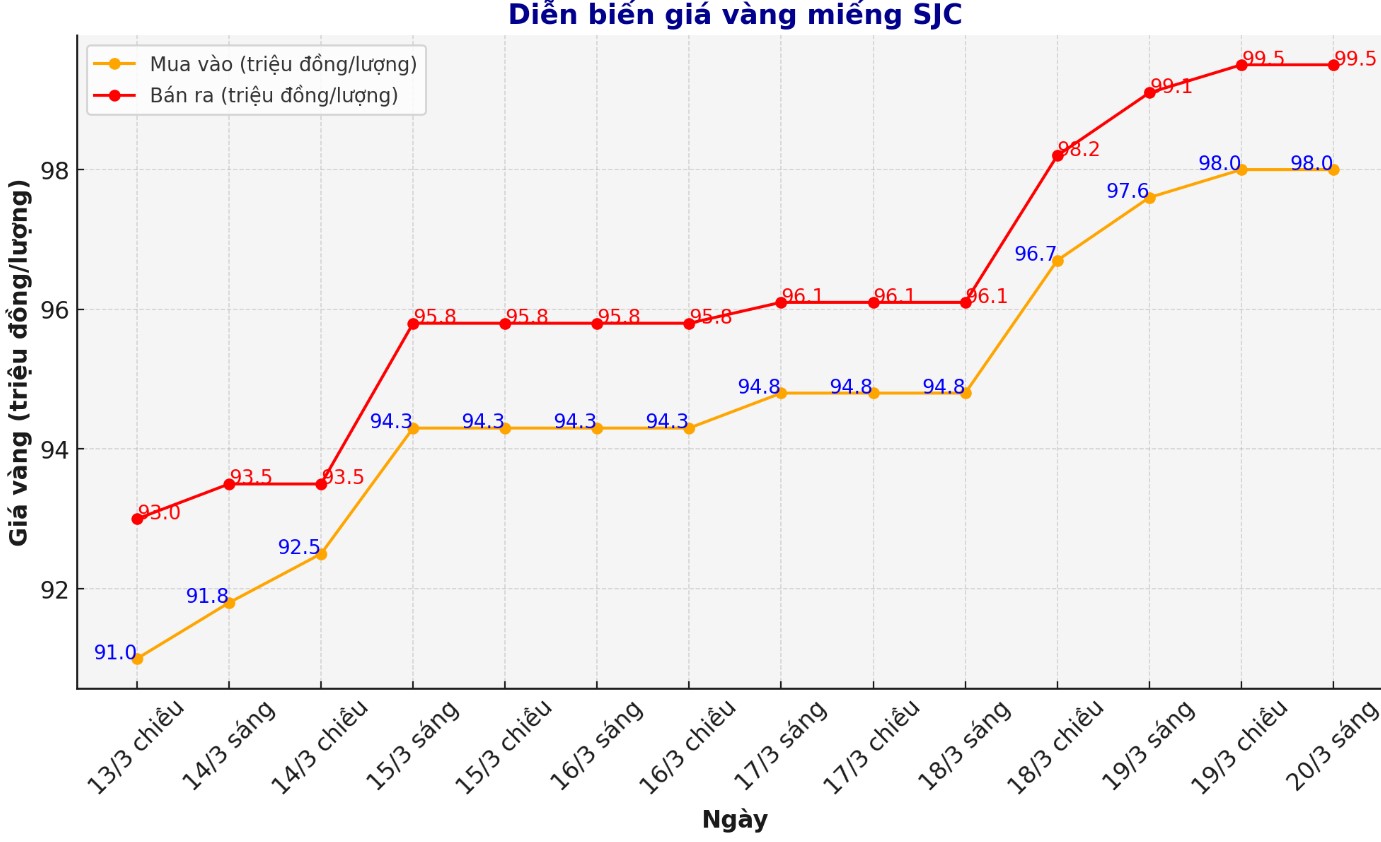

Updated SJC gold price

As of 6:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND98-99.5 million/tael (buy in - sell out), an increase of VND1.3 million/tael for both buying and selling. The difference between buying and selling prices is at 1.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 98-99.5 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for both buying and selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 98-99.5 million VND/tael (buy - sell), an increase of 1.3 million VND/tael for both buying and selling. The difference between buying and selling prices is at 1.5 million VND/tael.

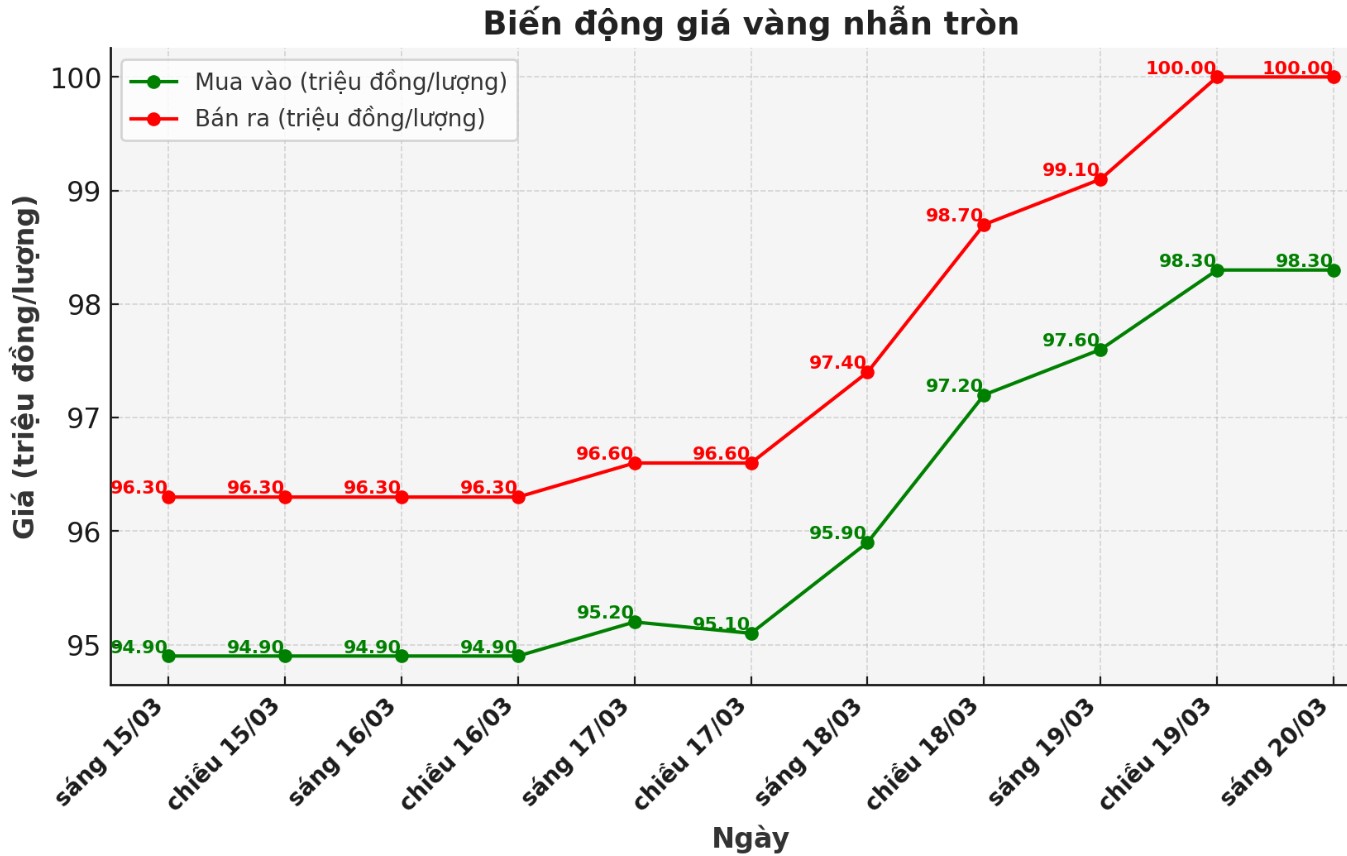

9999 round gold ring price

As of 6:30 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 98.3-99.9 million VND/tael (buy - sell); an increase of 1.1 million VND/tael for buying and an increase of 1.2 million VND/tael for selling. The difference between buying and selling is listed at 1.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.35-100 million VND/tael (buy - sell); increased by 830,000 VND/tael for buying and increased by 1.2 million VND/tael for selling. The difference between buying and selling is 1.65 million VND/tael.

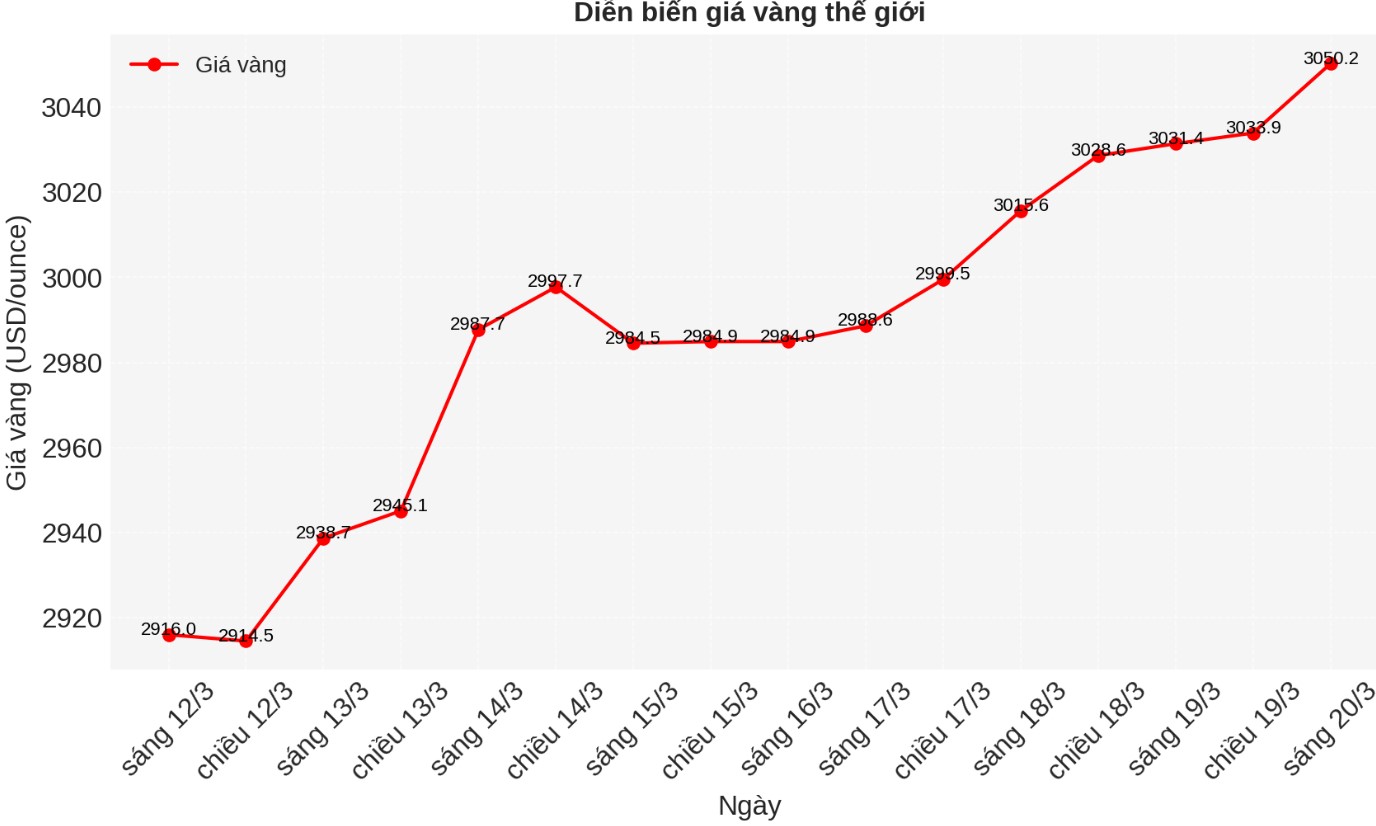

World gold price

As of 6:30 a.m., the world gold price listed on Kitco increased sharply to 3,050.2 USD/ounce, up 13.2 USD/ounce.

Gold price forecast

World gold prices skyrocketed despite the increase of the USD. Recorded at 6:30 a.m., the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.1 points (up 0.2%).

Gold prices increased after the US Federal Reserve (FED) announced the Federal Open Market Committee's policy statement without any major surprises. Meanwhile, silver futures fell sharply due to profit-taking by short-term traders after a recent rally. Gold prices for April delivery increased by 4.1 USD to 3,045 USD/ounce, while silver for May delivery decreased by 0.508 USD to 34.3 USD/ounce.

The Fed did not change interest rates as expected, and said that the US economic outlook is currently uncertain and inflation remains high. The Fed also announced that it will slow down the narrowing of the accounting balance sheet, this move is considered a slight easing of monetary policy.

The gold market reacted positively when the FOMC did not give a policy tightening view. Investors are now awaiting the press conference of Fed Chairman Jerome Powell.

According to brokerage SP Angel, gold is attracting more and more attention, as fund managers increase their investment holdings, as reflected in holding gold ETFs up 5% over the past 12 months. However, this holdings are still lower than the COVID-19 period, creating room for gold prices to continue to increase as speculators enter the market."

The April gold contract still holds a solid technical advantage in the short term. The next target for buyers is to close above the important resistance level of 3,100 USD/ounce, while the seller aims to push prices below strong support at 2,900 USD/ounce.

The first resistance level was the contract peak of 3,052.4 USD, followed by 3,065 USD. First support was at the lowest level in the session of 3,031.3 USD, followed by a low of 3,008.2 USD on Tuesday.

In outside markets, WTI crude oil prices increased slightly to about 67.25 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.296%.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...