The fundamental factor is still supporting silver prices to rise

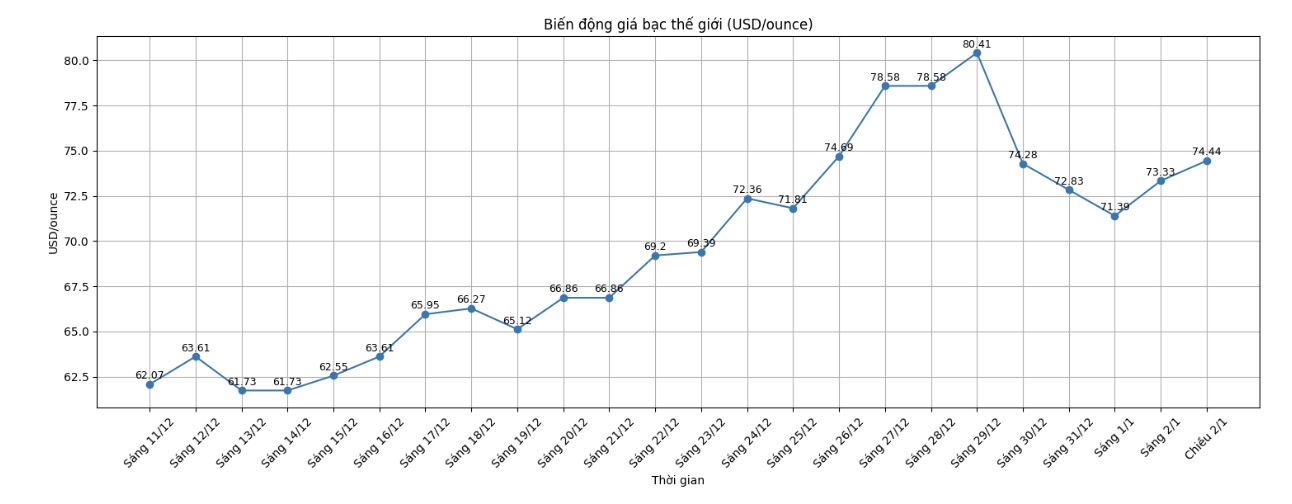

The silver market continues to attract great attention from investors as the price of this metal soared in the last days of 2025. However, this unprecedented increase also created strong fluctuations, with the silver price falling 9% in Monday's trading session after reaching an all-time high of 84 USD/ounce.

After Monday's sell-off, many investors questioned whether the silver market is in a "bubble" that has burst or not? Commodity analysts at Societe Generale believe that, although some models show that the parabolic upward momentum of silver has turned into a bubble, investors should not ignore the fundamental factors that are still supporting prices to rise.

According to experts, if viewed on a normal linear scale, silver prices seem expensive. However, when observing price movements on a logarithmic scale, it can be seen that a exponential growth trend has been formed over the past 25 years.

When silver prices soared almost vertically and exceeded the 80 USD/ounce mark last week, this development naturally caused a very dramatic feeling, heavily psychological and in the eyes of some people, it looked no different from a price "bubble".

However, if we switch to looking at price movements on the time chart using a logarithmic scale, the picture is completely different: the upward momentum of silver becomes smoother, more stable and not an unprecedented phenomenon in history. According to analysts, the logarithmic scale is the appropriate view, because it clearly reflects the exponential growth trend that has formed for a long time of silver prices".

Although according to some models, the upward momentum of silver can be seen as a bubble, the French bank believes that those parameters are not appropriate when applied to this precious metal, because silver is a small and volatile market. According to them, the silver market easily emits a bubble-like signal due to low liquidity, causing the herd effect, feedback loops and price instability to be amplified.

“Therefore, we tend to interpret the "bubble" state as indicators of instability, because healthy corrections can always occur after too strong price fluctuations,” analysts said.

SocGen also emphasized that they do not expect their bubble models to predict changes in the momentum or general trend of silver prices, considering the current underlying context. Silver demand, according to them, is still well supported by the global dedollarization trend and high levels of economic uncertainty.

Serious supply shortage

Looking ahead, SocGen forecasts that the silver market may face more serious liquidity problems, especially as China begins to tighten exports from January 1.

China supplies about 60–70% of global refined silver, so this move is expected to significantly tighten refined silver supply – which could reduce China's silver exports by up to 30%. In the context of a prolonged global deficit (about 200–230 million ounces, while demand in 2025 exceeds 1.24 billion ounces), these restrictions could exacerbate the shortage situation," analysts warned.

In the opposite direction, SocGen believes that the Western market may be partially "cleared" because they do not expect the US government to impose tariffs on imported silver, even when silver has just been classified as a strategic metal.

Through industry sources, we know there will be clear information in mid-January about the analysis results under Article 232," analysts said. "From our point of view, it is difficult to imagine that the US government will impose taxes on silver, especially 1,000 ounce gold bars. If that happens, the tension in the OTC market will escalate seriously, as export shipments from the US will almost be stalled.

Currently, the market is witnessing a regional shortage of 1,000 ounce gold bars, including in China, London and India, leading to increased material insurance premiums in key markets.