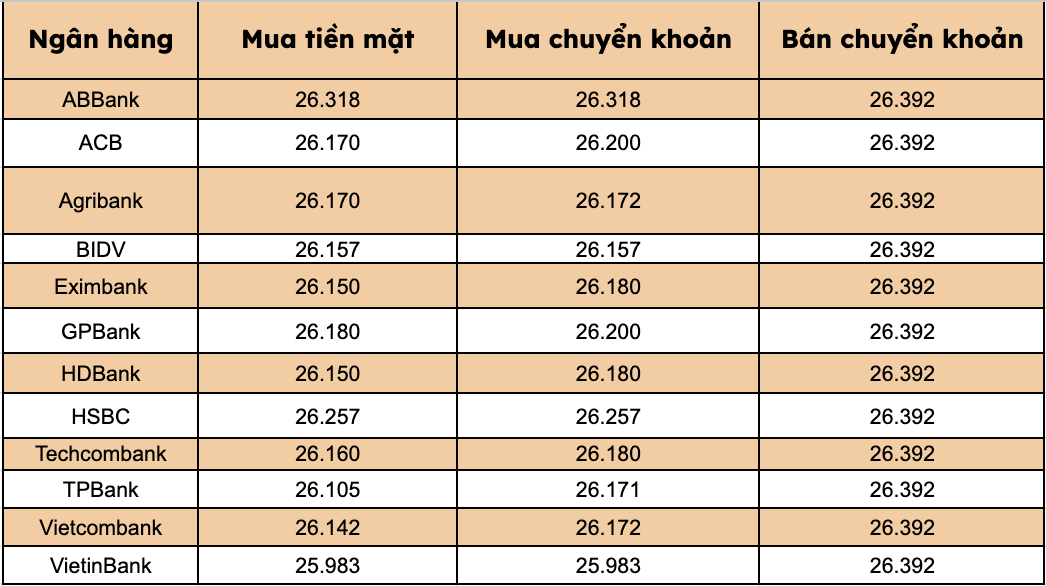

At commercial banks, USD prices mostly kept up compared to the previous session.

Most banks listed USD selling prices at VND26,392/USD.

Bank with the highest cash and bank transfer price: ABBank (26,318 VND/USD).

The difference between buying and selling prices at banks fluctuates within a large range of 74-409 VND/USD.