World gold skyrockets and suddenly plummets

With no US economic data affecting investor sentiment, gold prices have been rising steadily every day over the past week, fueled by a wave of concerns about tariffs and trade, before suddenly turning around and falling sharply on Friday - the shock that left many new investors in the market.

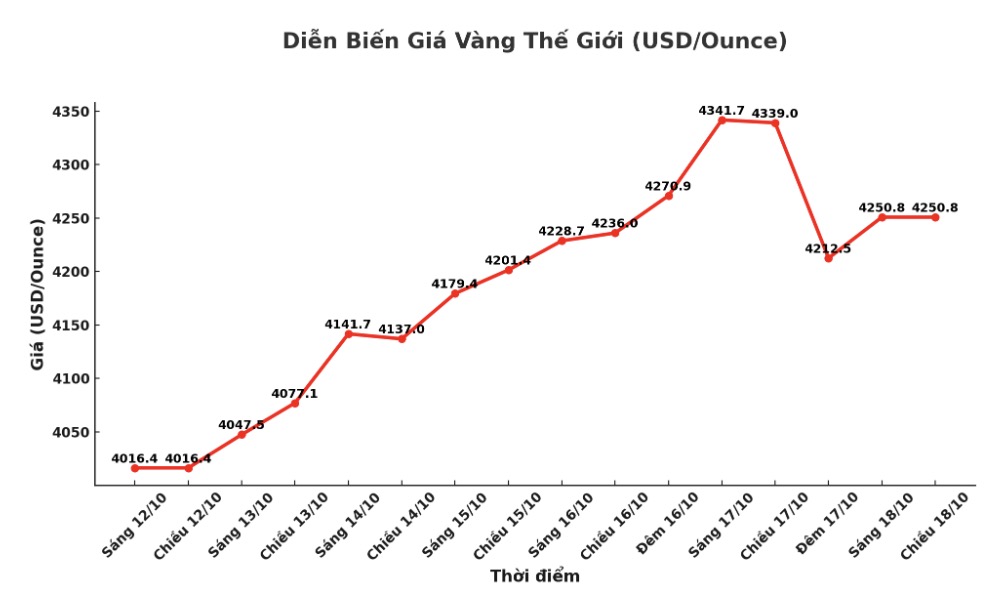

Spot gold prices opened the week at $4,022.44 an ounce, and this is one of the cases where the chart says it all. The precious metal surpassed the $4,100/ounce mark just before Monday's noon, breaking through $4,200/ounce just before the market closed on Wednesday, continuing to reach $4,300/ounce just 15 minutes before the North American market closed on Thursday, and peaking nearly $4,400/ounce specifically, $20 below this mark around 1:00 a.m. on Friday (Eastern time).

While the unprecedented rally in gold has been exciting, the entire drama of the week has centered on Friday's trading sessions.

As soon as the Asian market opened on Friday, gold prices increased sharply from 4,315 USD/ounce to 4,368 USD after only 15 minutes. A three-peak pattern quickly took shape around 8:30 p.m., sending gold down to $4,290 an ounce just an hour later. However, buyers have not given up, and by midnight, spot gold has set a new peak at 4,370 USD/ounce.

After a final rally that hit a weekly high and also an all-time high $4,380.99 an ounce buying power began to weaken.

Gold then entered a deep decline, falling to 4,334 USD at 4:00 a.m. (Eastern time), continuing to 4,287 USD at 7:45 a.m., and reaching 4,217 USD/ounce just half an hour after the North American market opened.

After two failed attempts to surpass the 4,260 USD/ounce mark at around 11:30 am, gold prices continued to slide to the lowest level of the day at 4,185.91 USD/ounce just after 13: 15.

At this price range, buying pressure returned, helping gold recover slightly and trading around 4,240 USD/ounce when entering the weekend.

Domestic gold market

Domestic gold prices last week fluctuated strongly following the developments of the world market, with a continuous increase and an increasingly wide price gap between brands.

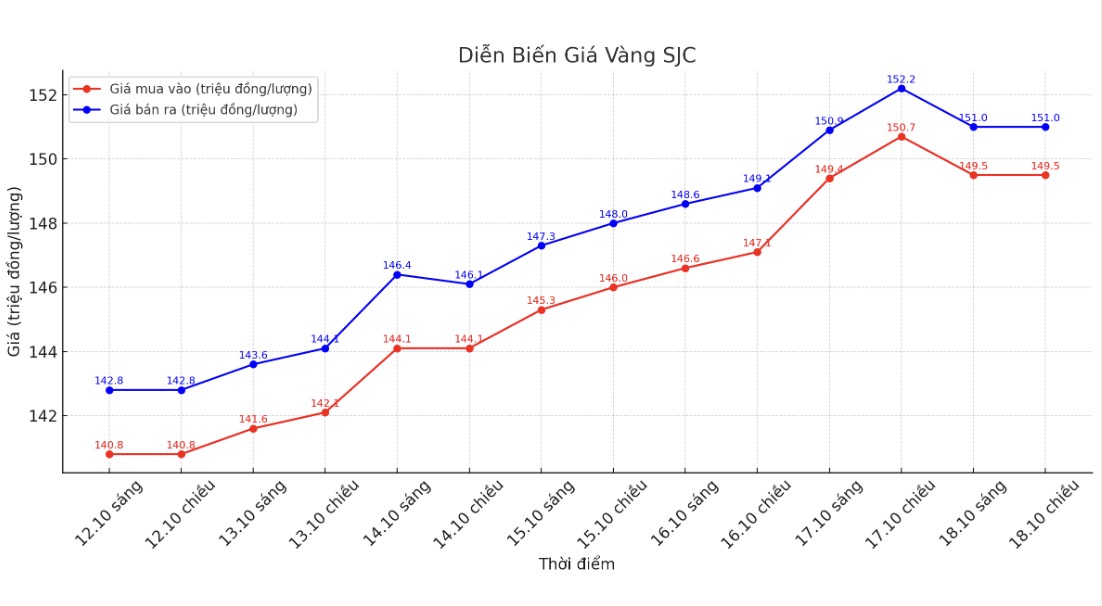

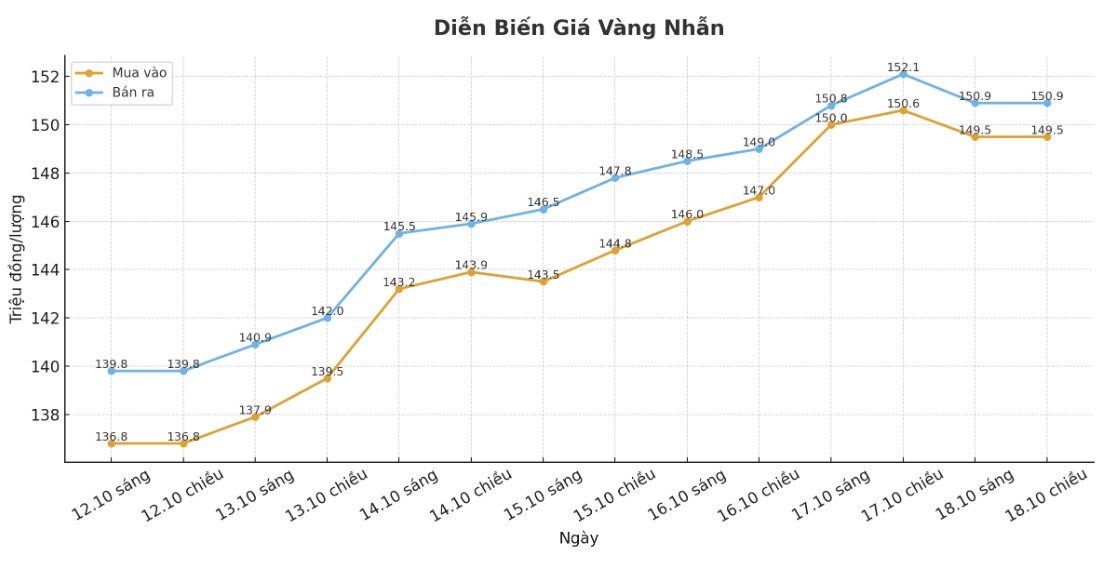

On Monday morning (October 14), the price of SJC gold bars was listed by large enterprises around 141.6-143.6 million VND/tael (buy - sell), while gold rings were at 137.9-140.9 million VND/tael, an increase of 800,000 VND to 1 million VND compared to the previous session.

Entering Tuesday, the price of SJC gold bars at DOJI Group increased sharply to 144.1-146.4 million VND/tael, while gold rings fluctuated around 142.4-145.4 million VND/tael; some other units listed the price of gold rings higher, at 143.2-145.5 million VND/tael.

By Wednesday, the increase continued when the price of SJC gold bars skyrocketed to 145.3-147.3 million VND/tael, with some places listing 144.5-147.3 million VND/tael. On Thursday, gold bars were traded at 146.6-148.6 million VND/tael; gold rings also increased accordingly, to 146-148.5 million VND/tael.

The climate will peak over the weekend. On Friday (October 18), the price of SJC gold bars reached 149.4-150.9 million VND/tael; gold rings increased to 150-150.8 million VND/tael. These prices were almost maintained until Saturday morning, before increasing slightly on Sunday, when SJC gold was listed at 149.5-151 million VND/tael, gold rings at 149.5-150.9 million VND/tael.

Thus, the sudden decline in world gold at the end of the week did not greatly affect the domestic market.

Notably, the gold price difference between domestic enterprises has reached a record level. At 5:00 p.m. on October 18, DOJI Group listed gold rings at VND 149.5-150.9 million/tael, while Bao Tin Minh Chau announced a much higher price, up to VND 156-159 million/tael.

In the free market, trading activities are even hotter when SJC gold bars and plain round gold rings are being offered for sale at 170-180 million VND/tael

See more news related to gold prices HERE...