USD Index

On November 8, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies decreased by 0.04%, standing at 99.67 points.

According to experts, the USD's slow recovery is partly due to the negative impact of tax policies on the image of the US, along with the possibility that Mr. Trump may find a way to adjust the exchange rate to support trade. In addition, the trend of investors increasingly holding gold and Bitcoin as a hedge also reduces demand for USD.

Explaining the rate cut cycle, Chairman Powell called the September rate cut as a "risk management" step, thereby erasing expectations of a strong easing cycle. It was this signal that paved the way for the USD to recover, helping the Dollar Index increase continuously in October and early November.

At the weakest time of the year, many people were skeptical about the role of this currency as a global reserve currency. However, reality shows that there is not enough currency to replace it. In contrast, the weakening of the Euro and the Japanese Yen has contributed to the USD's rise.

VND vs USD exchange rate

In the domestic market, at the beginning of the trading session on November 8, the State Bank announced that the central exchange rate of the Vietnamese Dong increased by 3 VND, currently at 25,103 VND.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office is currently at: VND 23,849 - VND 26,359.

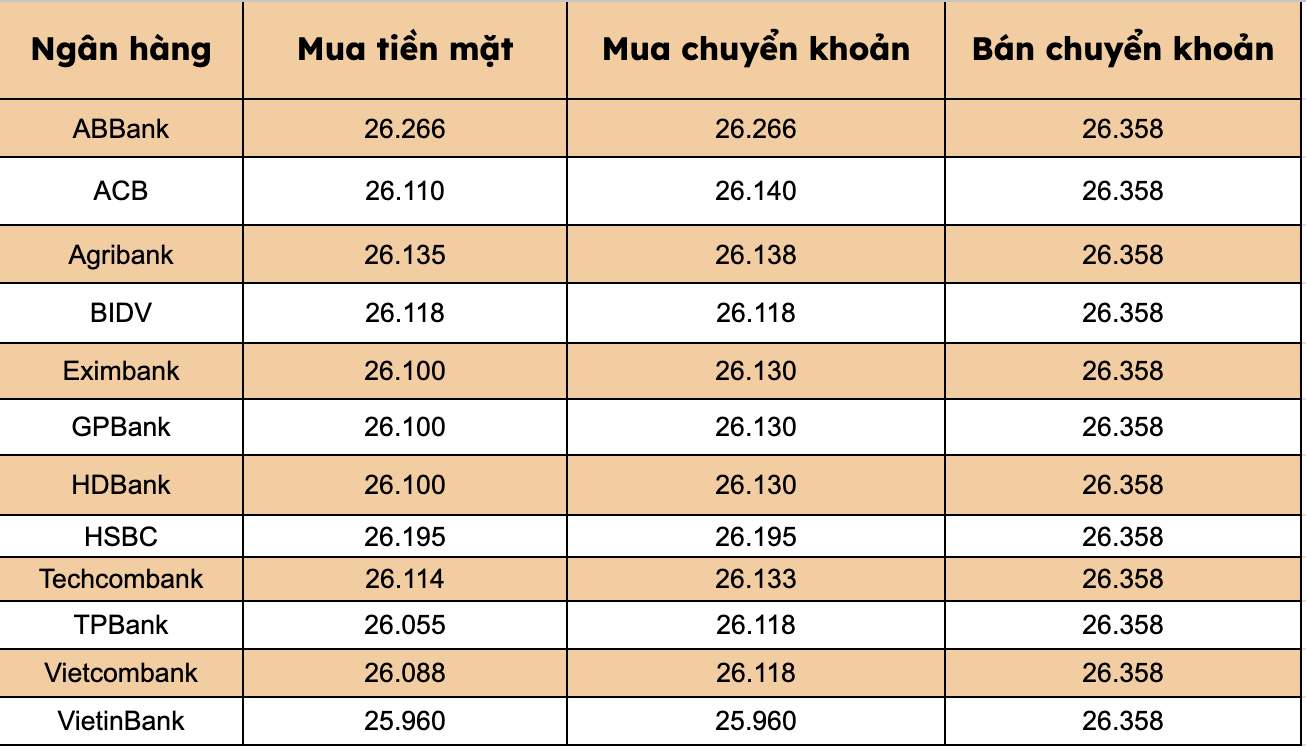

At commercial banks, USD prices increased at most brands.

Banks listed USD selling prices at VND26,358/USD, up VND3/USD.

Bank with the highest cash and bank transfer price: ABBank (26,266 VND/USD).

The difference between buying and selling prices at banks ranges from 92-394 VND/USD.