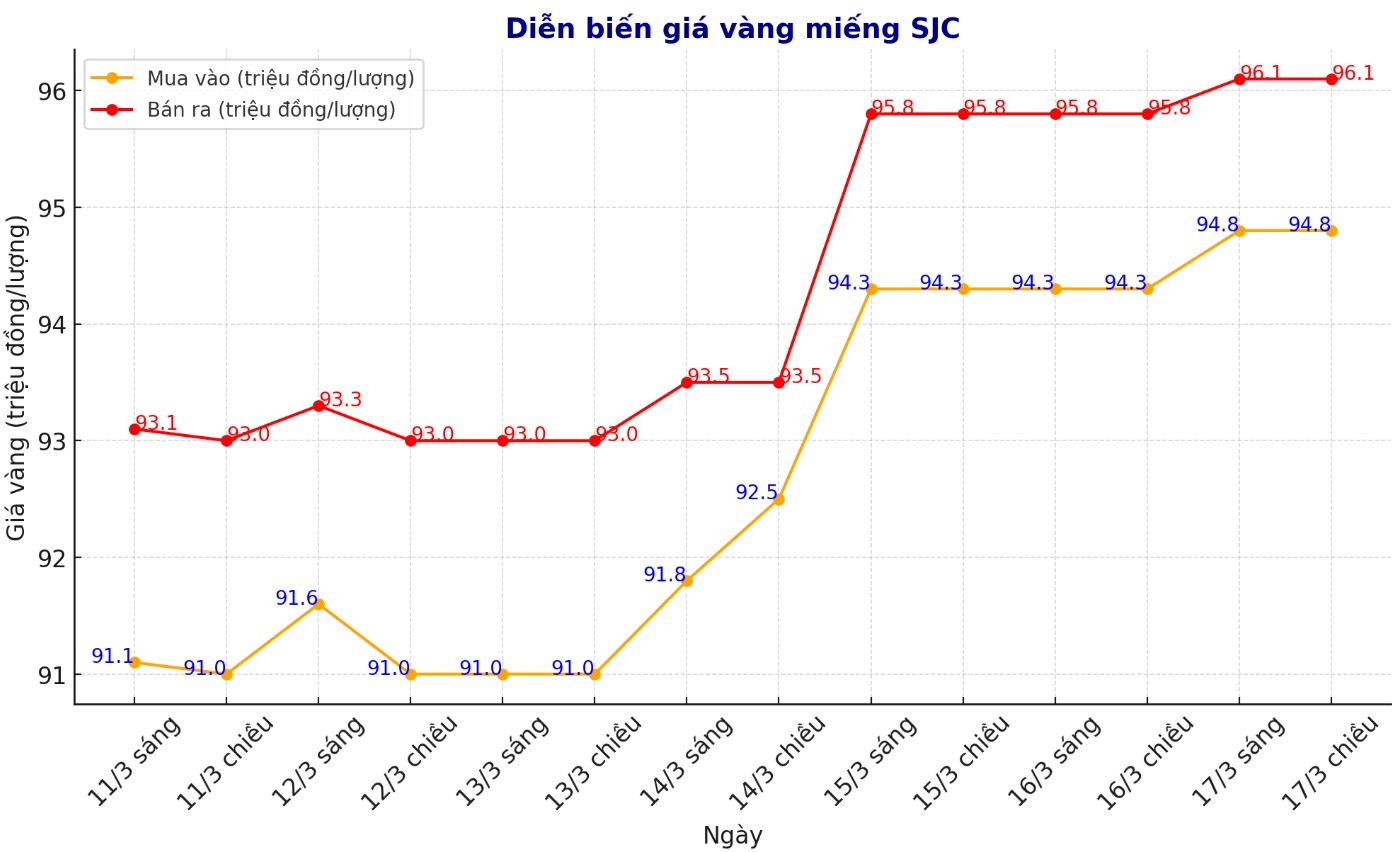

Updated SJC gold price

As of 6:50 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND94.8-96.1 million/tael (buy - sell), an increase of VND500,000/tael for buying and an increase of VND300,000/tael for selling. The difference between buying and selling prices is at 1.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND94.8-96.1 million/tael (buy - sell), an increase of VND500,000/tael for buying and an increase of VND300,000/tael for selling. The difference between buying and selling prices is at 1.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND94.8-96.1 million/tael (buy - sell), an increase of VND400,000/tael for buying and an increase of VND300,000/tael for selling. The difference between the buying and selling prices of SJC gold is listed at 1.3 million VND/tael.

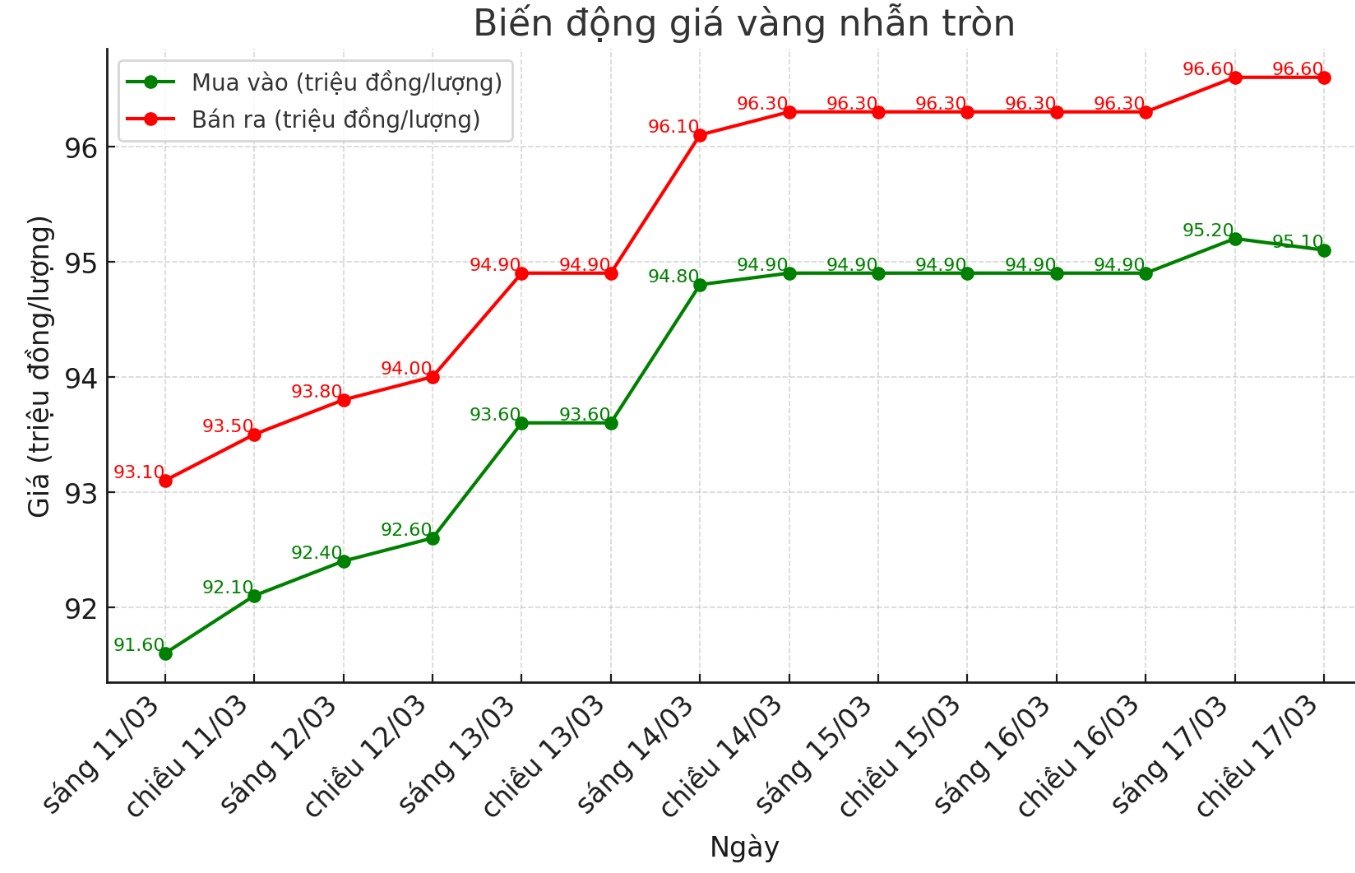

9999 round gold ring price

As of 6:50 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND95.1-96.6 million/tael (buy - sell); increased by VND200,000/tael for buying and increased by VND300,000/tael for selling. The difference between buying and selling is listed at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 95.2-96.8 million VND/tael (buy - sell); increased by 250,000 VND/tael for buying and increased by 300,000 VND/tael for selling. The difference between buying and selling is 1.6 million VND/tael.

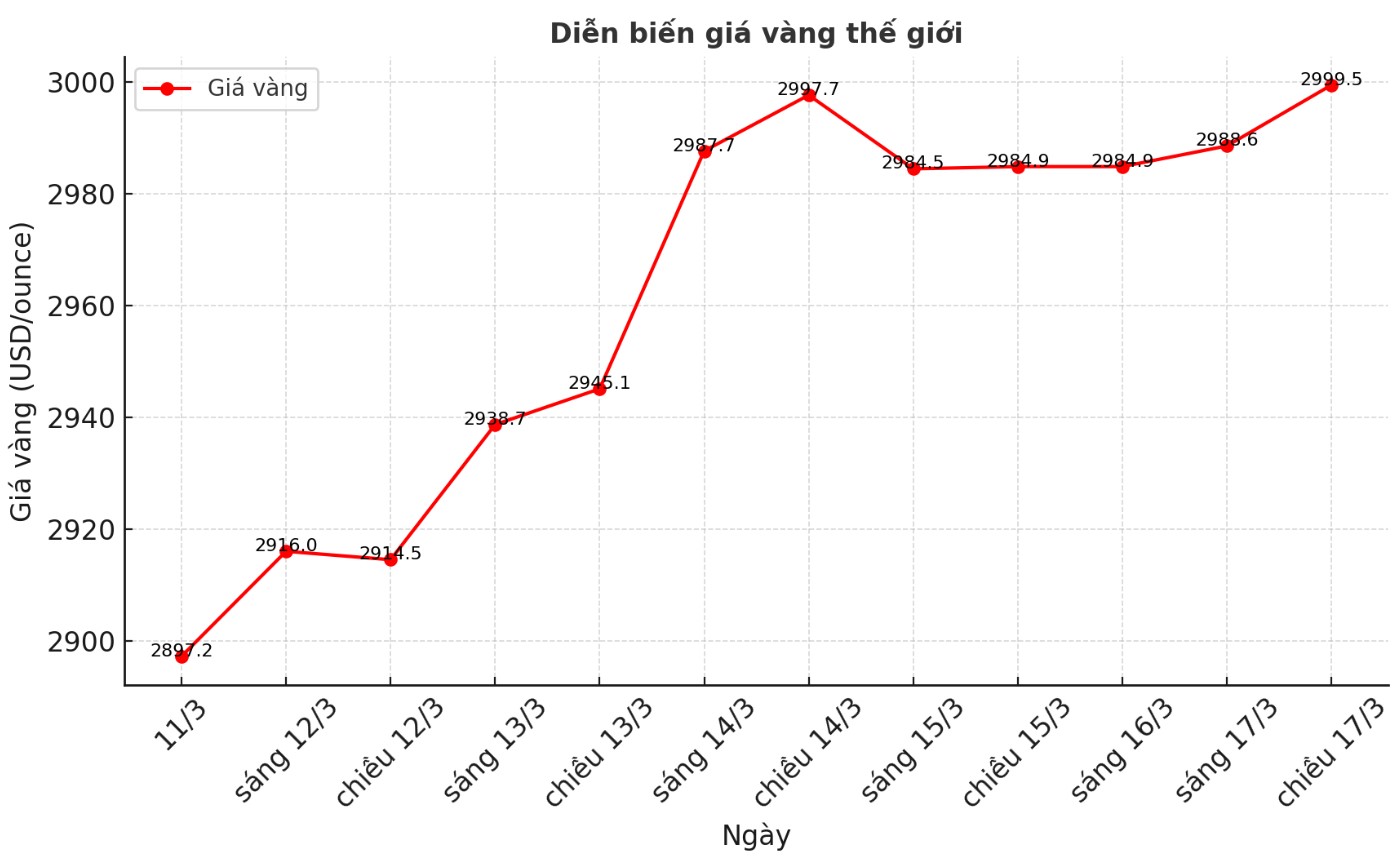

World gold price

As of 6:50 p.m., the world gold price listed on Kitco was at 2,999.5 USD/ounce, up 1.8 USD/ounce.

Gold price forecast

World gold prices increased in the context of the USD decreasing. Recorded at 6:50 p.m. on March 17, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.192 points (down 0.17%).

According to Reuters, despite a wave of profit-taking from investors, gold prices today remained close to the $3,000/ounce mark after reaching this level in the previous session.

Gold prices are struggling due to escalating trade tensions between the US and other partners, threatening economic growth and exacerbating geopolitical tensions.

Concerns that President Donald Trump's sweeping tariff policies will push prices higher and hurt the economy have become more evident after the new data showed consumer confidence fell to its lowest level in nearly two and a half years in March, while inflation expectations soared.

Regarding the risk of recession, US Treasury Secretary Scott Bessent said on Sunday that it is impossible to guarantee that the economy will avoid recession, even if there is still an adjustment.

"The recent increase in gold prices was driven by concerns about inflation," said Kelvin Wong, senior market analyst for the Asia-Pacific region at OANDA.

He said that gold's short-term momentum remains positive, with the next resistance levels at $3,016/ounce or $3,030/ounce.

Sean Lusk - co-head of commercial risk prevention at Walsh Trading - said that gold prices are being driven by economic and political events. He said central banks continue to increase their gold holdings whenever prices have a correction.

We have seen a strong rally from 2023 to present, thanks to the prolonged uncertainty that has benefited gold over the past three years, Lusk said.

He also noted that the next potential prices could be $3,036/ounce and $3,168/ounce.

Kevin Grady - President of Phoenix Futures and Options believes that the $3,000/ounce mark is an important psychological threshold, but the most important thing is who is buying and who is selling.

He found that central banks such as Poland, Turkey and China have all increased their gold reserves. I think youll see prices around $3,000 an ounce for a while, but the general trend is still up, Grady said.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...