Domestic silver price

As of 11:30 on October 20, the price of 999 Phuc Loc Gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 2.037 - 2.088 million VND/tael (buy - sell).

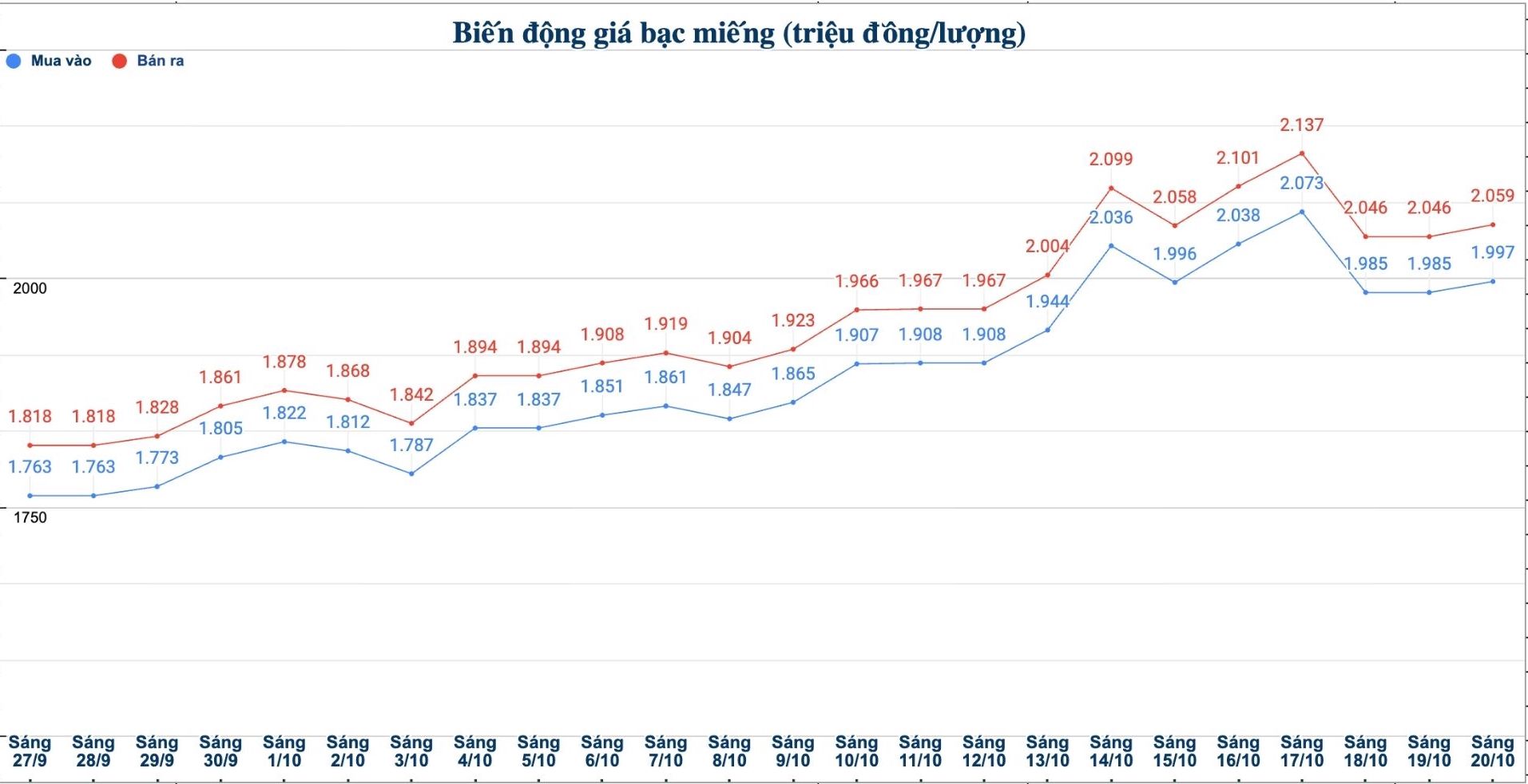

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.997 - 2.059 million VND/tael (buy - sell); unchanged in both directions compared to yesterday morning; increased by 12,000 VND/tael for buying and increased by 13,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 53.253 - 54.906 million VND/kg (buy - sell); an increase of 320,000 VND/kg for buying and an increase of 347,000 VND/kg for selling compared to yesterday morning.

World silver price

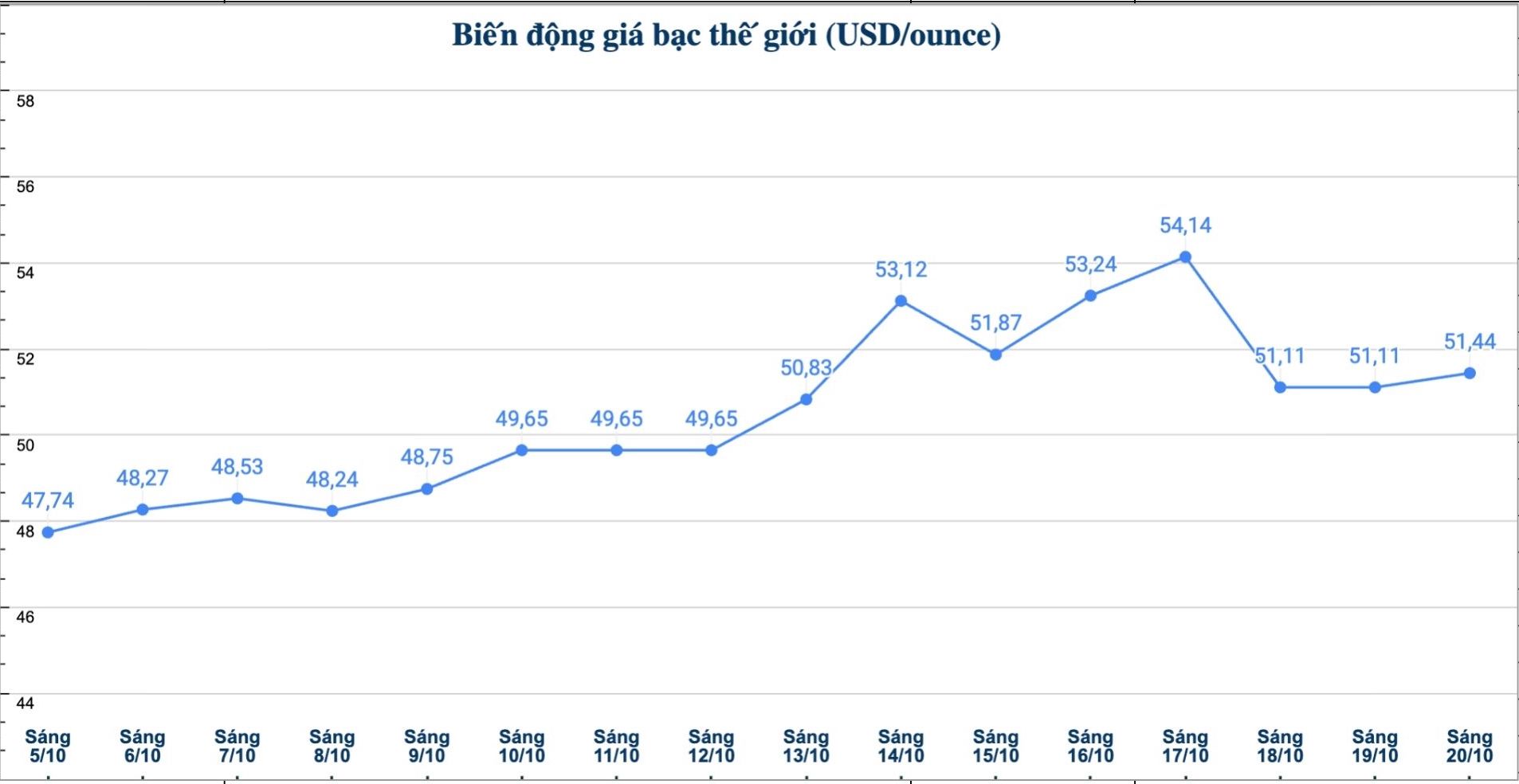

On the world market, as of 11:20 on October 20 (Vietnam time), the world silver price was listed at 51.44 USD/ounce; up 0.33 USD compared to yesterday morning.

Causes and predictions

Silver prices are benefiting from expectations that the US Federal Reserve (FED) will maintain a dovish stance and increasing geopolitical risks. According to market analyst James Hyerczyk, the market is currently predicting that this agency will cut interest rates in October and December, causing the cost of holding non-yielding assets such as gold and silver to decrease.

"Recent statements from the Fed also show an easing trend, while many US regional banks have warned of new credit pressure, contributing to strengthening investment demand for precious metals," he said.

However, gold - the metal that led the trend of this group - turned down sharply at the end of the week. According to James Hyerczyk, if the correction trend of gold is confirmed, silver prices may temporarily stagnate unless new supporting factors appear.

Technically, silver is still on the uptrend, but James Hyerczyk noted that there is an existential correction risk.

"The important support level is around 49.81 USD/ounce; if prices fall below this level, it may continue to fall to the range of 44.22 USD/ounce or even 41.40 USD/ounce" - he commented.

According to James Hyerczyk, with the characteristics of being both an industrial metal and a currency, silver still plays a special role, but is also vulnerable to impacts if global production slows down due to the trade war.

See more news related to silver prices HERE...