Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND94.3-95.8 million/tael (buy - sell), an increase of VND2.3 million/tael for buying and an increase of VND1.4 million/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND94.3-95.8 million/tael (buy - sell), an increase of VND2.3 million/tael for buying and an increase of VND1.4 million/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND94.4-95.8 million/tael (buy - sell), an increase of VND1.4 million/tael for both buying and selling. The difference between the buying and selling prices of SJC gold is listed at 1.4 million VND/tael.

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND94.9-96.3 million/tael (buy - sell); an increase of VND1.3 million/tael for buying and an increase of VND1.4 million/tael for selling. The difference between buying and selling is listed at 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 94.95-96.5 million VND/tael (buy - sell); an increase of 1.55 million VND/tael for buying and an increase of 1.5 million VND/tael for selling. The difference between buying and selling is 1.55 million VND/tael.

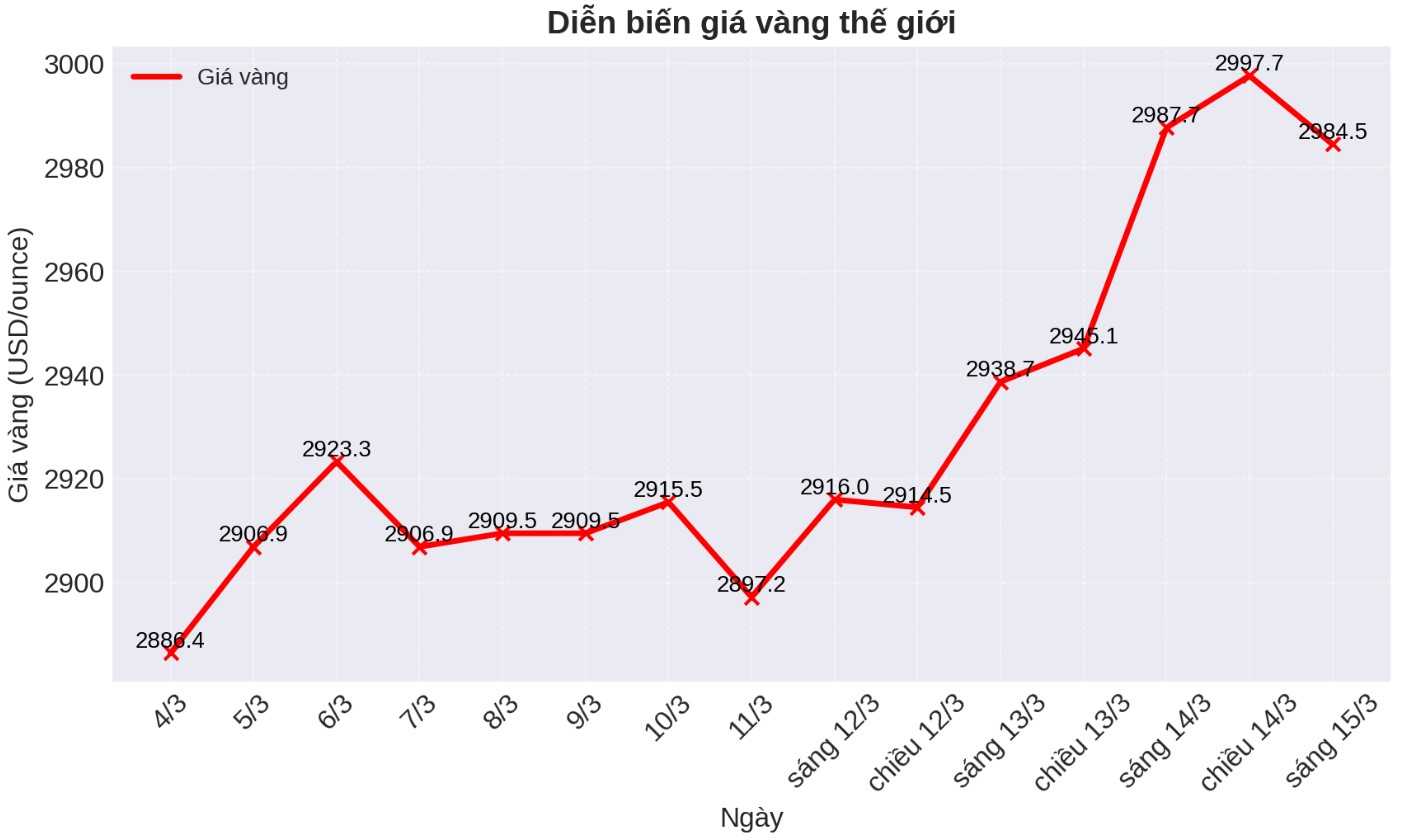

World gold price

As of 6:15 a.m., the world gold price listed on Kitco was at 2,984.5 USD/ounce, up 26.3 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices increased in the context of the USD decreasing. Recorded at 6:15 a.m. on March 15, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.720 points (down 0.11%).

Gold prices yesterday had a time to surpass the psychological milestone of 3,000 USD/ounce. According to Reuters, gold prices continue to increase strongly thanks to trade tensions and expectations that the US Federal Reserve (FED) will cut interest rates, making gold even more attractive as a safe-haven asset.

In the context of rising geopolitical tensions, rising trade tariffs and uncertainty in the financial market, investors are looking for stability and they are finding that in gold.

When gold breaks above $3,000, short-term profit-taking could temporarily put pressure on gold prices," said Alexander Zumpfe, a precious metals trader at Heraeus Metals Germany.

SPDR Gold Trust - the world's largest gold ETF said that the fund's gold holdings reached 905.81 tons, the highest level since August 2023 at the end of February.

Meanwhile, data shows that the US consumer price index fell more strongly than analysts expected, which could create more space for the Fed to cut interest rates. The Fed's next policy meeting is on Wednesday, and is expected to keep the benchmark interest rate unchanged overnight.

The FOMC decision next week, along with Chairman Jerome Powells signal, will determine whether spot gold prices will remain above $3,000 an ounce, said Han Tan, chief market analyst at Exinity Group.

Traders expect policymakers to continue cutting borrowing costs in June.

We maintain an optimistic view on gold, with prices forecast to reach a record $3,050/ounce in 2025, ANZ analysts noted.

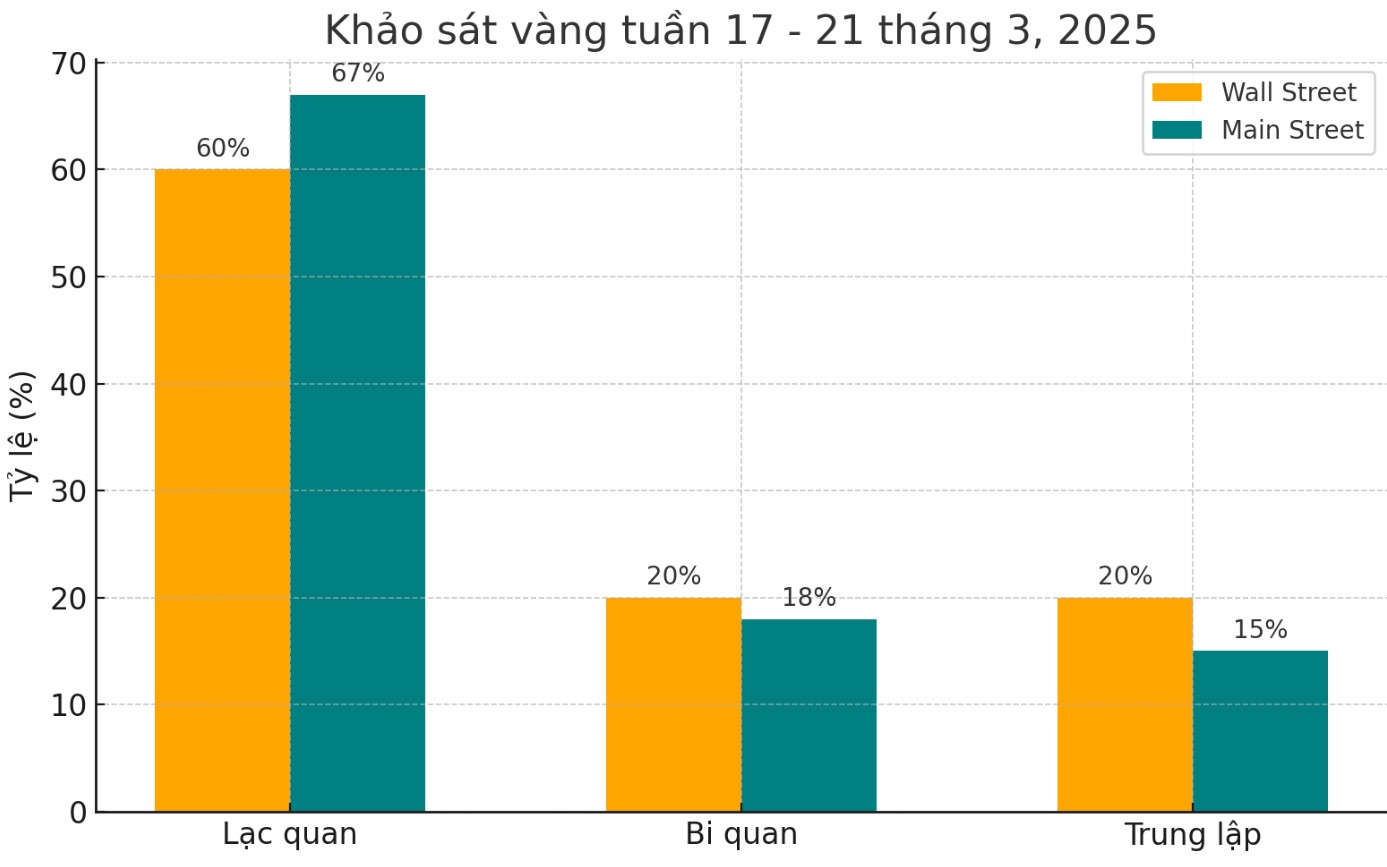

This week, 15 analysts participated in the Kitco News gold survey, with Wall Street reducing optimism compared to last week, although only a little.

Nine experts, or 60%, predict gold prices will continue to rise next week, while three analysts, or 20%, predict gold prices will fall, and the remaining three experts believe that gold prices will fluctuate within a stable range after the important milestone.

Meanwhile, 262 votes were cast in Kitco's online survey the strongest participation in 2025 with retail investors' sentiment almost unchanged from last week.

175 retail traders, or 67%, expect gold prices to surpass $3,000 next week, while another 47 - 18%, predict gold prices will fall. The remaining 40 investors, accounting for 15% of the total, predict gold prices will move sideways in the coming days.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...