Gold price developments last week

After the first week of decline in two months, gold prices have recovered strongly this week, helping investors regain confidence in the precious metal.

Spot gold prices opened the week at $2,858/ounce, quickly establishing $2,860/ounce as a short-term support level before soaring above $2,880/ounce in the first trading session of the week in North America.

This level quickly became a solid support level and was maintained throughout the week.

On Tuesday evening, spot gold prices increased sharply from 2,886 USD/ounce at 1:30 am (Eastern US time) to 2,927 USD/ounce at 8:00 am.

Since then, gold has maintained its position above the $2,900/ounce mark, continuously testing the high price zone around $2,920/ounce in the trading session on Wednesday morning. Although unable to break out of this zone, gold only decreased slightly to 2,894 USD/ounce on Thursday morning before quickly recovering to 2,920 USD/ounce in the afternoon.

Gold prices then maintained a relatively narrow trading range of $2,900 - $2,926/ounce. By Friday afternoon, after falling slightly to $2,905 an ounce, gold continued to recover and closed the week at $2,911 an ounce.

What do experts predict about gold prices next week?

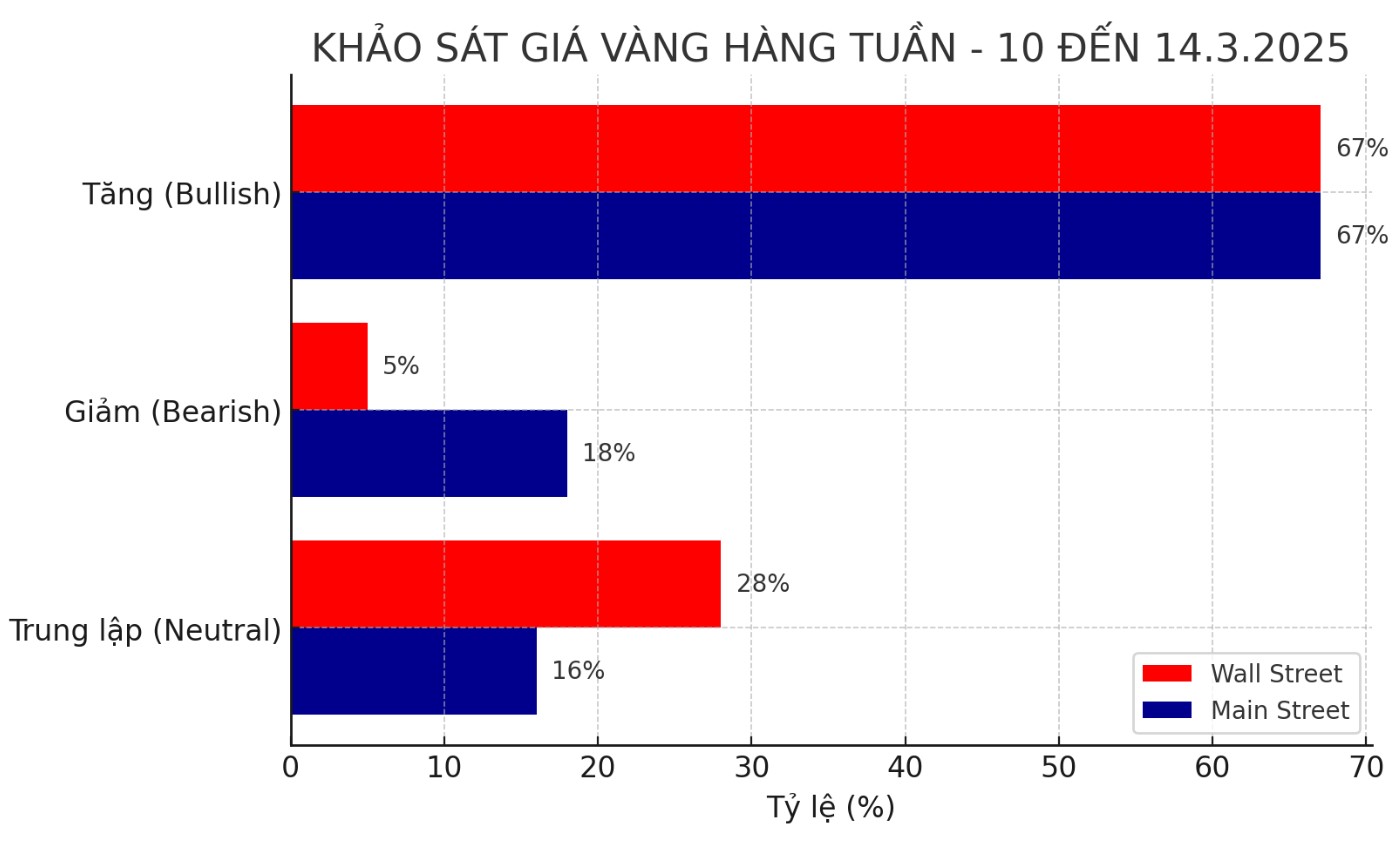

Compared to last week, market sentiment has changed significantly, especially from the group of Wall Street experts. In the previous survey, only 21% of experts predicted gold prices would increase, while up to 64% thought prices would decrease.

However, this week, the experts' expectation of gold increasing has skyrocketed to 67%, while only 5% predicted a decrease - a significant change reflecting the reversal in analysts' assessment.

The group of individual investors (Main Street) also recorded a clear change. The proportion of investors who predict gold prices to increase has increased from 45% to 67%, while those who expect prices to decrease from 28% to 18%.

Notably, the number of participants this week's survey reached 251 - the highest in 2025, showing greater investor interest in the gold market.

The change in market sentiment may reflect the weakening of the USD, concerns about economic and political instability, as well as expectations that gold prices may continue to head towards new record highs.

With strong consensus from both experts and individual investors, gold prices may continue to increase in the coming time.

Economic calendar affecting gold prices next week

Next week, inflation will be the focus as the market receives many important data on prices and spending from US consumers. Most notably is the February CPI report on Wednesday, followed by the PPI on Thursday, and the University of Michigan consumer confidence survey on Friday.

Other major events include the US JOLTS employment report on Tuesday, the interest rate decision of the Bank of Canada on Wednesday morning and the US weekly unemployment report on Thursday.

See more news related to gold prices HERE...