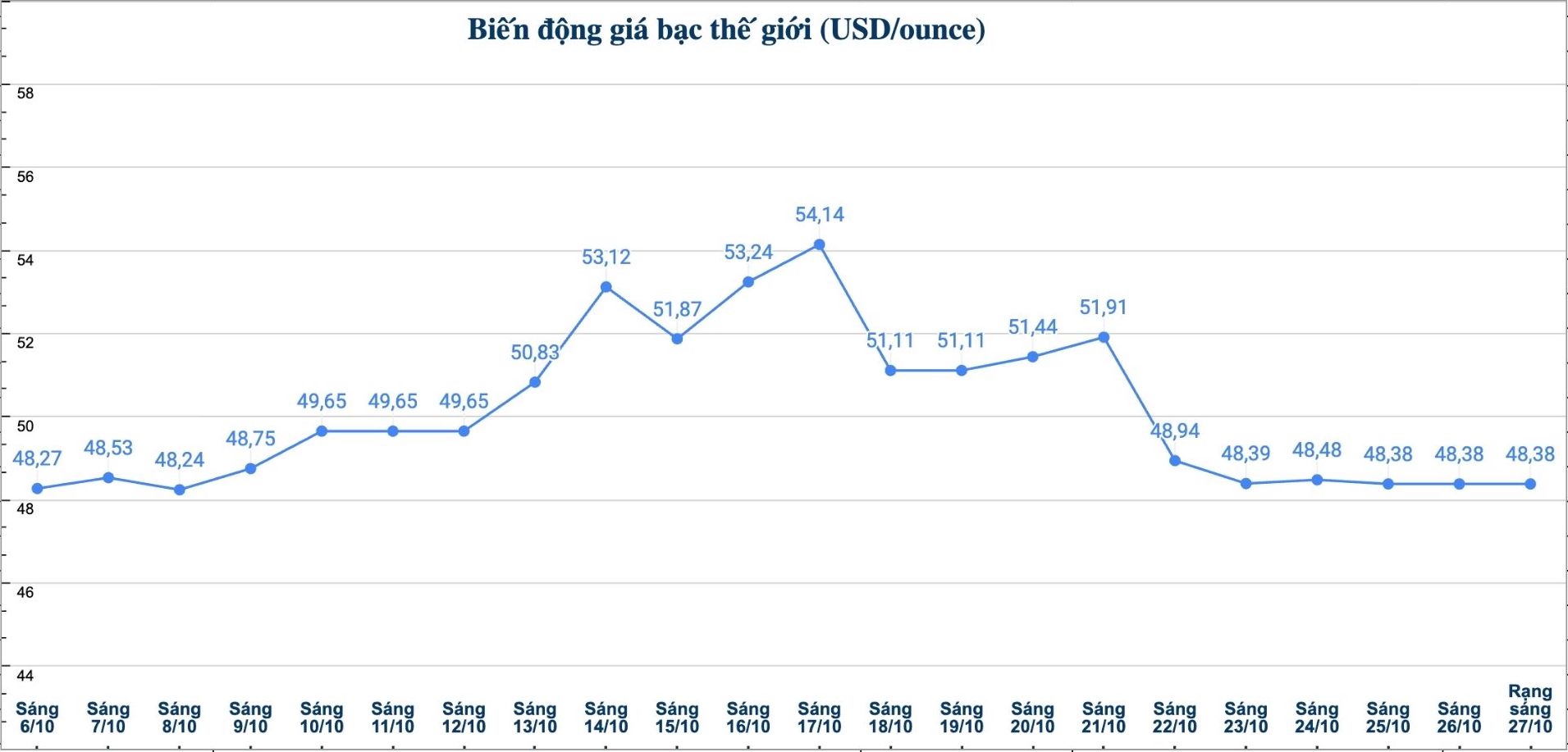

World silver prices fell sharply after a period of hot increase in early October. Currently, spot silver prices have fallen to 48.5 USD/ounce, down from 54.47 USD/ounce a week ago.

According to Times Of India, the improved supply of silver in London and profit-taking activities are the main reasons for prices to decline. London is a global physical silver trading center, so its inventory here has a direct impact on world prices.

The strong price increase at the beginning of the year was driven by large industrial demand from the fields of solar energy, electric vehicles, 5G infrastructure and AI equipment - industries that play an important role in the global green energy transition. Limited exploitation activities and low recycling rates continue to put pressure on supply.

Mr. Vikram Dhawan - Director of Commodity and Fund Management at Nippon India mutual Fund - commented: "While speculators are adjusting their positions, strategic investors such as central banks or long-term ETF investors can view the bearish trend as a period of normalization after a period of too strong inflows".

Meanwhile, gold prices also fell due to profit-taking pressure and the USD appreciated. However, Mr. Dhawan emphasized that gold and silver still play an important role in the portfolio thanks to their risk-off capability.

From a market perspective, Mr. Manav Modi - an expert at Motilal Oswal Financial Services - said that geopolitical factors are still complicated, so the price of precious metals may be adjusted further.

" Any decline can trigger new buying momentum. Precious metal prices are likely to be adjusted further, opening up opportunities for investors. However, the gold and silver market foundation remains positive, Manav Modi stressed.

Sharing the same view, Mr. Jateen Trivedi - Vice President and analyst at LKP Securities - said that individual investors are cautious but do not leave the market.

"Many people see this adjustment period as an opportunity to return to a reasonable allocation, in the context of the long-term outlook for gold and silver still favorable thanks to global liquidity and the net purchase of the central bank" - Jateen Trivedi expressed his opinion.

Updated silver price

As of 6:00 a.m. on October 27, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.864 - 1.906 million VND/tael (buy - sell).

The price of 999 Ancarat 999 (1kg) at Ancarat Metallurgy Company is listed at 48.956 - 50.376 million VND/kg (buy - sell).

The price of 999 gold bars of Golden Rooster 999 (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) is listed at 1.881 - 1.929 million VND/tael (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.861 - 1.919 million VND/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 49,626 - 51.173 million VND/kg (buy - sell).

On the world market, as of 00:15 on October 27 (Vietnam time), the world silver price was listed at 48.38 USD/ounce.

See more news related to silver prices HERE...