After setting a new record, world silver prices are under pressure from large profit-taking activities. According to independent investment research firm BCA Research, this adjustment could be the beginning of a deeper downtrend.

Ms. Roukaya Ibrahim - Strategy Director of BCA Research - warned that silver prices have recently increased too much compared to the practical platform.

She said that silver prices hit a peak partly due to limited liquidity in the OTC market (decentrated trading) due to prolonged supply chain problems. Strong demand for physical silver has caused the reserves at London Gold Market Association (LBMA) warehouses to plummet, while New York's treasury is full. Banks hesitate to transport silver to Europe due to concerns about import taxes, because silver is considered an important metal in many industries.

However, she said that the gap in spot silver prices compared to CME futures contracts has narrowed, as part of the supply has begun to return to London.

Ms. Ibrahim noted: " short squeeze price spikes rarely end well. History shows that after a sharp increase, prices often reverse rapidly and it is difficult to regain the old peak within 6 months".

She also said that the silver market is being overbought. "Although the outlook for long-term silver demand remains positive, the increase is too fast, allowing prices to soon correct in the short term," she said.

However, Ibrahim said US trade tensions could still partly support silver prices. Since August, the US Geological Survey (USGS) has included silver in the list of important minerals in 2025 due to its growing role in the global electrification process.

She added that the official list could be delayed due to the US government's temporary suspension. Roukaya Ibrahim believes that if the investigation into silver import taxes (Real 232) ends, this could be a "catalyst" for a price adjustment in both London and New York.

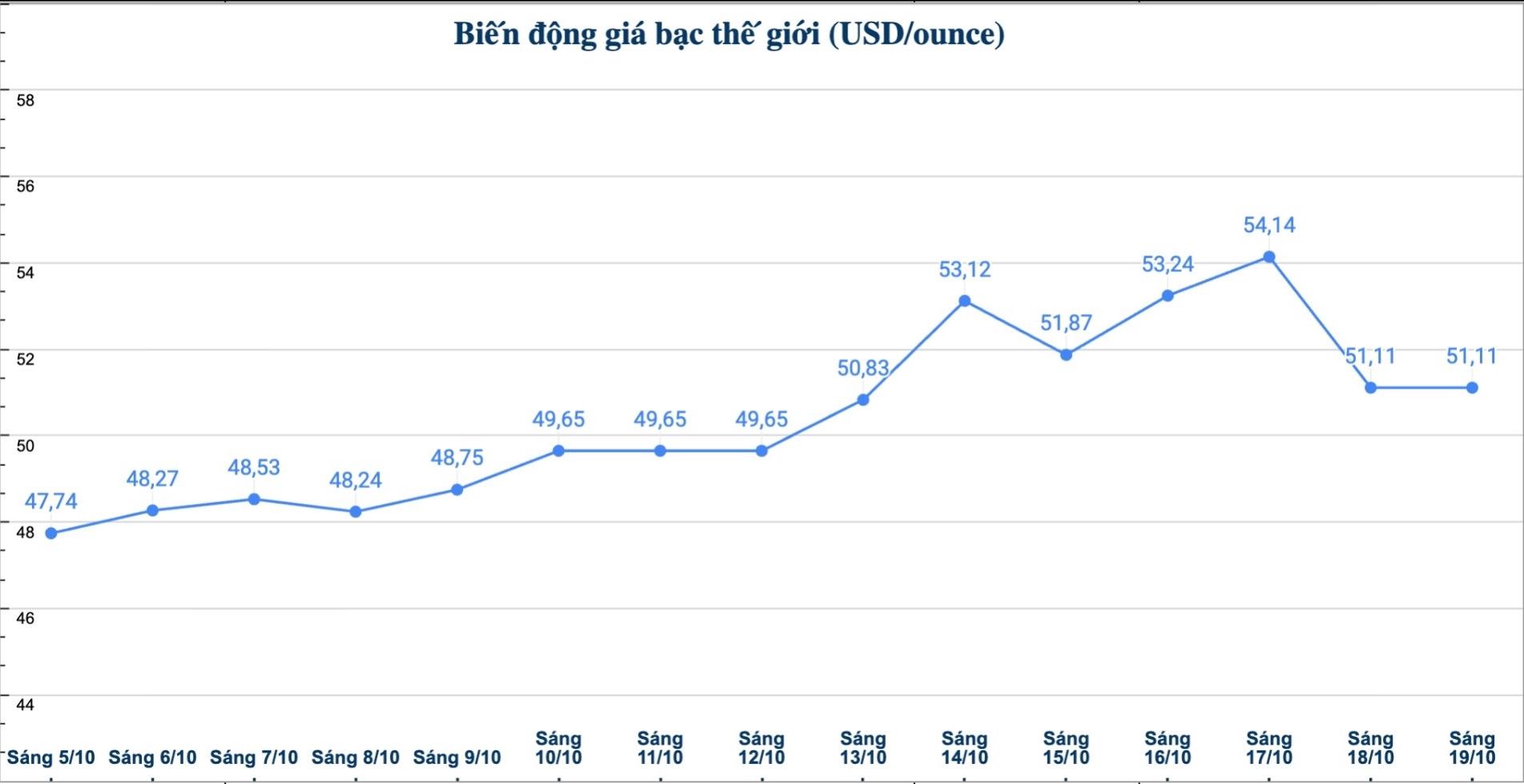

As of 7:25 a.m. on October 20, the world silver price was listed at 51.38 USD/ounce.

Update on domestic silver prices

As of 7:25 a.m. on October 20, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.989 - 2.031 million VND/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 52.310 - 53.810 million VND/kg (buy - sell).

The price of 999 gold bars of Golden Rooster 999 (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) is listed at 2.097 - 2.148 million VND/tael (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.985 - 2.046 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 52.933 - 54.559 million VND/kg (buy - sell).