Gold price movements last week

Geopolitical tensions and internal instability pushed gold prices to record highs this week, as strong fluctuations returned to the precious metal market.

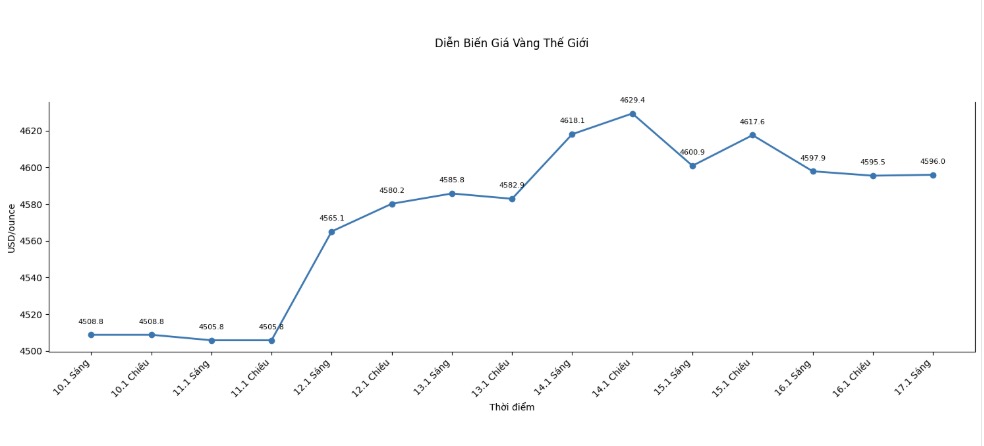

Spot gold price opened the week at 4,529.89 USD/ounce. According to Kitco, when information about the US Department of Justice's lawsuit against the Federal Reserve (Fed) spread, this precious metal immediately soared, hitting a peak of 4,591.53 USD/ounce at around 7:30 PM Sunday (Eastern US time).

By 4 am on Monday, spot gold prices traded right below the 4,600 USD/ounce mark. After a short correction to the important support zone around 4,582 USD/ounce.

Fluctuations occurred very strongly right from the beginning of the session. At 8 am, spot gold prices broke through the 4,600 USD/ounce mark, reaching nearly 4,616 USD/ounce at 8:45 am, before falling sharply to 4,586 USD/ounce just 15 minutes before the stock market opened. Then, the price rebounded strongly, reaching 4,630 USD/ounce at around 11 am.

In the afternoon, gold prices cooled down, but a high trading range was set. Throughout Tuesday and Wednesday, gold fluctuated in the range of 4,580 to 4,630 USD/ounce. On Wednesday afternoon alone, a strong increase pushed spot gold prices to the highest level of the week, reaching 4,640 USD/ounce.

After that, gold prices fell in the night trading session, but the support zone above 4,580 USD/ounce was once again maintained. The market entered a period of accumulation, when gold prices fluctuated in a narrow range from 4,585 to 4,620 USD/ounce.

The drama of the week was focused on Friday morning. Failure to surpass the 4.620 USD/ounce mark at 10 am caused gold prices to plummet sharply, falling to the lowest level of the week at 4,536 USD/ounce just half an hour later. However, the recovery momentum also took place no less quickly, when gold prices rebounded, approaching the 4,600 USD/ounce mark at around 11:30 am, before stabilizing in a range of about 20 USD/ounce until the end of the week.

Gold price forecast for next week

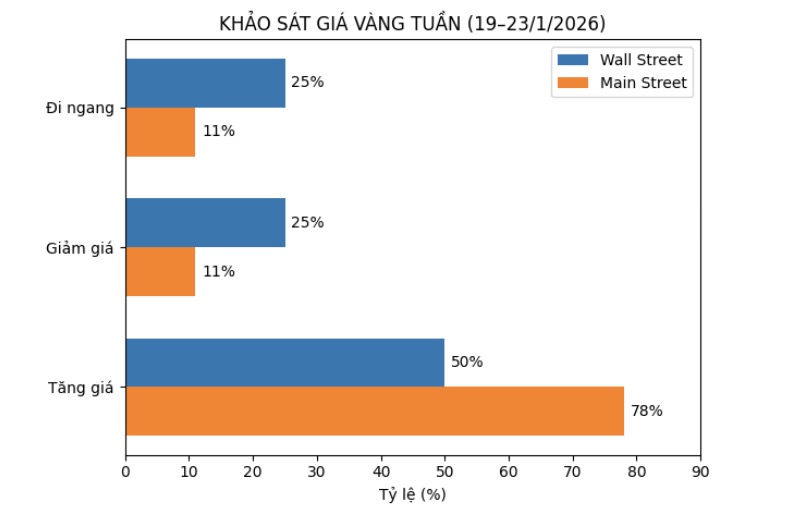

The latest weekly gold survey with Wall Street experts shows that analysts are having mixed views on the short-term outlook for gold prices, while individual investors continue to consolidate the optimistic trend.

This week, 16 experts participated in the gold survey. Among them, only half of Wall Street maintained a positive view of the short-term outlook for gold prices.

Accordingly, 8 experts, equivalent to 50%, predict that gold prices will continue to rise next week; 4 others, accounting for 25%, believe that gold prices will decrease. The remaining 4 analysts (25%) predict that this precious metal will continue to move sideways and accumulate next week.

Meanwhile, Kitco's online poll recorded a total of 247 votes, with the optimism of individual investors increasing after gold prices set new peaks. There are 192 small investors, equivalent to 78%, expecting gold prices to continue to rise next week.

Meanwhile, 27 people (11%) predicted gold prices would weaken. The remaining 28 investors, accounting for 11% of the total, believe that gold prices will remain unchanged in the near future.

Economic data to be monitored next week

Next week's economic information release schedule focuses on important data on inflation and growth, but market developments are likely to still be mainly affected by geopolitical factors.

The US market will close on Monday on Martin Luther King Jr.'s Day. Meanwhile, in Europe, the World Economic Forum (WEF) officially opened in Davos (Switzerland). By Tuesday, the market will receive the US ADP weekly jobs data.

On Wednesday, US Pending Home Sales data in December will be released. On the same day, US President Donald Trump is scheduled to deliver a speech at the World Economic Forum.

On Thursday morning, the US will announce a series of figures including Q3 GDP (the final version), the PCE inflation index for October and November, and the number of weekly jobless claims.

The trading week closed on Friday with the US announcing the preliminary PMI of S&P's manufacturing and service sector in January, along with the final consumer sentiment report from the University of Michigan.

See more news related to gold prices HERE...