On Wednesday, commodity analysts at TD Securities (TDS) announced their latest trading strategy, saying they had opened up a position to short sell silver futures contracts and expect prices to fall sharply in the next three months, as market supply and demand factors begin to rebalance.

In the latest commodity report, Mr. Daniel Ghali - senior commodity strategist of TDS - said that the bank has opened a position to short sell March silver futures contracts at 78 USD/ounce, with a price target of 40 USD. At the same time, TDS set the cut-loss level at 92 USD/ounce.

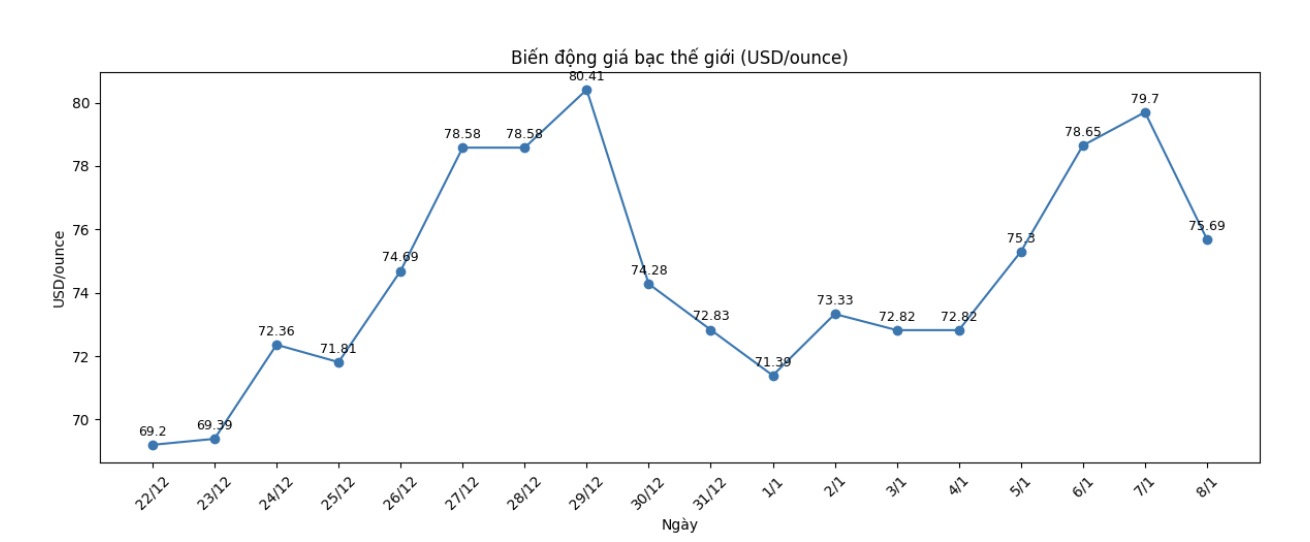

March silver futures are currently trading around $77.94/ounce, down nearly 4% on the day.

TDS's fictitious selling move takes place in the context that this bank forecasts that significant selling pressure will appear on this metal, as the index rebalancing activity at the beginning of the year strongly impacts silver - a commodity that increased by nearly 150% last year.

We expect about 13% of the total open interest in the Comex silver market to be sold in the next two weeks, leading to a strong price correction," Daniel Ghali wrote in a note last week.

Besides, Mr. Ghali also said that the market is witnessing a major change in supply-demand factors. The record price increase of 84 USD/ounce last month for silver partly stemmed from the serious breakdown in the material supply chain of this precious metal.

Strong industrial demand has caused the market to fall into a supply deficit in the past 5 years, significantly reducing inventory on the ground. Along with the increasing interest of investors, TDS once expected a "short squeeze" (short-squeeze) to occur in the market.

However, according to Mr. Ghali, this upward momentum has been pushed too far, as the current high price is said to gradually rebalance the physical market. He believes that a catalyst that could trigger the silver sell-off is President Donald Trump's decision related to the new role of silver as a critical metal.

Problems in the silver supply chain are even more serious due to the risk of US tariffs on imported silver. Large amounts of silver flowing into the US in the first half of 2025 have largely remained in this market due to concerns about the possibility of tariffs.

TDS does not expect silver imported into the US to be taxed, and when this is confirmed, it may release a large amount of physical silver back into the global market.

We expect no tax on brass. Scrap brass and from private storage can continue to be added to warehouses in London. Primary supply shortages continue to shrink as demand weakens. Supply droughts tend to last longer. These are typical signs of peak cycles" - Mr. Ghali said.

Many other analysts also believe that silver is unlikely to be taxed, because consumption tax could seriously damage the US manufacturing industry. US domestic silver production is not enough to meet consumption demand, and the market is unlikely to witness a significant increase in supply in the near future.

This is the second time TDS has tried to sell virtual silver. Previously, this bank had opened a selling position in October, when the price exceeded the 50 USD/ounce mark, but had to close the position with a loss of nearly 2.4 million USD.

The world silver market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and instant delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December delivery contracts are currently the most actively traded type on CME.