The driving force for gold price increase has changed, currency depreciation is the main factor

Daniel Ghali - senior commodity strategist at TD Securities commented that if last year, the central bank was the main purchasing force driving gold prices up, now the main driving force has shifted to currency depreciation and risk-off sentiment.

Gold buying by central banks is a long-term trend. Since 2010, the number of central banks buying gold has increased. The reasons they buy gold are also very different, said Ghali.

He gave an example of the downward trend in dependence on the US dollar since sanctions on Russia were imposed, as well as the desire of many countries to diversify their assets and reduce dependence on the US dollar. However, I think the main reason for the increase in gold purchases this year is to prevent the risk of currency depreciation.

We have started the year with a strong increase in the USD. It sounds counterproductive, but if a country wants to reduce its dependence on the US dollar, it can take advantage of strong US dollar times to sell USD-denominated assets and buy non-USD assets, including gold. In that way, the pressure of currency depreciation is actually a factor that is driving central banks' gold purchases this year, he said.

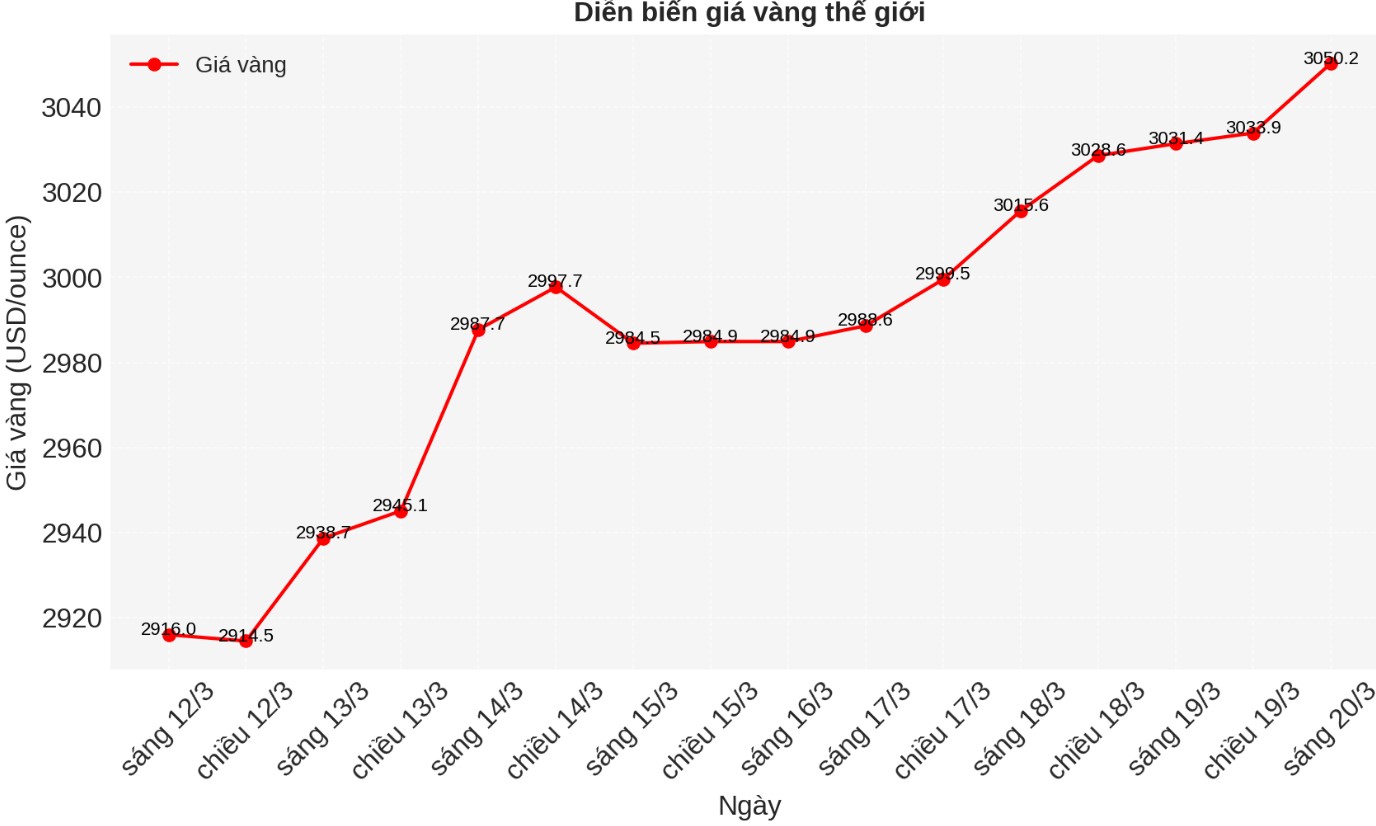

However, the value of the US dollar has weakened significantly recently, along with a decline in the US stock market, causing the upward momentum of gold to once again change.

The US dollar has weakened significantly in recent weeks, so we believe that the mystery buying activity we call mystery buying has declined. But the interesting thing about gold prices this year is that you have the perfect variety of gold buying drivers, said Ghali.

If the US dollar appreciates, central bank shady buyers will participate. But as the US dollar falls, Western investors also tend to buy gold. This is a traditional scenario where gold has an inverted relationship with interest rates, the US dollar and other economic factors.

In our opinion, this is what is happening right now. In fact, this is a scenario that could boost the fear of missing out on opportunities in the gold market, as macro funds have sold off a large amount of gold in the past few weeks. When gold prices hit a new peak, they will have to buy back, said Ghali.

Many people also speculate that the decline in Bitcoin and other digital assets could cause cryptocurrency flows to gold, but Ghali believes that this relationship is almost non-existent.

People often talk about gold as a replacement for Bitcoin and vice versa. But the reality is that capital flows into ETFs Bitcoin is not correlated with capital flows into gold. These are two different investment channels. Capital flows into ETFs Bitcoin have a higher correlation with risky assets, so the decline in the US stock market in the past few weeks has caused investment funds to limit risks.

Ghali was one of the first experts to see a shift in the traditional relationship of the precious metals market, especially the US dollar. In an interview on February 12, he noted that a strong US dollar is often bad for goods, including precious metals, but that is no longer true.

Silver Scenario Is More Attractive

While TD Securities rates gold as having a positive outlook, Ghali said that the scenario for silver is even more attractive: We believe that silver is having a very strong establishment. This is the most attractive opportunity in the current commodity market.

This is not a story of a shortage of money supply as people think, but a real investment opportunity, Ghali stressed.

"One factor of artificial impact is causing London silver reserves to plummet, while the US Treasury is rising rapidly. The US is an important silver consumer market, but supply has been lacking for the past four years. With the current price, the amount of silver available is unlikely to return to the market. To attract more supply, silver prices need to increase.

This is a very strong set for silver prices. We believe silver will catch up with gold's impressive performance last year, the expert said.

Ghali is one of the first market experts to warn of changes in the precious metals market in recent months. At the end of November 2024, he warned that large funds were gradually divesting from gold.