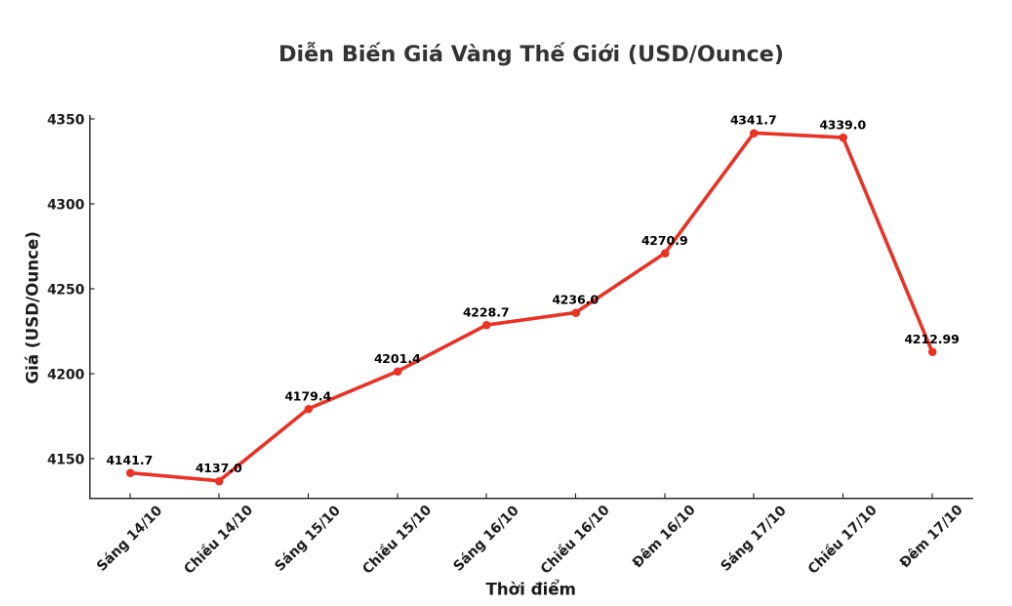

Gold prices fell sharply last night, due to profit-taking waves when prices were too high. In addition, the stronger US dollar and new statements from US President Donald Trump have made the market less optimistic about trade tensions.

At 12:39 p.m. New York time (ie 11:39 p.m. last night, Vietnam time), spot gold prices fell 2.6%, down to $4,212.99/ounce, after setting a historical peak of $4,378.69/ounce in the session.

The day before, the precious metal surpassed the $4,300/ounce mark for the first time and is heading for a gain of about 5% for the week. The price of December gold futures in the US fell 1.8%, to 4,225.80 USD/ounce.

The USD Index (DXY) rose 0.1%, making gold which is priced in greenback more expensive for buyers outside the US. Before falling, gold was on track for its biggest week of gains since September 2008 the time of a global financial crisis due to the collapse of Lehman Brothers.

Independent trader Tai Wong commented: "Mr. Trump's more dovish stance since announcing a 100% tax rate has somewhat cooled down the precious metals market." Also on October 17, Mr. Trump confirmed that he will meet with the Chinese leader, contributing to reassuring concerns about trade tensions.

Since the beginning of the year, gold has increased by more than 62%, thanks to support from geopolitical instability, central bank purchases, withdrawal from the USD and strong investment in gold ETFs. Expectations of the US Federal Reserve (FED) cutting interest rates soon also contribute to consolidating the increase of this non-yielding asset.

We expect gold prices to average $4,488/ounce by 2026, with the risk of price increases still present due to market supporting structural factors, said Suki Cooper, head of global commodity research at Standard Chartered Bank. The market is now pricing in the possibility of a 25 basis point cut at the October meeting and another in December.

HSBC also raised its 2025 average gold price forecast by $100 to $3,455 an ounce, and said the precious metal could reach $5,000 an ounce by 2026.

Meanwhile, physical gold demand in Asia remains steady despite consecutive record prices, with the difference in India at a 10-year high as the holiday season approaches.

Spot silver prices fell 5.1% to 51.48 USD/ounce, after setting a new peak of 54.47 USD/ounce. However, silver is still heading for a 2.6% increase for the week. platinum prices fell 6.1% to $1,607.69/ounce, while gold lost 8.1%, down to $1,483.75/ounce.