Cautious start after political upheaval

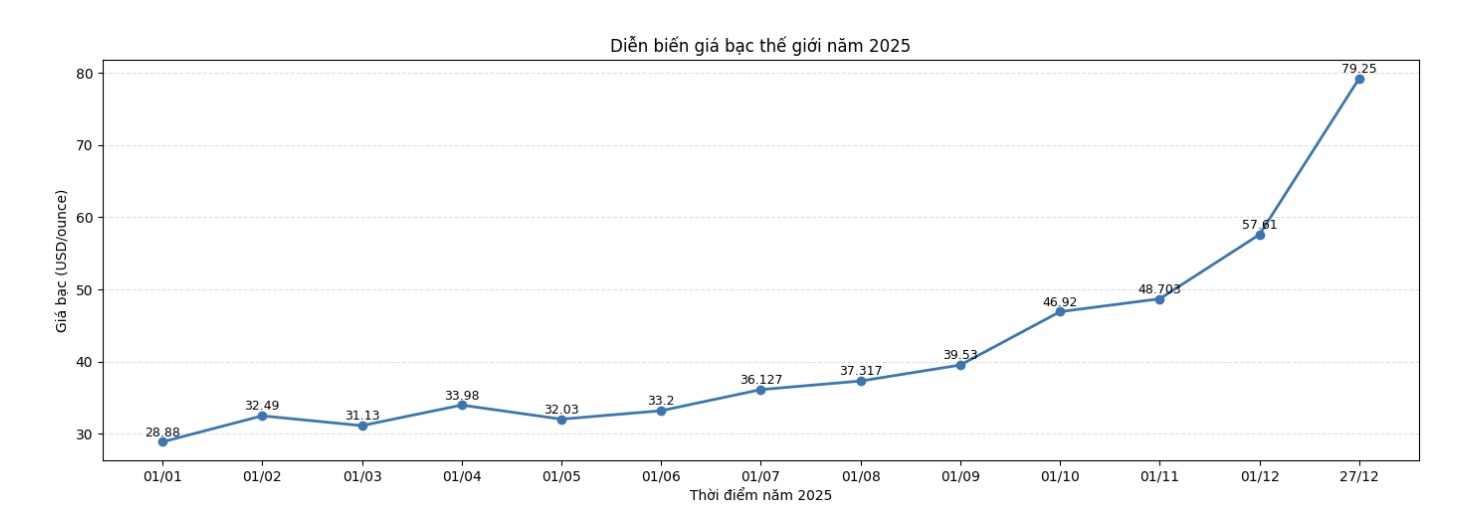

World silver prices entered 2025 listed around 29.5 USD/ounce, after the end of 2024 with many fluctuations related to the US presidential election. Cautious sentiment engulfed the market as investors remained wary of economic prospects and trade policy. However, the fact that prices repeatedly maintained the 29-USD support zone shows that long-term buying power is still silently accumulating.

In the first two months of the year, silver recovered above 31.5 USD/ounce, opening up expectations for a more positive trend. In March, gray metal maintained a slow but steady upward momentum, peaking above 34.4 USD/ounce at the end of the month – a signal that the market has begun to "warm up".

In early April 2025, the precious metal market fluctuated sharply after US President Donald Trump's large-scale tax announcement. Silver quickly fell back to the $29.5/ounce zone, eliminating almost all previous gains. However, unlike many periods of decline in the past, selling pressure this time did not last. Prices recovered to over $33/ounce at the end of April and went sideways in May, showing that the market is accumulating energy for a new upward momentum.

Turning point from mid-year

June marked an important turning point when silver surpassed the 34 USD/ounce mark and quickly advanced to nearly 37 USD in early July. On July 22, 2025, the price touched nearly 39.3 USD/ounce before a slight correction. In August, silver traded in a narrow range, but this was a "necessary pause" before the big wave.

Real momentum exploded from September, when silver surpassed the 41 USD/ounce mark right at the beginning of the month. From here, the upward trend became clear and persistent, with short corrections only aimed at retesting the support zone.

By the beginning of October, the 47 USD/ounce mark was set as a solid support zone. On October 15, silver officially set a new historical peak above 54 USD/ounce, strongly attracting speculative cash flow and long-term investment. Although November witnessed a correction to 47–50 USD, the price quickly recovered and continued the upward trend.

December is an unprecedented "acceleration" period. Silver surpassed 58.5 USD/ounce right at the beginning of the month, then successively conquered the 60 USD, 70 USD marks and by December 26 traded above 79 USD/ounce, only a fraction of the psychological threshold of 80 USD.

A pivotal year for the silver market

According to Kitco News' assessment, the 2025 silver price increase journey comes not only from speculation, but also reflects a combination of strong industrial demand, ETF capital flows into precious metals and prolonged concerns about material supply.

Looking back at the whole year 2025, it can be seen that silver has gone through all levels: from doubt, challenges to explosions. This is not only a year of simple price increases, but also a year marking the "maturity" of the silver market, laying the foundation for expectations – and also caution – in the next period.

See more news related to silver prices HERE...