An annual gold survey by an international financial information platform shows that individual (retail) investors have very strong confidence in the prospect of gold price increases. Meanwhile, large banks and industry experts also generally predict that gold prices will continue to rise in 2026.

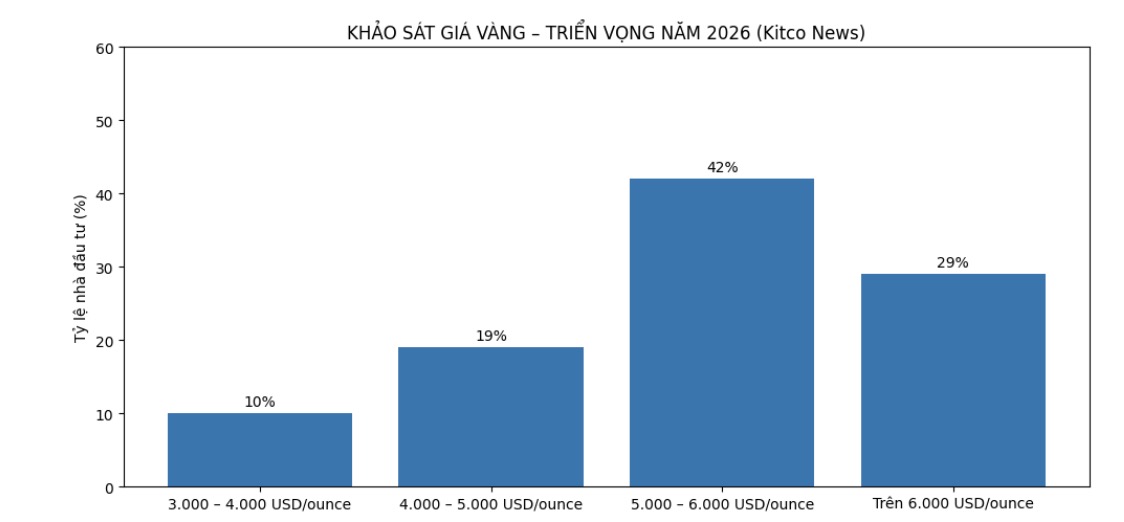

There were a total of 475 retail investors participating in the survey. Most individual investors predicted that gold prices would reach a new record high, exceeding the 5,000 USD/ounce mark previously set in 2025. Only about 1/10 of respondents believe that gold prices could fall back below 4,000 USD/ounce.

138 retail investors, equivalent to 29% of total feedback, expect gold prices to surpass the 6,000 USD/ounce mark next year, compared to the current historical peak of over 4,550 USD/ounce set on December 26, 2025. The group accounting for the largest proportion, including 197 people (42%), forecasts that gold prices in 2026 will fluctuate in the range of 5,000 - 6,000 USD/ounce in 2025.

92 people (19%) believe that gold prices will peak in the current price range, from 4,000 - 5,000 USD/ounce. Meanwhile, the remaining 49 investors, accounting for 10%, predict that gold prices will fall back to the 3,000 - 4,000 USD/ounce range - the level previously recorded in the period from spring to early autumn 2025.

Major banks on Wall Street remain optimistic about the outlook for gold prices in 2026, even after two consecutive impressive years of growth. However, no organization expects the percentage increase to repeat itself like in 2025.

Goldman Sachs (a leading investment and financial service banking group in the world, headquartered in the US) assesses gold as the most attractive investment option in the entire commodity group for 2026. According to this bank, if private investors participate in asset diversification like central banks, gold prices could completely exceed the base scenario of 4,900 USD/ounce.

Among the items being considered, Goldman Sachs is most optimistic about gold, in which the buying demand from central banks is a key factor.

Meanwhile, J.P. Morgan's prospects for 2026 (one of the largest and most influential financial and banking groups in the world, headquartered in the US) believe that the gold price increase cycle will continue as key drivers remain firm, and new demand from major insurance groups in China and the cryptocurrency community may help this precious metal surpass the $5,055/ounce mark by the end of the year.

The upward momentum of gold is not and will not take place in a straight line, but we believe that the trends that are driving the gold's high revaluation process are still not exhausted.

The long-term trend of diversifying official reserves and investment portfolios in gold still has room for development. We expect gold demand to push prices closer to the 5,000 USD/ounce mark by the end of 2026" - Ms. Natasha Kaneva, Head of Global Commodity Strategy at J.P. Morgan, said.

Meanwhile, UBS (a leading Swiss banking and financial services group) expects gold demand to increase steadily in 2026, supported by low real yields, prolonged concerns about the global economy and instability in US domestic policy - especially issues related to midterm elections and increasing fiscal pressure.

If political or financial risks escalate, gold prices could rise to $5,400/ounce (previously forecast at $4,900/ounce)" - UBS strategists wrote in the report.

See more news related to gold prices HERE...