Gold price forecast for next week

After many consecutive weeks of optimism, the latest survey results show that the Western market sentiment suddenly Differentiated significantly, as gold prices have just experienced a series of strong increases and then adjusted shortly at the end of the week. Meanwhile, individual investors remain calm ahead of the new trading week.

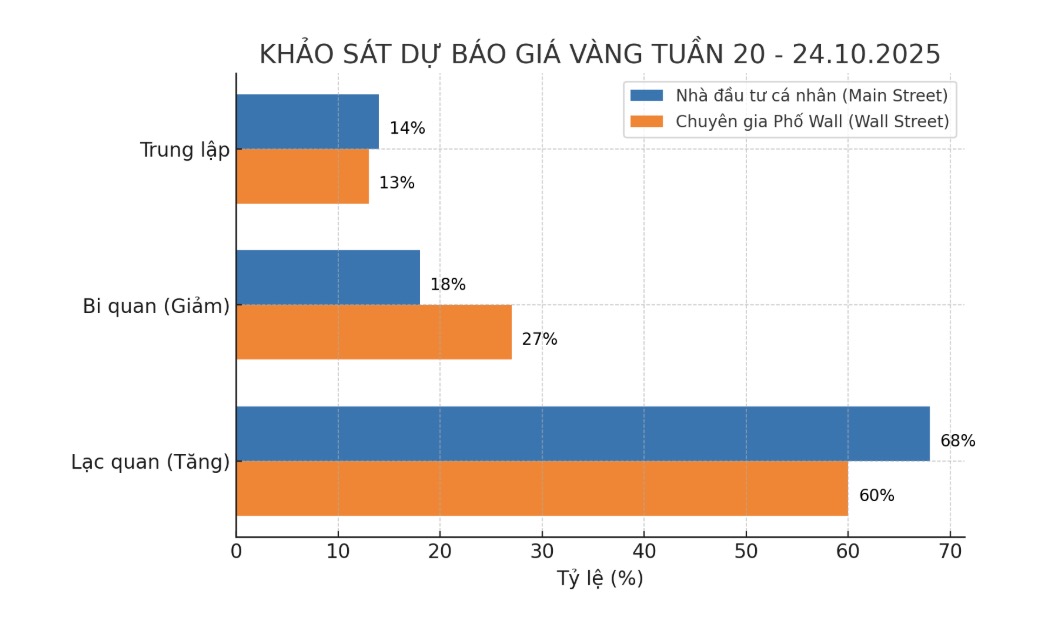

This week, 15 analysts participated in the survey. Wall Street analysts have somewhat eased their expectations for price increases. Of these, 9 people (equivalent to 60%) predict gold prices will increase next week, 4 people (27%) think prices will decrease, and the remaining 2 people (13%) predict gold prices will go sideways.

Meanwhile, an online survey by an international financial information platform attracting 265 participants reflects the optimistic sentiment of individual investors that remains stable despite strong fluctuations in gold prices.

180 traders (68%) expect gold prices to continue to rise next week, 48 (18%) predict prices will fall, and 37 (14%) expect prices to remain flat.

Mr. Marc Chandler - CEO of Bannockburn Global Forex - said that the gold price last week's breakthrough was not only due to buying pressure from central banks, but also due to the upward momentum and trendy psychology that caused many investors to enter the market.

Mr. Chandler noted that US bond yields have fallen over the past week. US two-year yields are at a three-year low, 10-year yields are at a six-month low, and the USDXY is having its biggest week of decline since early August, he said. In the context of many fluctuations around the world, gold is not only a safe haven asset but also has the characteristics of an attractive risk asset.

Mr. Rich Checkan - Chairman and CEO of Asset Strategies International - predicted that gold prices will increase. Actually, I was happy when the market adjusted a bit on Friday morning, but the general trend was still clear to go up. A weak US dollar, an expected rate cut, and a chaotic US government situation all of which support the upward trend in gold prices.

On the other hand, Mr. Alex Kuptsikevich - senior analyst at FxPro, said that after more than two consecutive months of increase, gold prices are likely to decrease next week.

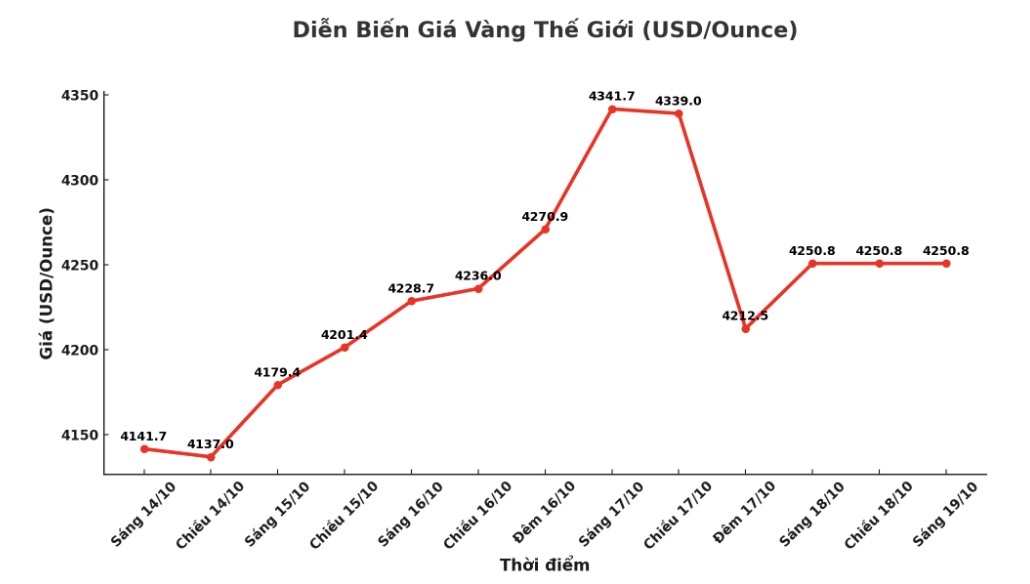

The record rally of over $4,200 an ounce comes from a wave of disbelief in the currency. Governments are struggling with budget deficits, huge public debt and central banks are being required to cut or keep interest rates low.

Investors have therefore lost faith in bonds and currencies, looking to precious metals. Gold has been rising for nine consecutive weeks something that has only happened five times since the 1970s, he said.

However, gold has never had a 10-week winning streak, he warned. The current increase has far exceeded the 200-week average of 90%, only lower than the 1980 record. The market needs a technical correction and if that happens, it could open up a multi-year downtrend.

Economic data to watch next week

As the US government remains closed, markets are forced to rely on private sector data, including home sales reports and manufacturing data for next week.

However, the market will still receive some official inflation figures, as the US Bureau of Labor Statistics (BLS) has summoned a limited number of employees to release the September CPI report.

The move is aimed at helping the US government calculate the annual cost of living adjustment for social security pensioners before November 1.

The US home sales data for September is scheduled to be released on Thursday, while the September CPI report will be released on Friday, followed by the S&P preliminary PMI.

See more news related to gold prices HERE...