The gold market reached an important milestone on Friday morning when spot gold prices temporarily surpassed the $3,000/ounce mark, setting an all-time high of $3,005.04/ounce as many North American traders had just enjoyed a cup of morning coffee.

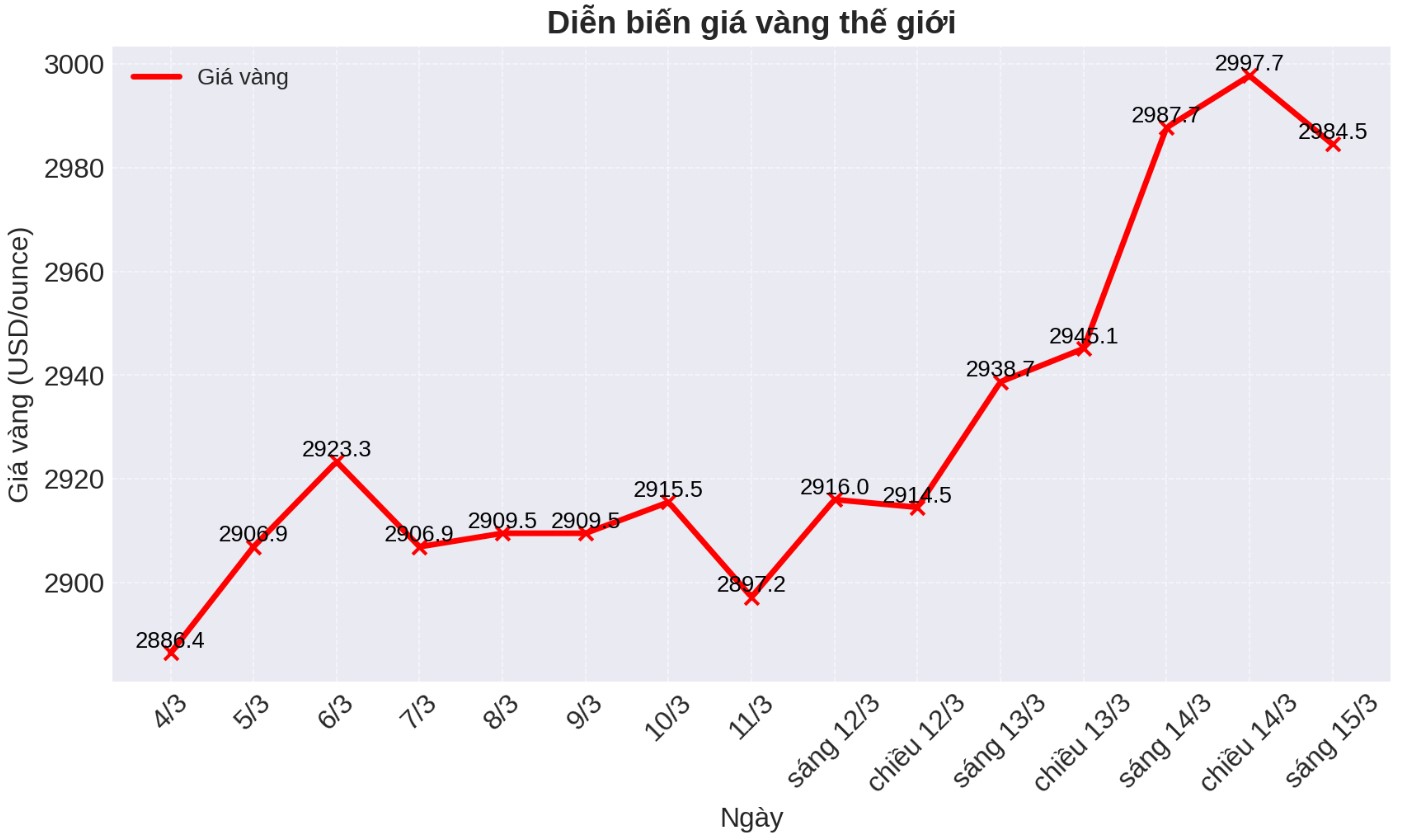

The gold breakout began late Thursday after gold prices fluctuated around $2,900/ounce for the past three weeks. Overnight, the precious metal traded in a narrow range but hit a high of $2,999.99 an ounce. Although gold prices have fallen compared to the highest level of the session, they still maintained a slight increase.

The spot market hit $3,000/ounce somewhat slower than gold futures, as the futures reached the price late Thursday.

Analysts have been waiting for gold to reach $3,000/ounce since the beginning of the year and some predict that this important price will stimulate profit-taking. However, market sentiment is still quite optimistic and more and more analysts are increasing their gold price target for this year.

On Thursday, commodity analysts at Macquarie updated their gold price forecast, saying that gold prices will peak at $3,500/ounce in the third quarter of this year.

Many analysts said that global economic instability and geopolitical situations continue to support gold prices, even when gold prices are at their current highs.

Mr. Paul Williams - CEO of Solomon Global, a certified gold and silver supplier, told Kitco News: "Gold surpassing $3,000/ounce is a direct response to escalating trade tensions and economic instability that this brings.

The new tariff threat from US President Donald Trump, a tax of up to 200% on imported alcohol from the European Union, has caused a strong fluctuation in the global market, increasing demand for safe-haven assets.

This is not just a quick response to individual policies; it is investors looking to protect themselves from systemic risks. With the current growth momentum, gold prices could reach $3,500/ounce in the summer and $4,500/ounce next year, which is entirely possible. As President Donald Trump's tariff chaos has left the market confused, gold is chosen as the optimal shield for political and economic instability," he said.

In a comment to Kitco News, Mr. Stuart O'Reilly - Market Analysis Manager at The Royal mint, said that many investors are turning to gold as a safe haven.

"Although the stock market has been shaken in recent weeks, safe-haven assets such as gold are rising strongly. This not only helped gold prices set a record but also broke the threshold of 3,000 USD/ounce.

Thanks to the prospect of continued global trade tensions, along with the continued purchase of gold by central banks, according to British sources, gold has increased by more than 9% since the beginning of this year when it entered the bull market," he said.

Alex Kuptsikevich - Chief Market Analyst at FxPro, said that weak inflationary pressures last week are also helping to fuel the gold price increase. This opens up an opportunity for the US Federal Reserve (FED) to cut interest rates this year, and the market is now predicting that there could be two interest rate cuts by the end of the year.

Last week, consumer price index and producer price index both showed lower-than-expected inflation in February. However, some economists say that this data should be ignored because it was collected before the US launched a global trade war.

Kuptsikevich also said he may see gold prices stabilize after reaching $3,000/ounce, but he also noted that the uptrend remains strong.

"In terms of technical analysis, we see a continued growth after a downward correction. The target price for this increase could be the 3,190 USD/ounce area. The further growth target could be $3,400/ounce," he said.

David Morrison - Senior market analyst at Trade Nation, said that gold prices may stabilize in the short term after reaching this historical price.

"It takes time for traders to feel comfortable when trading in an unprecedented territory. It will be interesting to see how gold will behave by the end of the week. It should be noted that gold prices are not currently overbought," he said.