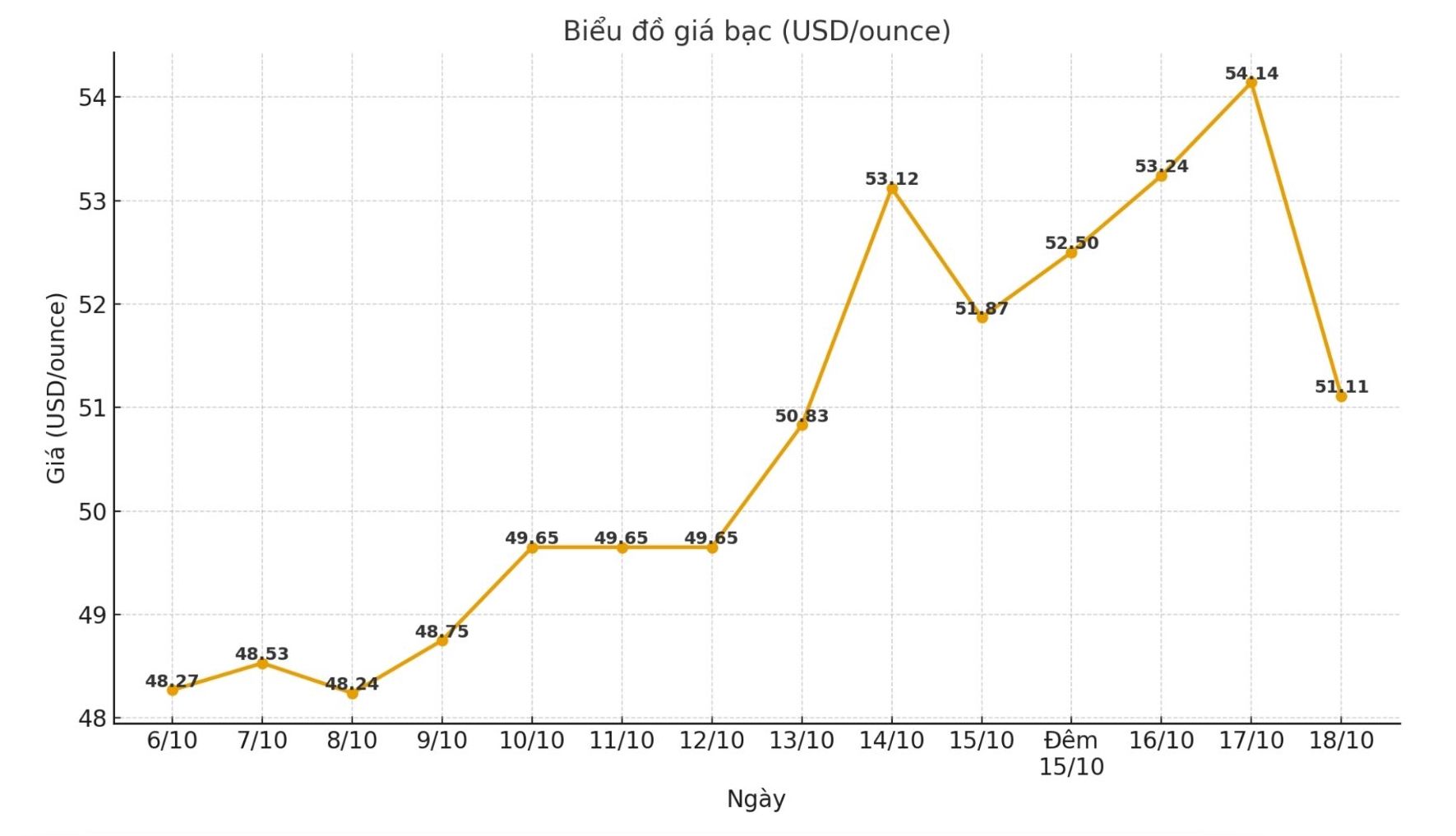

World silver prices fell more than 6%, marking the strongest decline in the past 6 months, as the precious metals group simultaneously adjusted after a series of hot increases throughout this week.

According to Bloomberg, this decrease comes as the market is less concerned about credit risks in the US and US-China trade tensions show signs of cooling down. As demand for safe-haven assets such as gold and silver eases, investors are starting to take profits after a period of strong price increases.

In addition, the historic scarcity in the London silver market - a factor that once caused silver prices to escalate - is also gradually improving.

Ms. Nicky Shiels - Director of Metals Strategy of MKS Pamp SA - commented: "The situation of silver shortages in London has somewhat eased after reaching the extreme stress level. As regional fluctuations become more stable, pressure to adjust prices and profit-taking activities may continue to appear."

The correction in silver also coincides with a recovery in US Treasury yields, as concerns about the financial health of regional banks and lending activities ease, according to Bloomberg. This development has caused safe-haven capital to withdraw from precious metals, contributing to reducing demand for gold and silver.

Overseas markets are now seeing the USD index continue to weaken. The USD index is having its biggest week of decline in two months. The greenback fell for the fourth consecutive session, due to the "unmatched" signal from the Federal Reserve (FED) and new concerns about US regional banks.

The yield on the two-year US Treasury note fell to a three-year low, while the 10-year yield fell below 4%.

Oil prices decreased slightly to about 57.25 USD/barrel, the 10-year bond yield was 3.94%.

As of 8:50 a.m. on October 18, the world silver price was listed at 54.14 USD/ounce, down 3.03 USD compared to yesterday morning.

Update on domestic silver prices

As of 8:50 a.m. on October 18, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.989 - 2.031 million VND/tael (buy - sell); down 86,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company was listed at 52.310 - 53.810 million VND/kg (buy - sell); down 1.770 million VND/kg in both directions compared to yesterday morning.

The price of 999 gold bars of Golden Rooster 999 (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) is listed at 2.097 - 2.148 million VND/tael (buy - sell).

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.985 - 2.046 million VND/tael (buy - sell); down 88,000 VND/tael for buying and down 91,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 52.933 - 54.559 million VND/kg (buy - sell); down 2.346 million VND/kg for buying and down 2.427 million VND/kg for selling compared to yesterday morning.

See more news related to silver prices HERE...