Gold price developments last week

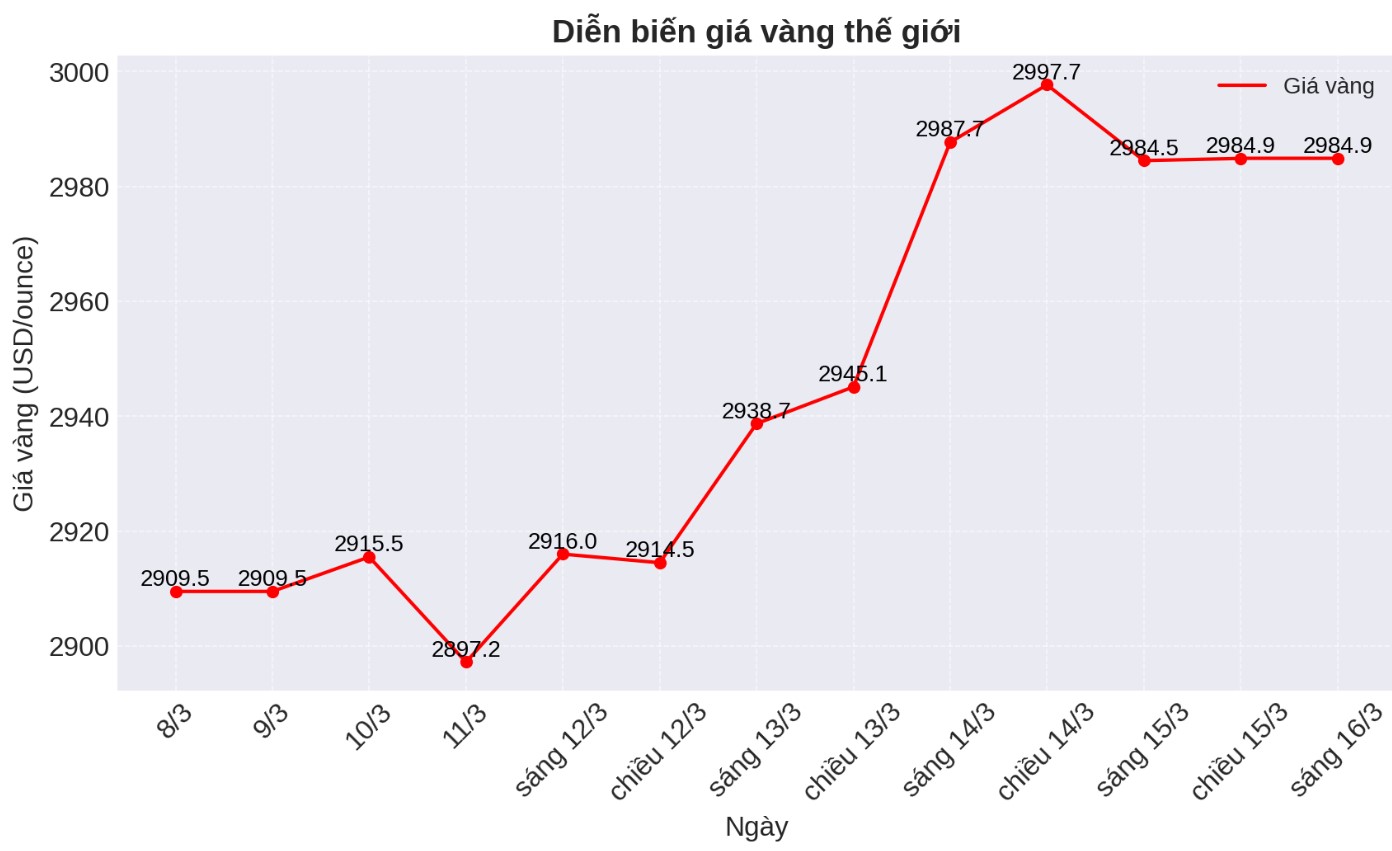

Spot gold opened the week at $2,913.63 an ounce and remained steady at $2,900 an ounce until it edged down to $2,880 an ounce on Monday afternoon.

However, this decline did not last long, as gold quickly recovered and returned above $2,900/ounce on Tuesday morning. From there, gold prices established a solid support level throughout that trading session.

Wednesday morning brought the first significant volatility of the week as US CPI data (consumption price index) was lower than forecast, causing gold prices to fall to 2,910 USD/ounce, just 15 minutes before the North American market opened. But shortly after, buyers quickly pushed gold prices to $2,940 an ounce at 1:30 p.m. US Eastern time.

This trend continued in the Thursday session. After the US PPI (producer price index) report fell slightly, gold prices immediately fell but were immediately pushed by North American traders to surpass the previous record high, reaching 2,985 USD/ounce in the early afternoon.

Once again, precious metals investors have no intention of selling, helping gold prices continue to increase close to the $3,000/ounce mark in the Asian session.

After a brief correction to the $2,985/ounce zone to re- test the support level, European traders continued to push gold prices to a new record high of $3,005.04/ounce at 6:15 a.m. Eastern time.

The North American market then re-tested the support zone of $2,980/ounce, but this level remained stable, helping gold prices fluctuate within a narrow range of $2,980 - $2,990/ounce throughout the trading session on Friday.

What do experts predict about gold prices next week?

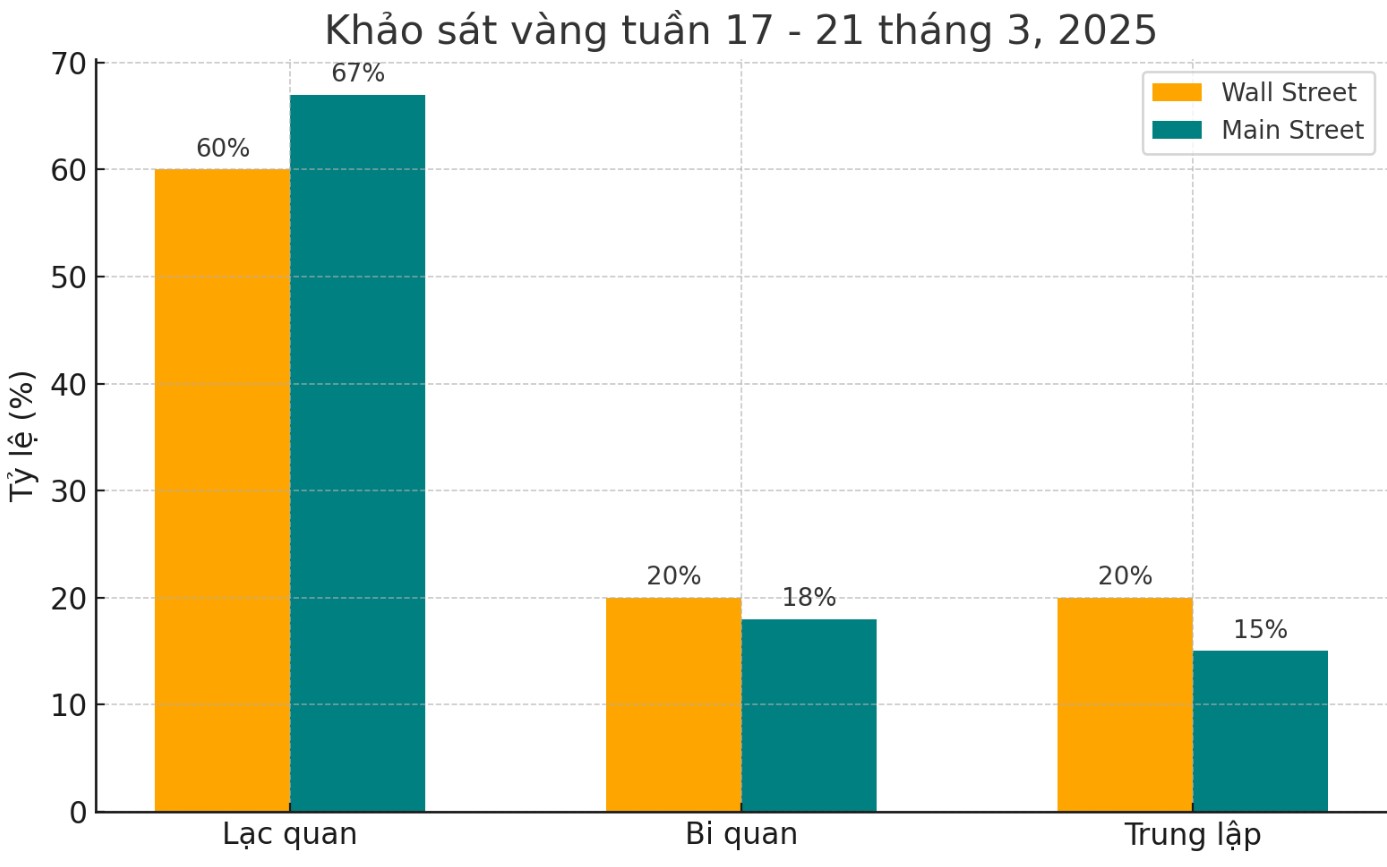

The latest weekly gold survey from Kitco News shows that optimism is still strong among experts and retail investors, despite record high prices. Most opinions predict that gold prices will continue to increase next week.

15 analysts participated in the Kitco News gold survey. Nine experts, or 60%, predict gold prices will continue to rise next week. Three analysts, or 20%, predict gold prices will fall. The remaining three experts see gold prices moving sideways.

Meanwhile, 262 people participated in Kitco's online survey, with investor sentiment almost unchanged from last week.

175 retail traders, or 67%, expect gold prices to surpass $3,000 next week. Meanwhile, another 47 people, accounting for 18%, predict gold prices will fall. The remaining 40 investors, accounting for 15% of the total, predict gold prices will move sideways in the coming days.

Economic calendar affecting gold prices next week

Next week will be a volatile week for gold, as the market receives many important economic news.

Central banks continue to dominate the event schedule, with the Bank of Japan announcing the interest rate decision on Tuesday, followed by the US Federal Reserve (FED) on Wednesday and the Swiss National Bank and the Bank of England on Thursday.

In addition, many important US economic data will also be released, including Retail Sales and Empire State Production Index on Monday, Housing Construction Start-up and Construction Permit data on Tuesday. By Thursday, the market will monitor the Weekly Unemployment Report, available home sales and the FED Philadelphia Production Survey.

See more news related to gold prices HERE...