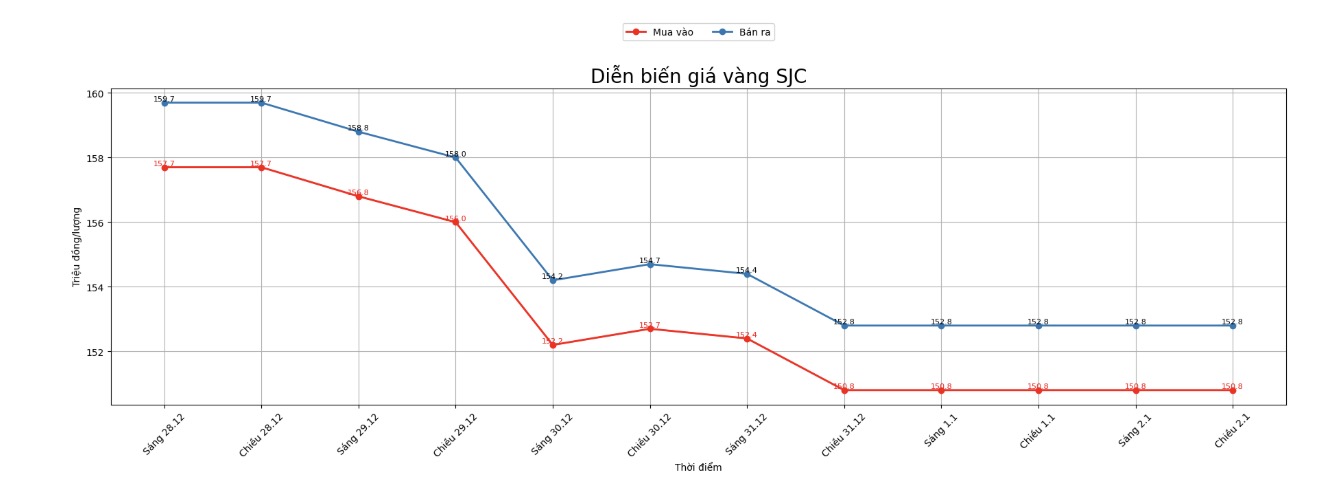

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 150.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 150.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 150.3-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

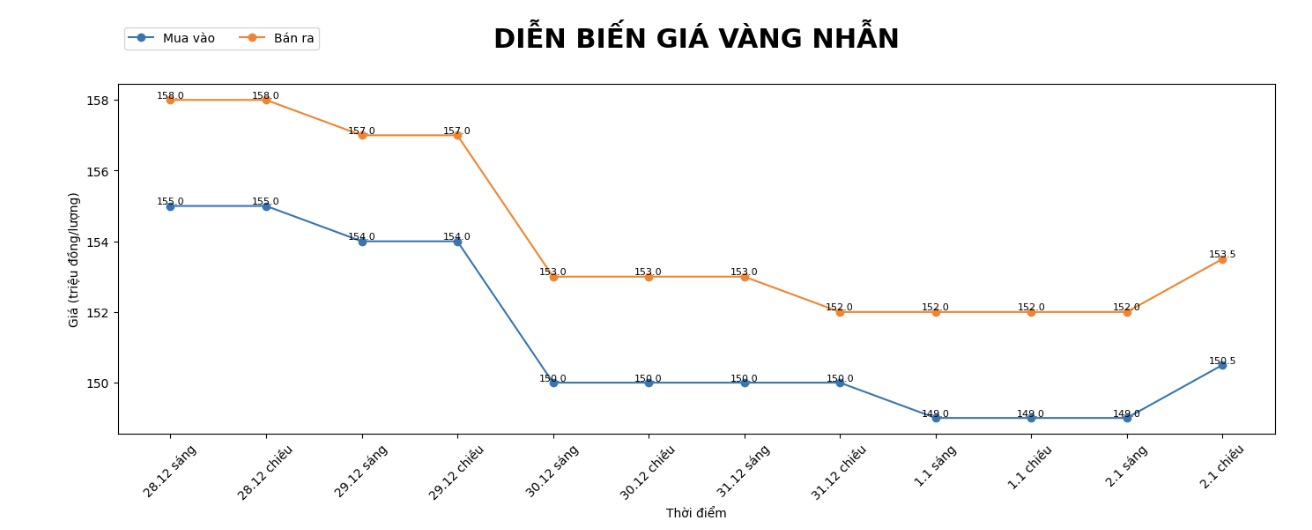

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of plain gold rings at 150.5-153.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both buying and selling directions. The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 152-155 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 150.5-153.5 million VND/tael (buying - selling), an increase of 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

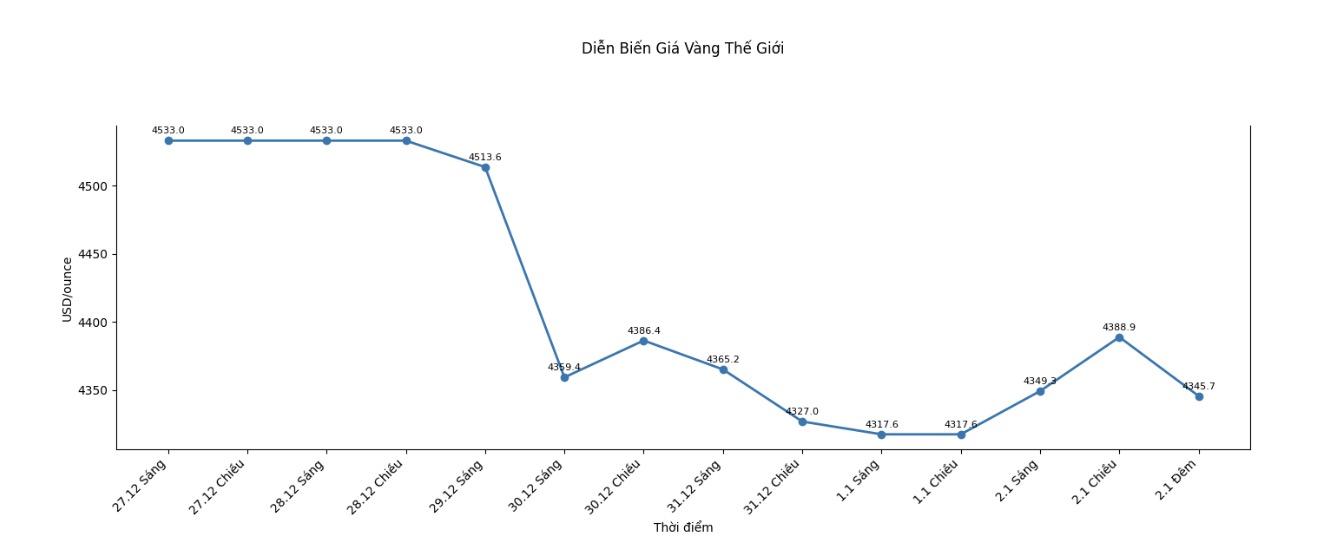

World gold price

World gold price listed at 10:09 PM on January 2 at the threshold of 4,345.7 USD/ounce, up 28.1 USD/ounce.

Gold price forecast

Stepping into the first trading sessions of 2026, the world gold market showed clear signs of recovery after the year-end adjustment period.

The upward momentum returns in the context that fundamental factors continue to support the safe-haven role of precious metals, from geopolitical risks, loose monetary policy prospects to improved material demand in major consumer markets.

According to analysts, the adjustment of gold prices from historical peaks has partly "cooled down" buyers' fear, thereby helping retail demand recover.

This development is clearly reflected when gold prices in India and China – the two world's leading gold consumers – have shifted to a positive selling position compared to international prices after weeks of discounts. This shows that material demand is still present, especially as prices are no longer as hot as in the previous period.

From a macro perspective, the expectation that the US Federal Reserve (Fed) will continue to cut interest rates this year is considered a key factor in supporting the market. In a low-interest environment, non-performing assets such as gold are often more attractive, especially when other investment channels are still facing many instabilities.

Commenting on the general trend, Mr. Tim Waterer - senior market analyst at KCM Trade - said that precious metals are starting the new year on a fairly similar trajectory to the previous year. According to him, after short-term profit-taking pressure and year-end position balancing activities gradually subsided, fundamental factors returned to play a leading role in the market.

However, investors are also warned about the possibility of strong fluctuations in the short term. The fact that the Chicago Mercantile Exchange (CME) continuously raises margins for precious metal futures shows that risks from speculation are increasing, especially in the context that market liquidity is still not completely stable after the holidays.

According to Mr. Kevin Grady – Chairman of Phoenix Futures and Options, recent fluctuations mainly reflect short-term speculative activity, rather than changes in long-term trends. He believes that increasing margins is systemic risk hedging and does not mean that the gold's upward cycle has ended.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...