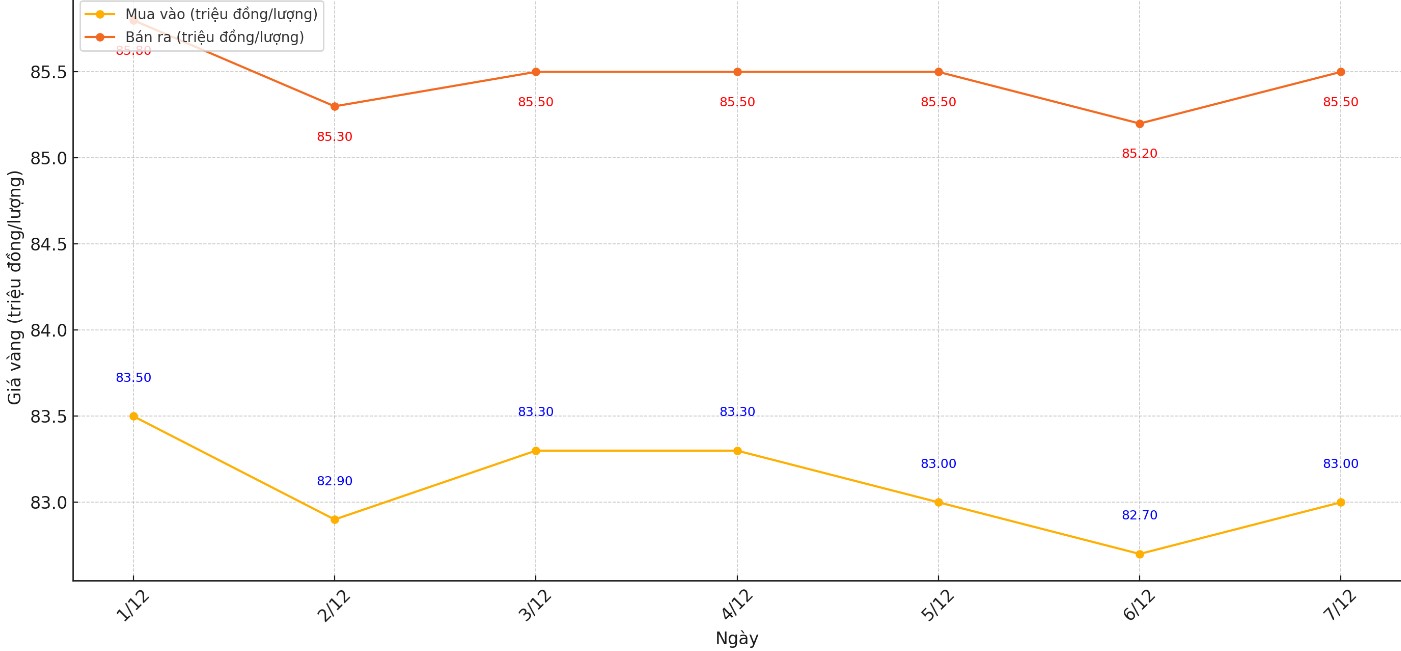

Update SJC gold price

As of 10:30 a.m., DOJI Group listed the price of SJC gold bars at VND82.7-84.8 million/tael (buy - sell); an increase of VND400,000/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 83-85.5 million VND/tael (buy - sell); 82.7-84.8 million VND/tael (buy - sell); an increase of 400,000 VND/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.7-84.8 million VND/tael (buy - sell); increased 400,000 VND/tael in both directions compared to the opening of the trading session yesterday morning.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

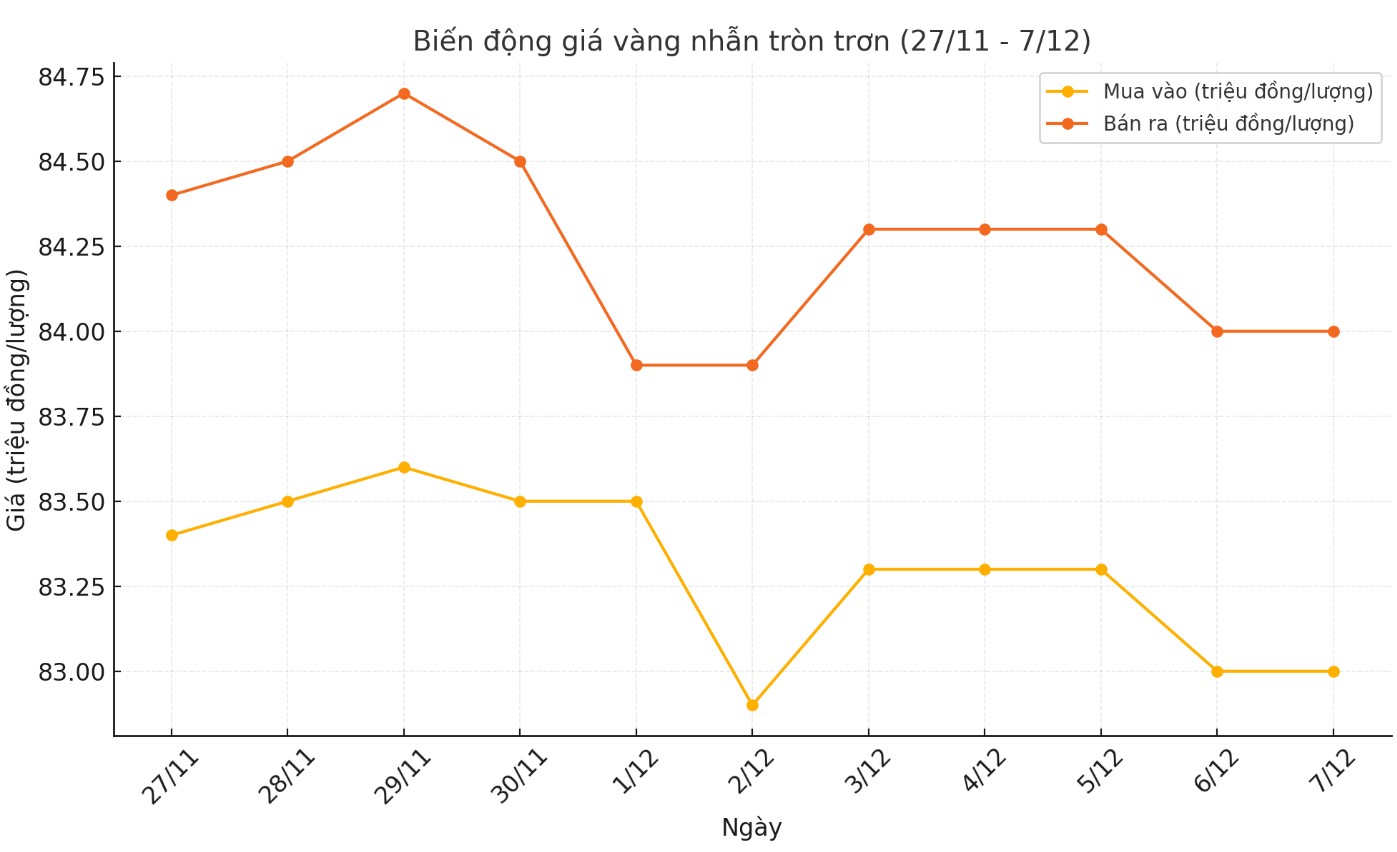

Price of round gold ring 9999

As of 10:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83-84 million VND/tael (buy - sell); an increase of 200,000 VND/tael for buying and an increase of 100,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 82.98-84.08 million VND/tael (buy - sell), an increase of 100,000 VND/tael for both buying and selling compared to early this morning.

World gold price

As of 10:30 a.m., the world gold price listed on Kitco was at 2,633.3 USD/ounce, up 11 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased slightly despite the increase in the USD. Recorded at 10:30 a.m. on December 7, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 106.040 points (up 0.32%).

World gold prices increased slightly after the Bureau of Labor Statistics released a report on December 6 showing that the US economy created 227,000 more jobs in November.

Not only did this figure exceed the experts' forecast of 214,000, it also showed a significant improvement compared to October's 36,000 jobs. The unemployment rate edged up slightly to 4.2%, as expected. Average hourly earnings rose 0.4% month-over-month and 4% year-over-year, beating market expectations by 0.1 percentage points...

Gold is currently consolidating in a symmetrical triangle pattern, hovering around the 18-week moving average support at $2,640 an ounce. A break above the $2,750 resistance level could see gold move towards a target of $3,000 an ounce, which would represent the top of a 13-year cup-and-handle pattern. Conversely, a drop below $2,600 an ounce could see gold test the 200-day moving average at $2,450 an ounce.

With predictions suggesting that gold prices could peak at $2,700 to $3,000 an ounce by 2025, keeping an eye on these factors will be important for anyone looking to invest in gold, according to Aksha Kamboj, Vice President of the India Bullion and Jewellers Association (IBJA) and Executive Chairman of Aspect Global Ventures.

Central banks around the world continue to buy gold to protect against external shocks. According to the latest report from the World Gold Council (WGC), central banks bought a net 60 tonnes of gold in October - the highest amount in 2024. In particular, Eastern European countries have emerged as the largest buyers of gold, surpassing China.

Russia's exclusion from the SWIFT system in 2022 also prompted BRICS to increase gold purchases, while reducing dependence on the US dollar.

Despite the volatility of the US dollar, the gold market is expected to benefit from the economic policies of US President-elect Donald Trump. His pledges to impose high import tariffs on countries such as Canada, Mexico, and China have raised concerns about trade wars and the possibility of a global economic recession.

According to the CME FedWatch tool, investors predict an 85% probability that the US Federal Reserve (FED) will cut interest rates again in the next 2 weeks. Gold usually falls when interest rates are low, but this is also uncertain when geopolitical tensions in many places have not cooled down and precious metals are still chosen by many investors as a safe haven asset.

See more news related to gold prices HERE...