Gold prices increased in the trading session on Friday, regaining the important resistance level of 4,000 USD/ounce when the USD decreased. The move comes after US private sector jobs reports showed signs of weakness in the labor market, raising expectations for another rate cut by the Federal Reserve (FED). In addition, the prolonged US government shutdown has also boosted safe-haven demand.

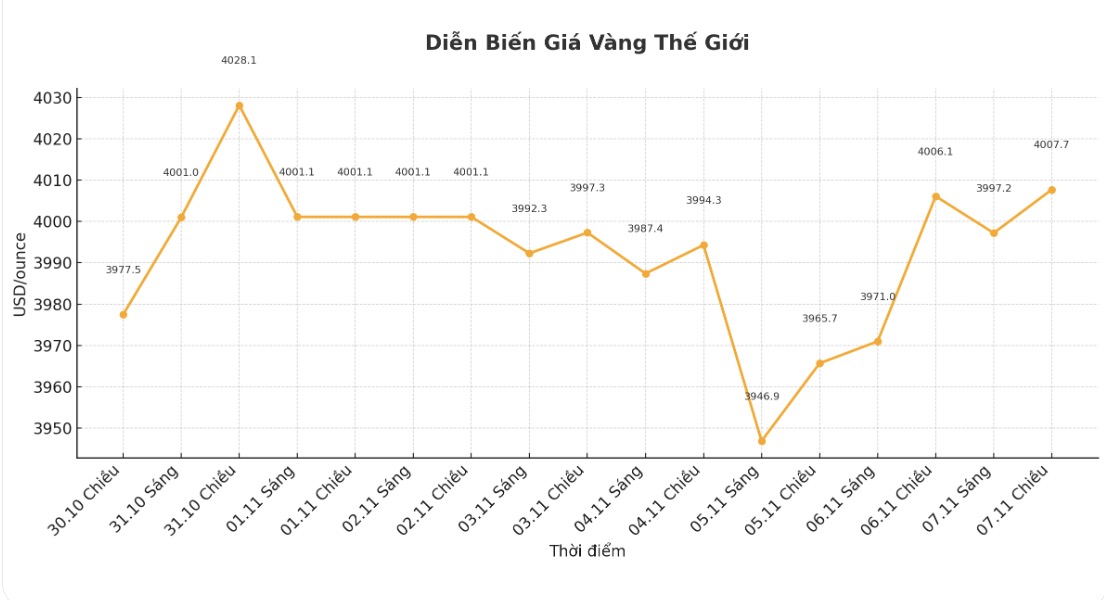

Spot gold prices rose 0.7% to $4,005.53/ounce at 7:02 a.m. GMT, heading for a 0.1% increase for the week. From the record of 4,381.21 USD/ounce recorded on October 20, gold prices have decreased by 8%. US December gold futures increased by 0.3%, reaching $4,004/ounce.

According to data released on Thursday, the US economy lost jobs in October, mainly in the government and retail sectors, while the wave of cost cuts and businesses' push for the application of artificial intelligence (AI) caused the number of layoffs to increase sharply.

Private employment data still shows that the possibility of the FED cutting interest rates in December is very high, and that is why gold prices are receiving support, said Soni Kumari, commodity strategist at ANZ.

The US dollar weakened, falling sharply against other major currencies, as investors - in the context of a lack of official data on the labor market - relied on private sector surveys to assess the situation. A weak labor market often increases the likelihood of interest rate cuts.

Investors now see a 67% chance of a rate cut in December, up from nearly 60% in the previous session. The Fed cut interest rates last week and Chairman Jerome Powell said this could be the last cut of the year.

The focus is on macroeconomic data and the timing of the US government's end of the shutdown, which is contributing to boosting safe-haven demand for gold, according to Kumari.

The Congressional deadlock has dragged the US into the longest government shutdown in history, forcing investors and the Fed - which rely on data - to rely on private sector indicators.

In the context of low interest rates and economic instability, gold - a non-yielding asset - often tends to increase in price.

In other precious metals, spot silver rose 1.5% to $48.69 an ounce, heading for a 0.1% increase for the week; platinum rose 0.6% to $1,550.7/ounce but still fell 1.1% for the week; palladium rose 1.6% to $1,397.20 an ounce but was expected to fall 2.4% for the week.

See more news related to gold prices HERE...