According to Bloomberg, the silver shortage is not only happening in India but is spreading globally. The holiday shopping fever in India has quickly resonated with a wave of international investment and hedge funds, as many see silver as a way to bet on the weakness of the US dollar - or simply chase the strong rally of the market.

Last weekend, the heat spread to the entire London silver market - where global silver prices are priced. Major banks are almost out of metals to trade, many traders have described the market as "nearly paralyzed", as banks have to refuse to quot prices amid the wave of rushed calls and stress from customers.

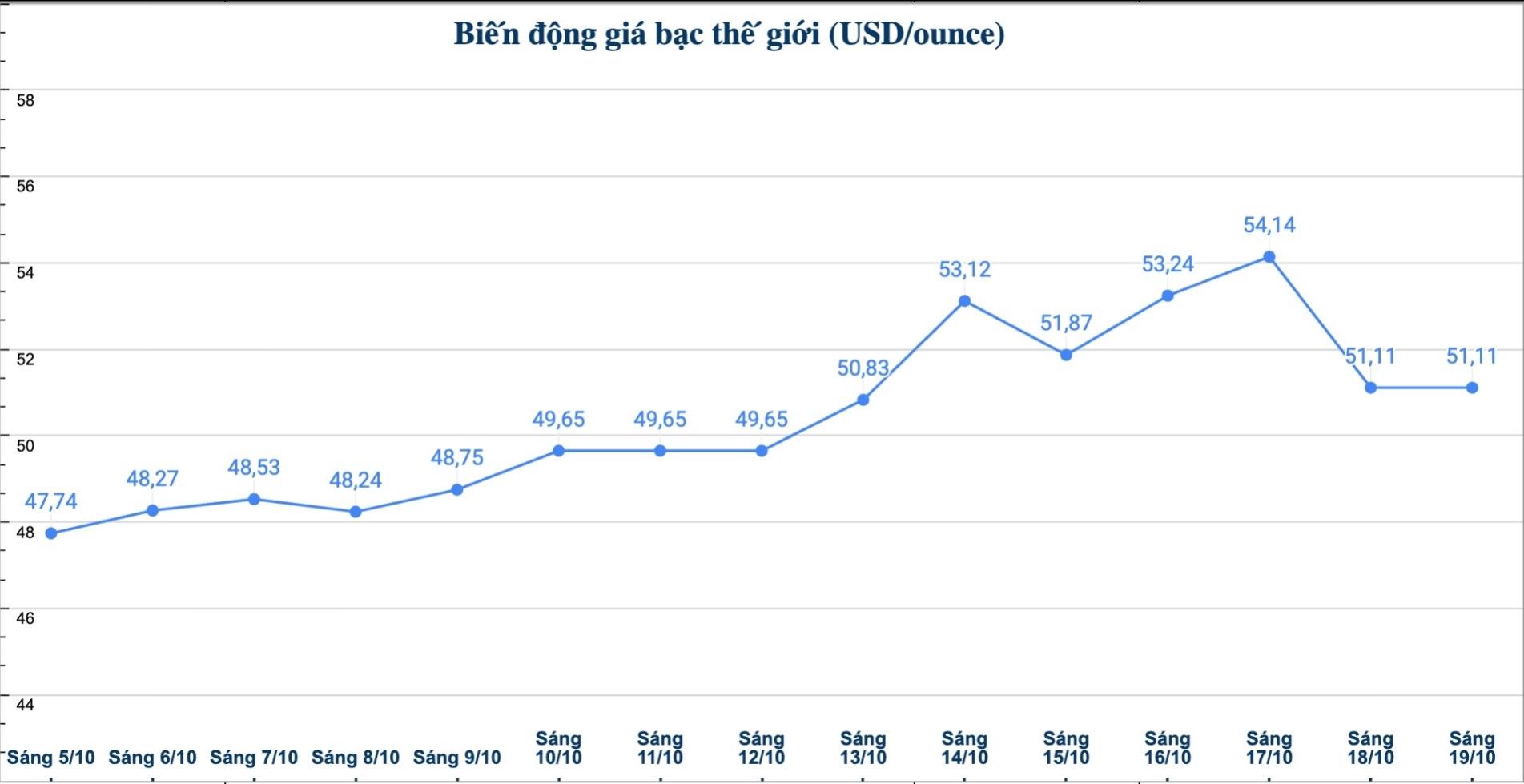

This week, silver prices climbed to a new peak of more than 54 USD/ounce and then suddenly plummeted 6.7% on Friday - a testament to the huge pressure that the market is suffering.

According to Bloomberg, the story of a "silver market collapse" in 2025 is due to many factors: the solar energy industry has been growing hotly for many years, silver is being transferred to the US to avoid the risk of taxation, the wave of investment in precious metals is part of the trend of "buying when the USD is weak" and the demand for silver consumption increases dramatically in India.

In India, Diwali festival is often associated with people buying gold, but this year the trend has changed. After a record rally in gold, many believe silver will be the "next star".

As a result, demand for silver in India has increased unprecedently. dealers are out of stock, the domestic and world price gap exceeds 5 USD/ounce - an unprecedented high. Meanwhile, supply from China was disrupted by the holiday, putting huge pressure on the London market.

Global silver ETFs increased their purchases, attracting more than 100 million ounces of silver in just the first few months of the year, causing physical reserves in the market to decrease significantly.

In London, Metals Focus said that silver loan interest rates skyrocketed to the equivalent of 200%/year, liquidity was almost frozen. Some banks offer prices that are so different that traders can buy at one bank and immediately resell to another bank for profit - something rarely seen in a large market.

TD Securities analyst Daniel Ghali said he has been warning for more than a year about the possibility of a supply shortage in the London silver market.

When prices increase too quickly, he recommends that investors be cautious because the market can soon adjust. Although this prediction came earlier than expected, this weekend, the market turned down more than 5% when the US-China relationship showed positive signals, causing investors to simultaneously sell.

"Siliver may face further downward pressure in the coming period as silver from New York and China is being transported to London to supplement supply" - Daniel Ghali commented.

As of 8:05 a.m. on October 19, the world silver price was listed at 51.11 USD/ounce.

See more news related to silver prices HERE...