Low US inflation reinforces confidence that the US Federal Reserve (Fed) may begin a cycle of interest rate cuts this year.

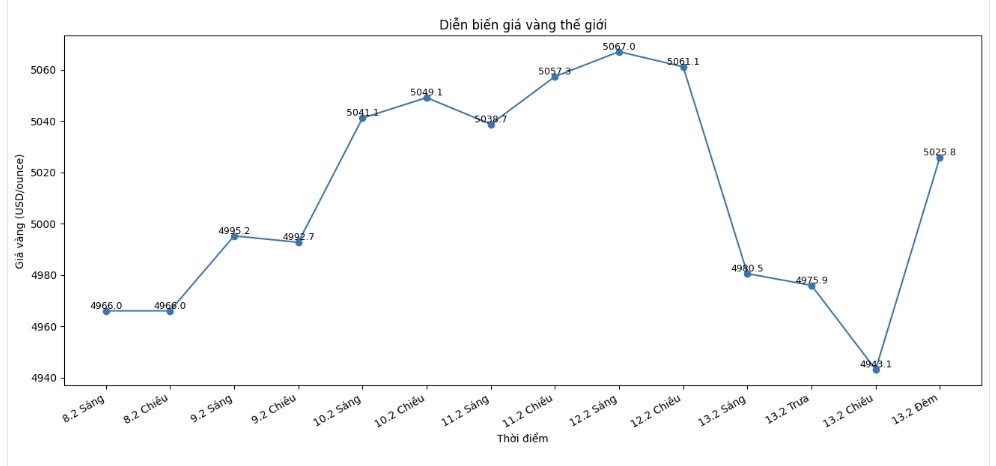

At the time of writing (23:33 on February 13 - Vietnam time), the spot world gold price increased sharply, fluctuating around the threshold of 5,025.8 USD/ounce.

Previously, the market witnessed a deep correction when gold lost nearly 3% in just one session.

The main driving force comes from the US consumer price index (CPI) report for January. Accordingly, the CPI only increased by 0.2%, lower than analysts' forecast of 0.3%. Year-on-year inflation also cooled down to 2.4%, significantly down from the previously recorded 2.7%.

Experts believe that easing inflation gives the Fed more room to ease monetary policy. Market data shows that investors are betting on a total cut of about 63 basis points this year, with the first cut possibly taking place from July.

In a low-interest environment, gold - a non-interest-generating asset - is often more attractive, especially when the role of "safe haven" is emphasized.

Not only gold, silver also surged sharply, at one point climbing more than 3% after a double-digit plunge in the previous session. However, some analysts warned that silver's increase could slow down if industrial demand weakens due to high prices.

In the Asian market, physical gold demand in China remained positive ahead of the Lunar New Year. Meanwhile, the Indian market recorded a discount trend, reflecting the caution of buyers.

Investment banks continue to maintain optimistic views. ANZ recently raised its gold price forecast for the second quarter of 2026, saying that precious metals are still an effective risk hedging tool in the context of economic and geopolitical uncertainty.

Observers believe that in the short term, the 5,000 USD/ounce zone is playing an important psychological resistance role. The next developments of gold will largely depend on the Fed's policy roadmap and upcoming US economic data.

The world gold market operates based on two main pricing mechanisms. The first is the spot market, where prices are listed for buying and selling and immediate gold delivery transactions.

The second is the futures contract market, where prices are determined for gold delivery at a time in the future. Due to liquidity factors and position adjustments at the end of the year, the December gold futures contract is currently the most actively traded contract on the Chicago Mercantile Exchange (CME).

See more news related to gold prices HERE...