Techniques to "pull chickens" and block communication

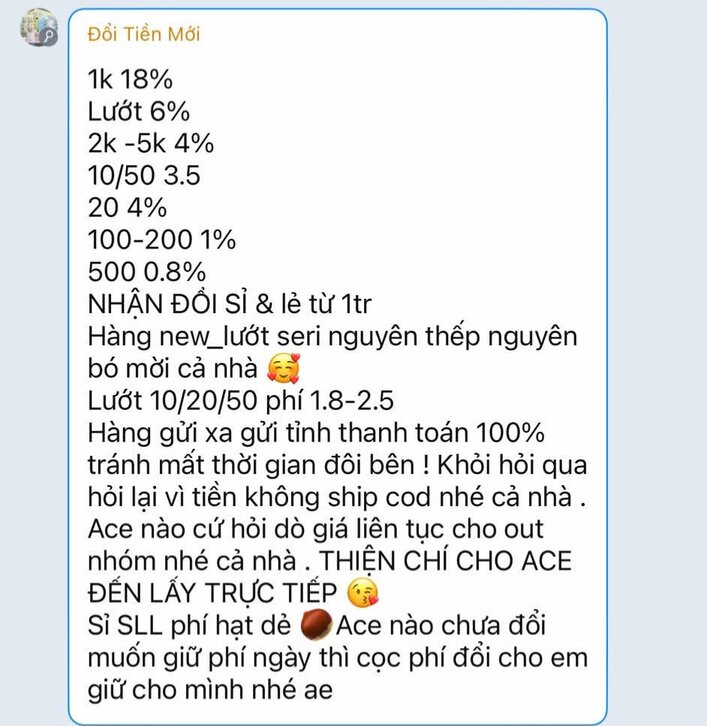

On Facebook and Zalo platforms, groups "Exchange new money, lucky money" spring up like mushrooms. The general scenario is to post photos of piles of money with full denominations, committing low fees from only 0.8 - 1.5%. However, to "keep place", customers are forced to transfer deposits. As soon as the money enters the account, the group owner immediately blocks contact (blocks) and "kicks" the victim out of the group.

Ms. H.T (Cau Giay, Hanoi) shared: "They put up a list of successfully exchanged customers as news. I transferred 500,000 VND of deposit and was immediately removed from the group. At that time, I realized I was just one of dozens of people being'trapped' every day.

Mr. Quoc Nam (Ha Dong, Hanoi) added: "Their tricks are very sophisticated, often using virtual accounts and photos of money from different sources. When someone comes in to unblock, they will delete all messages and disband the group to form a new group.

Illegal money exchange is heavily fined, the fine can be up to 80 million VND

Based on Circular No. 25/2013/TT-NHNN, only the State Bank and licensed credit institutions are allowed to carry out money exchange activities. In particular, this exchange only applies to money that does not meet circulation standards (scratched, broken, deformed...).

Therefore, individuals and organizations spontaneously exchanging new money with circulating value to make a profit through collecting difference fees is an act against regulations. The law does not prohibit people from exchanging at the same price for lucky money, but once service fees arise, this act may be administratively sanctioned.

According to the provisions of Clause 5, Article 30 of Decree No. 88/2019/ND-CP on sanctioning administrative violations in the field of currency and banking:

For individuals: A fine of 20 - 40 million VND for the act of performing money exchange not in accordance with regulations.

For organizations: The fine is double, from 40 - 80 million VND.

Besides legal risks, people need to be especially vigilant against the risk of being defrauded of transfers to appropriate assets or receiving counterfeit money. In cases where transactions show clear signs of fraud, the perpetrators may be prosecuted for criminal liability.

Experts recommend that people should exchange money at the banking system or switch to electronic lucky money to both ensure safety and comply with the law.