Alex Kuptsikevich - senior market analyst at FxPro, believes that gold may turn down not only next week but also extend to the following period. According to him, the developments last week have sent a noteworthy warning signal.

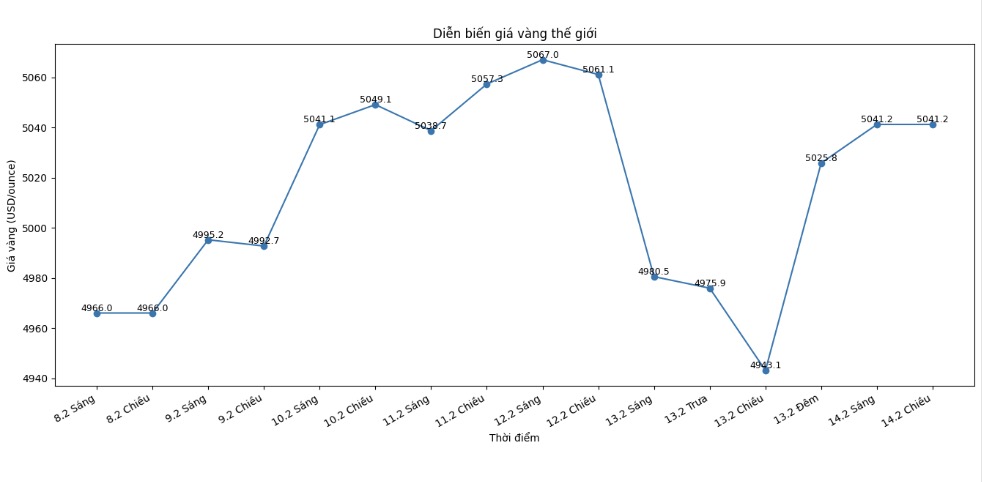

Gold fluctuates in the 4,900 - 5,100 USD range for most of this week. Although prices have increased steadily in many sessions, a decrease of nearly 4% in less than an hour on Thursday evening shows that sellers still prevail" - Kuptsikevich commented.

He further analyzed that gold has maintained an upward trend since February, but other precious metals show a less positive picture. "Silver continuously created low peaks for three weeks, and platinum also weakened after each sell-off. This is a clear signal of a shift to a downward price market," he said.

According to Kuptsikevich - although gold appears to be more solid than silver and platinum, the risk of correction is increasing as many speculators switch to taking profits or closing buy positions. "We expect prices to fall back to the 4,600 - 4,700 USD zone, where recent extremes converge and the 50-day moving average. If this support zone is breached, selling pressure may accelerate," he warned.

Sharing the same cautious view, Michael Moor - founder of Moor Analytics, assessed that gold is likely to weaken next week, unless prices rebound to important technical levels.

Declining trend, unless the price backs up to the technical threshold mentioned" - Moor said. He gave a series of technical milestones at different time frames, showing that some previous signals are "temporarily suspended" or "reactivated", while emphasizing price zones that can create significant pressure or support for the market.

Meanwhile, Adam Button - Head of Currency Strategy at Forexlive. com - said that Thursday's strong sell-off was a modest reminder to experienced analysts as well.

That's the kind of session that makes analysts "confused", because our job is to always have an answer. But the reality is that there is no convincing explanation" - Button said.

According to him, immediately after the shock drop, the market appeared many rumors. "Many people believe that there was leakage of US CPI information. However, the CPI announced later was lower than expected, clearly not the cause" - he emphasized.

Button also pointed out the unusual trading time factor. "Around 11:15 am is not the time frame that usually witnesses a large enough order line to create such fluctuations. It could be a trading error (fat finger), but this is still an incomprehensible move" - he commented.

From the cash flow perspective, Button leans towards the scenario of liquidating positions. "If there is really a large volume to sell, there is no reason to "release" billions of USD at the same time. The move is too sudden, forcing the market to think about the possibility of margin calls" - he said.

I guess someone had to sell profitable assets to meet margin calls. To create such strong fluctuations, it must be a very large fund. In terms of timing, I lean towards the possibility of margin calls from a European organization" - Button commented.

According to this expert, the high volatility environment is causing precious metal traders to lack a reference point, thereby eroding confidence in the trend.

“It is a double-edged sword. Everyone wants the market to be as vibrant as meme stocks until they are caught up in the fluctuating "washing machine". Valuation becomes difficult, as is strategy operation. Eventually, this may cause investors to leave the market," he warned.

In the short term, Button believes that most known risks are leaning towards price reductions. "I am worried that as the Chinese Lunar New Year approaches, seasonal factors will turn unfavorable," he said.

In addition, Button said he is monitoring three main factors including tariffs, Iran and the Fed. "There is currently no clear catalyst to push prices higher until signals from Warsh or a ruling from the Supreme Court on tariffs appear. Iran may enter negotiations in the next month or two. The Fed is probably temporarily out of radar" - he said.

It may take several months for the market to see new momentum. I have not seen a catalyst for gold. If the price remains around 5,000 USD/ounce and the daily fluctuation range narrows to about 50 USD, the market may be able to attract cash flow again. Currently, I maintain a neutral stance" - Button concluded.