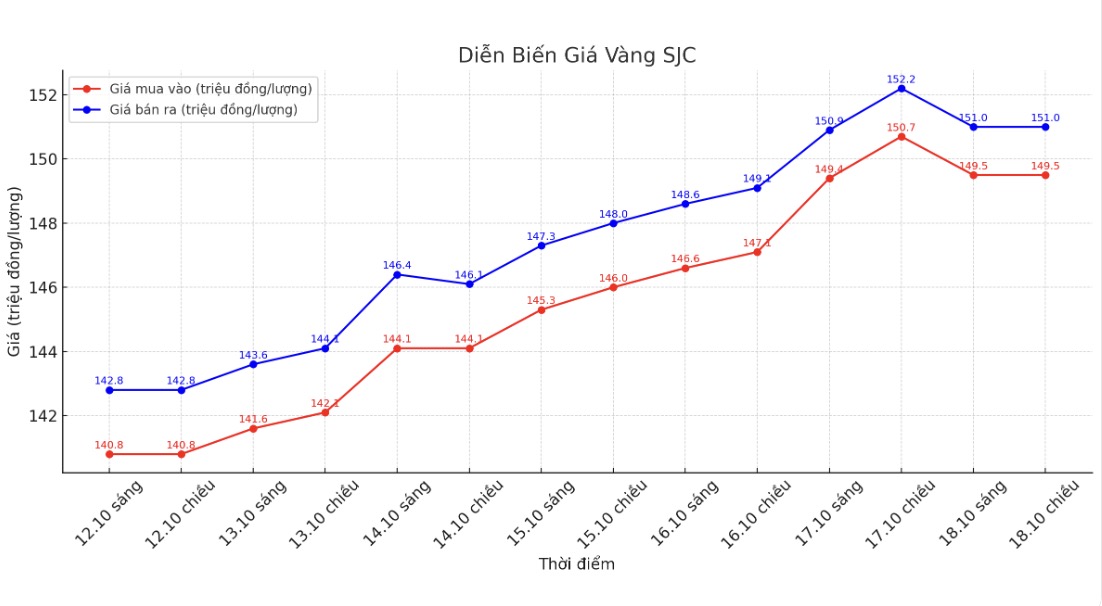

SJC gold bar price

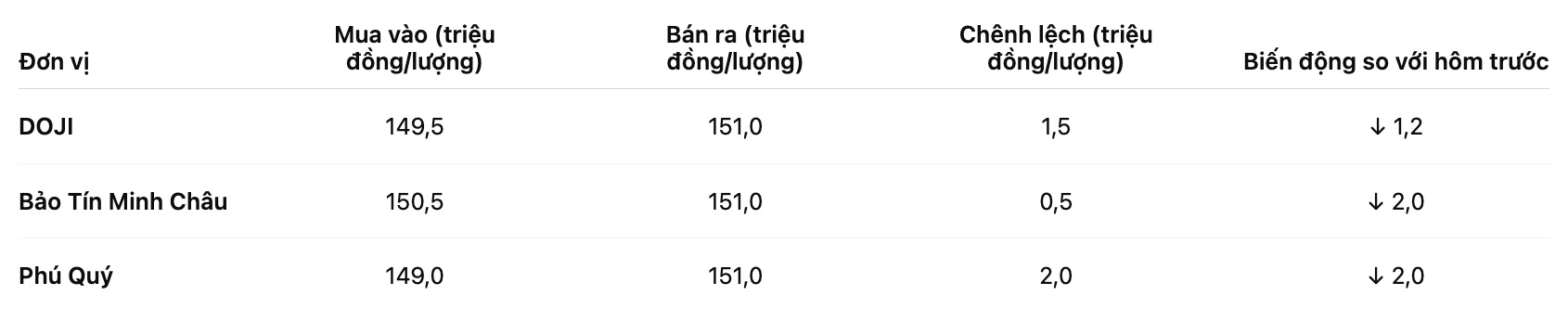

As of 7:30 p.m., DOJI Group listed the price of SJC gold bars at VND 149.5-151 million/tael (buy - sell), down VND 1.2 million/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 150.5-151 million VND/tael (buy - sell), down 2 million VND/tael in both directions. The difference between buying and selling prices is at 500,000 VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 149-151 million VND/tael (buy - sell), down 2 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

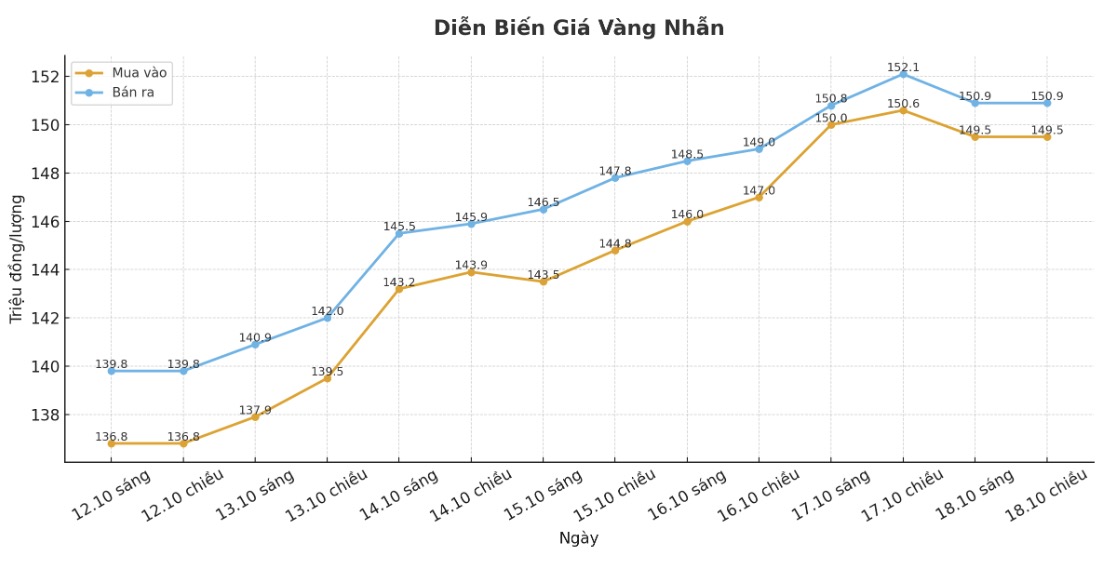

9999 gold ring price

As of 5:45 p.m., DOJI Group listed the price of gold rings at 149.5-150.9 million VND/tael (buy - sell), down 1.1 million VND/tael for buying and down 1.2 million VND/tael for selling. The difference between buying and selling is 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155.5-158.5 million VND/tael (buy - sell), down 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 148-151 million VND/tael (buy - sell), down 2 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

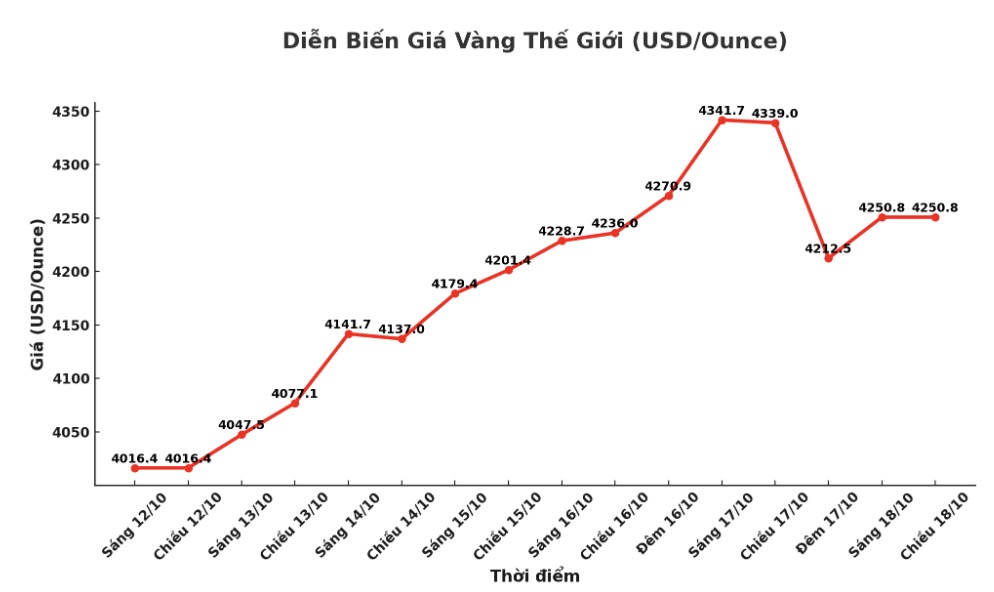

World gold price

The world gold price was listed at 6:35 p.m. at 4,250.8 USD/ounce, down 88.2 USD compared to a day ago.

Gold price forecast

With no US economic data affecting investor sentiment, gold prices have been rising steadily every day over the past week, fueled by a wave of concerns about tariffs and trade, before suddenly turning around and falling sharply on Friday - the shock that left many new investors in the market.

Gold prices fell sharply after hitting a record high of over $4,300/ounce, due to the rising USD and US President Donald Trump's comments that imposing a "comprehensive" tax on China is not feasible.

Mr. Donald Trump confirmed that the summit between him and Chinese President Xi Jinping will take place as planned later this month in Korea.

After these statements by the US President, the need for risk prevention has decreased. Earlier this week, concerns about escalating US-China tensions were a driver for gold prices to increase strongly.

I think Trumps more dovish statement has helped ease the heat in the precious metals market, independent precious metals trader Tai Wong in New York told Reuters.

In the context of falling adjusted prices, the world's largest gold ETF SPDR Gold Trust net bought 12.6 tons of gold in the session on Friday, raising its holdings to 1,047.2 tons of gold. This week, the fund net bought 30 tons of gold.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...