USD Index

On November 22, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies increased by 0.05%, returning to 100.28 points.

Just a few months after the US tariff shock caused the USD to plummet, the wave of foreign investors pouring in to protect US asset holdings from the risk of the greenback depreciating has slowed down significantly.

Although analysts say the level of protection is still higher than historically, this activity has slowed down compared to the period immediately after April 2, when US President Donald Trump announced a series of extensive trade tariffs.

At that time, foreign investors holding US assets suffered a double blow from the plummeting stock and bond prices along with the sharp decline of the USD. Rapid investors have been rushing to take protective measures against the possibility of a deeper decline in the USD, and this trend is expected to increase sharply. However, the reality has slowed down, helping the USD stabilize again.

David Leigh, global director of FX and emerging markets at Nomura, said: "Recent customer discussions show that cash flow (household) is unlikely to come as quickly as we predicted in May."

The USD Index, which measures the strength of the greenback against other major currencies, has recovered nearly 4% since late June - the time it recorded a decline of nearly 11% after its strongest plunge in the first half of the year since the 1970s.

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 22, the State Bank announced that the central exchange rate of Vietnam increased by 6 VND, currently at 25,136 VND.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office is currently at: VND 23,930 - VND 26,342, increasing by VND 6.

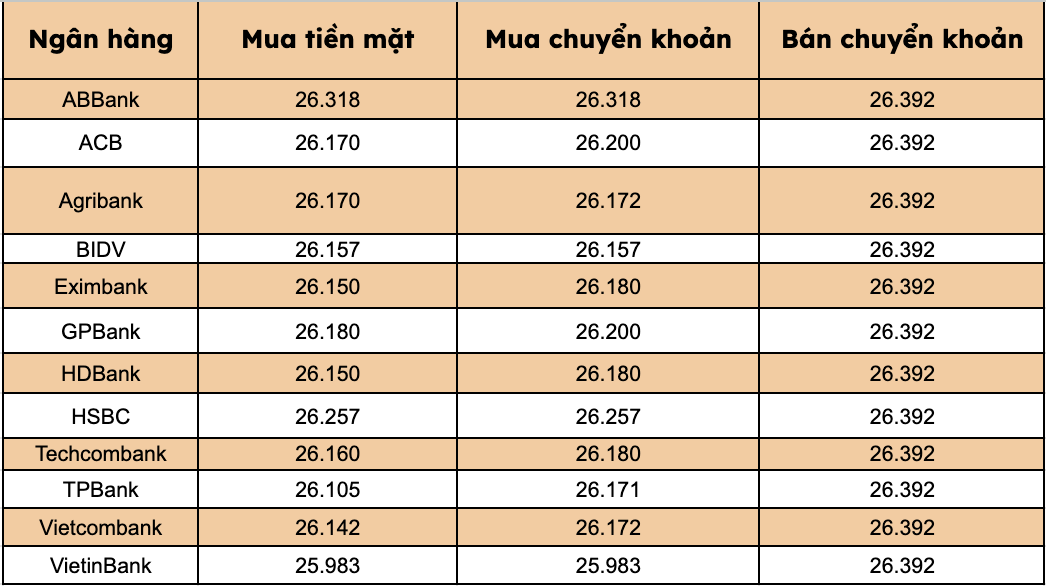

At commercial banks, USD prices have mostly increased compared to the previous session.

Most banks listed USD selling prices at VND26,392/USD, up VND6/USD.

Bank with the highest cash and bank transfer price: ABBank (26,318 VND/USD, down up to 50 VND/USD).

The difference between buying and selling prices at banks fluctuates within a large range of 74-409 VND/USD.