Central exchange rate of VND/USD

This morning (October 24), the State Bank of Vietnam announced that the central exchange rate decreased by 1 VND, currently at 25,098 VND/USD.

With an margin of plus/ minus 5%, commercial banks today are allowed to trade USD in the range of VND 23,894 - VND 26,302/USD.

At the State Bank of Vietnam's stock exchange rate, today's reference exchange rate decreased by 1 VND/USD:

Buy in: VND 23,894/USD.

Selling: VND 26,302/USD.

Domestic bank USD and black market USD prices plummet

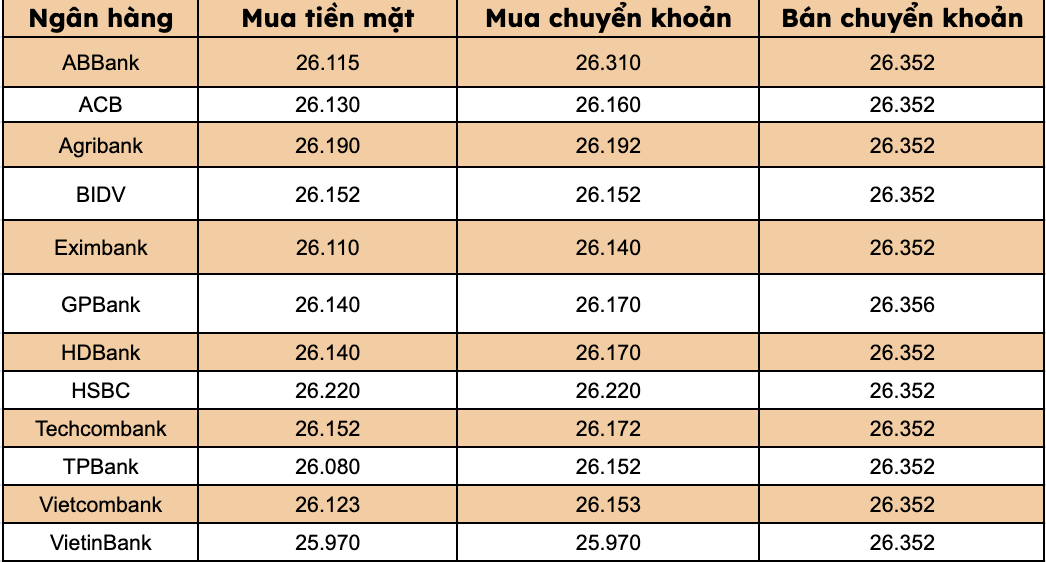

At most commercial banks, the USD price today increased sharply in both buying and selling directions. In the same direction, the price of black market USD reversed and increased, fluctuating between 27,309 - 27,429 VND/USD (buy - sell), and increased by 46 VND/USD compared to the previous session's close.

Banks listed USD selling prices at VND26,352/USD (down VND1/USD).

Bank with the highest cash and transfer price: HSBC (26,220 VND/USD, down 11 VND/USD).

The difference between buying and selling prices at banks ranges from 13 2-382 VND/USD.

Yen exchange rate against USD

At the time of the survey, the Yen exchange rate against USD was currently trading at 152.69 USD/JPY, continuing to increase. Meanwhile, in the free market, this pair of exchanges is trading between 176.65 - 177.85 USD/JPY (buy - sell), all decreasing compared to the previous session's close.

Assessment and forecast

According to Reuters, the USD increased compared to most major currencies, especially the Japanese Yen, on Thursday (October 23) as investors waited for US consumer inflation data to be released today and considered new US sanctions against Russian oil companies, which has pushed up oil prices.

The USD/JPY exchange rate was recorded at 152.64 yen, up 0.45%. The US dollar index (DXY) is almost unchanged, at 98.94 points.

The focus of the week is the US inflation data to be released despite the US government's closure, to support the US Department of Social Security in adjusting annual living expenses for 2026. Although the Fed has shifted its policy focus from inflation to the labor market, this figure is still receiving a lot of attention to assessing consumer spending and growth.

New US sanctions on Rosneft and Lukoil - two major Russian oil companies - pushed oil prices up nearly 5% on Thursday. The US Treasury Department has warned that additional sanctions will be imposed if Russia does not agree to stop the war in Ukraine. China has temporarily suspended Russian oil purchases from these two companies, further consolidating the momentum for oil price increases.

This move negatively affects the Japanese Yen as well as other oil import currencies, as Japan is a major oil importer. The Yen is heading for a seven-month low of 153.29 yen/USD, falling after Ms. Sanae Takaichi, who is seen as leaning towards loose fiscal and monetary policies, was chosen as Prime Minister of Japan. The market is waiting for information about the economic stimulus package from the new government.