Gold price developments last week

Spot gold started the trading week at $2,713.65 an ounce and quickly rose to a resistance level of $2,720 on Sunday evening. However, that was already the high of the week, as spot gold quickly fell to $2,670 an ounce by 11 p.m. EST on Sunday.

Gold prices then recovered slightly. Spot gold rose to $2,687 an ounce at 6:45 a.m. Monday. However, it later fell sharply to $2,634 an ounce. Gold continued to fall throughout the day, hitting a low of $2,609 an ounce at 6:30 p.m. EST.

Tuesday, Wednesday and the US Thanksgiving holiday on Thursday were relatively quiet, with gold prices fluctuating between $2,620 and $2,656 an ounce, frequently returning to $2,640 an ounce.

A new rally was seen on Thursday evening, as spot gold rose from $2,636 an ounce to $2,661 an ounce on the back of a weaker US dollar and renewed safe-haven demand amid escalating tensions over the Russia-Ukraine conflict.

Gold then entered a new trading range, failing to break above $2,666 an ounce but holding steady above $2,650 an ounce. These levels remained in place until the market closed on Friday.

Expert predicts surprise

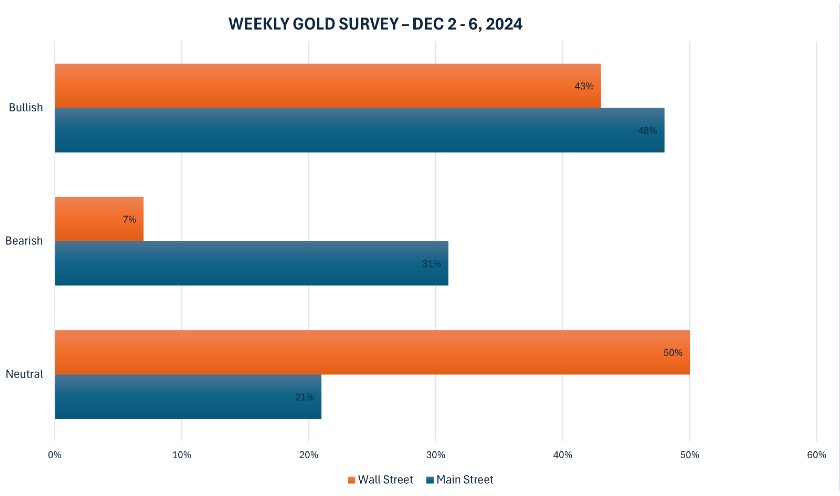

The latest Kitco News survey shows that industry experts are almost evenly split between bullish and wait-and-see, while retail investor sentiment has also softened compared to last week.

Of the 14 analysts surveyed by Kitco News, six, or 43%, predict gold prices will rise next week. Seven, or 50%, predict gold prices will remain flat. Only one, or 7%, predicts prices will fall.

199 votes were cast in Kitco’s online poll. Ninety-six traders, or 48 percent, expect gold prices to rise next week, while 61, or 31 percent, expect prices to fall. The remaining 42 investors, or 21 percent, expect gold prices to trade sideways in the short term.

Economic data to watch next week

Monday: ISM Manufacturing PMI - an index measuring the level of economic activity in the US manufacturing sector. This is one of the important metrics used to assess the health of the economy, especially in the manufacturing sector. This index is published monthly by the US Institute of Supply Management (ISM).

Tuesday: JOLTS employment report (a survey of employment and labor market movements in the US, conducted and published monthly by the US Bureau of Labor Statistics).

Wednesday: ADP Employment Data - a monthly report released by the human resources management services company Automatic Data Processing (ADP). This report provides information on the change in the number of non-farm private sector jobs in the United States, based on data from companies that use ADP's payroll services.

The ISM Services PMI (an index measuring the level of economic activity in the US service sector, published monthly by the ISM. This index provides important information on the health of the service sector, which accounts for the majority of US GDP). Also on this day, US Federal Reserve Chairman Jerome Powell participated in a moderated discussion at the New York Times DealBook Conference.

Thursday: US weekly jobless claims report.

Friday: US nonfarm payrolls report, University of Michigan preliminary consumer sentiment index.

See more news related to gold prices HERE...