According to Kitco, the world gold market has broken the $3,000/ounce mark firmly. Despite the strong upward momentum, a market analyst has not yet rushed to adjust the forecast, as higher prices could have a surprising impact on this precious metal.

In a recent interview with Kitco News, Chantelle Schieven - Head of Research at Capitalight Research - said she still maintained her initial prediction that gold would reach a peak of $3,200/ounce this year. However, she emphasized that, despite possible fluctuations, gold is still in a sustainable uptrend.

I think gold will surpass the highest level ever adjusted for inflation, but that cannot happen this year, she said.

Schieven said gold's record highs by inflation, as of January 1980, were around $3,400/ounce.

Despite his optimistic view on gold this year, Schieven admitted that it is difficult to predict the impact of the economic downturn on this precious metal. She explained that during recessionary periods, investors often sell gold to raise cash to cover losses in the stock market.

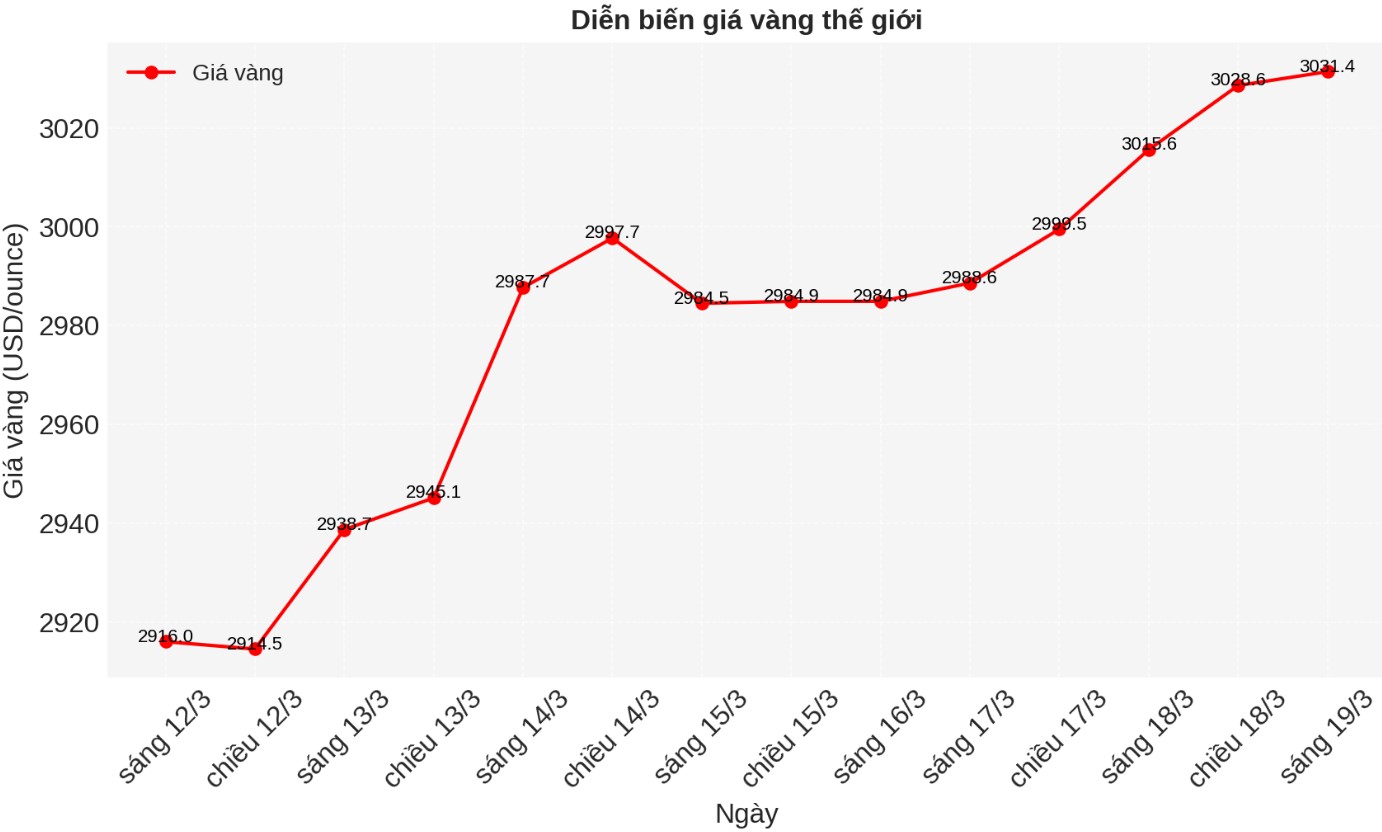

Gold prices have risen more than 15% since the start of the year, while the S&P 500 has fallen nearly 5% since the start of the year and down 8.5% from its historical peak last month.

Schieven predicts that the global economy will continue to face difficulties as US President Donald Trump persists in the US priority policy, including imposing tariffs on imports, increasing global trade tensions.

Schieven also noted that gold could face some short-term challenges as Donald Trump's isolationist policies force Europe to increase spending. In recent weeks, significant investment flows have flowed into Europe after the European Union (EU) announced a package of about $1 trillion to member states to increase defense and infrastructure spending.

On Tuesday, the German parliament voted to approve a 500 billion euro package - a record level of spending to strengthen the army and improve infrastructure.

However, in the long term, Schieven believes this will continue to strengthen the role of gold as an important monetary asset.

The more uncertainty is created by the US, the more the strength of the US dollar as a global reserve currency weakens. Gold will play an important role in a world where there is no longer a single reserve currency, she said.

Schieven predicts that central banks will continue to buy gold and reduce their dependence on the USD, thereby creating a solid floor in the market. I believe that gold prices will have a downward correction at some point, but many people will see it as a good buying opportunity, she said.

In the latest research report released on Friday, Ole Hansen - Head of Commodity Strategy at Saxo Bank also said that "it would not be surprising if gold prices fell to $2,956/ounce, or even $2,930/ounce when investors took profits".

However, he also said that he sees any decline in the market as an opportunity to buy and emphasized the gold price target for 2025 of $3,300/ounce.

Hansen noted that strong central bank demand, falling global interest rates and geopolitical instability are key factors driving gold's unprecedented rally from February 2024. He pointed out that gold prices have increased by 39% in the past 12 months and 14% since the beginning of 2025.