In the past six weeks, speculators have been selling gold contracts heavily, causing the precious metal's net buying position to fall to a three-month low.

However, selling pressure slowed last week as the latest trading data from the US Securities Exchange Commission (CSTC) showed that hedge funds had begun to buy back fake sales contracts.

According to the CFTC's Commitments of Traders report as of March 11, fund managers have reduced the number of comex gold futures to 204,907, down just 58 compared to last week. At the same time, the number of sales contracts decreased by 976 contracts to 37,331 contracts.

Gold's total net buying position has remained largely unchanged from last week, currently at 167,576 contracts. Compared to the peak at the end of January, gold buying positions have decreased by 22%.

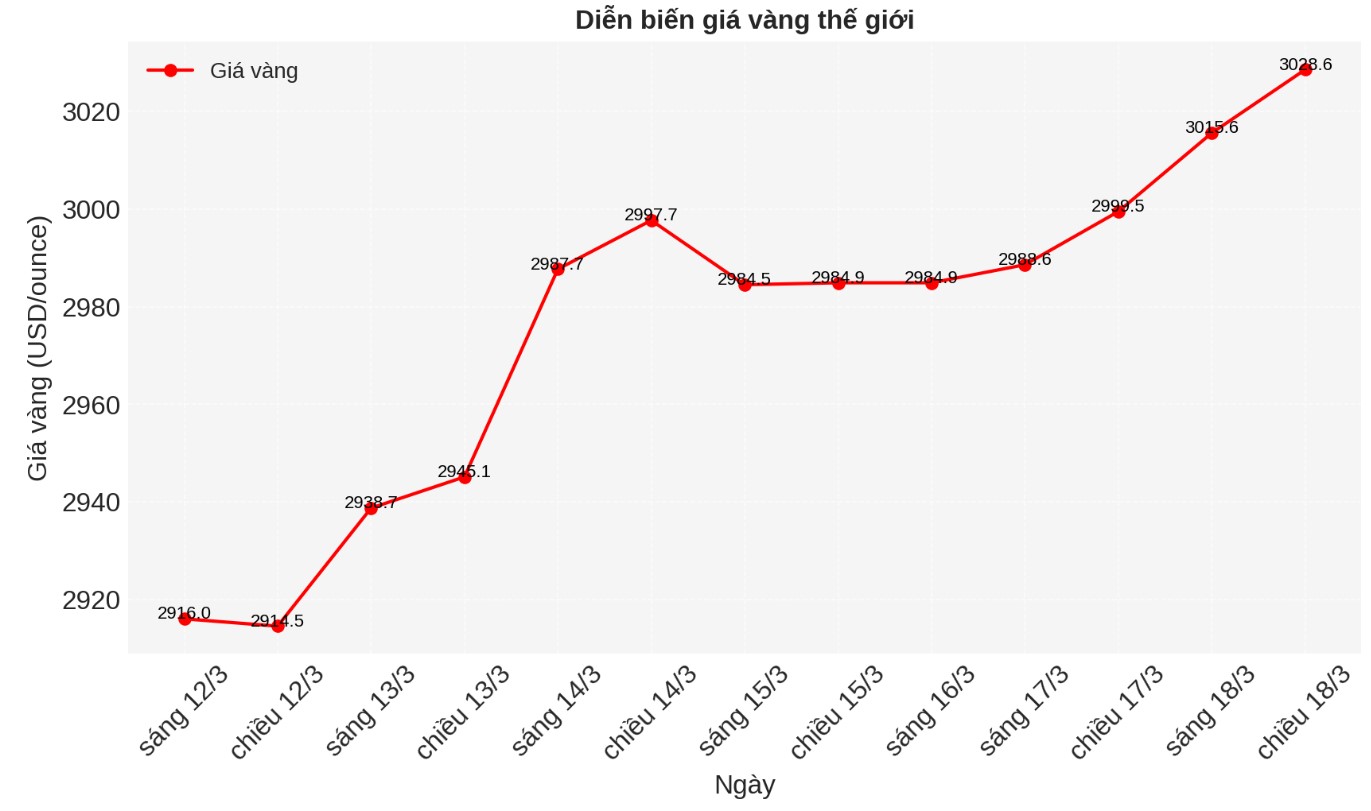

Commodity experts at TD Securities said that the gold market may see a "fear of missing out" (FOMO) mentality, as speculators return to the market when prices fluctuate around $3,000/ounce, an important psychological threshold.

"With risky investment budgets tightened due to pressure from the stock market, macro funds have reduced their net buying position for gold to the lowest level since the summer of 2024, when gold prices traded about 500 USD/ounce lower than at present.

This will eventually boost FOMO sentiment, especially as gold prices enter an unprecedented range above $3,000 an ounce. Conversely, if the global price trend reverses, selling pressure will be limited because macro funds have significantly reduced their positions and algorithmic trading floors (CTAs) still have a lot of room before activating the first sell order" - analysts commented.

According to data from the World Gold Council (WGC), last month, exchange-traded funds (ETFs) in North America attracted 72.2 tons of gold, worth $6.8 billion. This is the highest monthly inflows for the region since July 2020, and a record high in February.

This trend continued in March. Data from the WGC showed that global ETF holdings increased by 32.7 tons of gold last week, of which ETFs in North America attracted 22.6 tons of gold.

Experts say that although ETF capital flows are increasing, there is still much room to expand because the total global gold holdings are currently about 20% lower than the peak in 2020.

Chris Mancini, portfolio manager at Gabelli Gold Fund (GOLDX), told Kitco News: "The gold ETF is finally starting to attract cash flow after years of withdrawals. This is important because ETFs are the supply and demand for gold as a frontier material.

Mancini said that the increase in gold prices to $3,000/ounce is the next step in the price increase cycle that began two years ago, after Russia launched a military campaign in Ukraine and Western governments froze Russia's foreign exchange reserves in USD and euro. As a result, many central banks in emerging markets have shifted their reserves from USD to gold.

Meanwhile, David Miller - portfolio manager at GOLY - said that global central banks' gold reserves have increased by more than 1,000 tons per year over the past three years, higher than the average of the previous decade.