Domestic silver prices

As of 10:50 am on December 27, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Jewelry Company was listed at the threshold of 2.982 - 3.055 million VND/tael (buying - selling); an increase of 175,000 VND/tael on the buying side and an increase of 179,000 VND/tael on the selling side compared to yesterday morning.

The price of 2025 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at the threshold of 78.576 - 80.966 million VND/kg (buying - selling); an increase of 4.632 million VND/kg on the buying side and an increase of 4.772 million VND/kg on the selling side compared to yesterday morning.

The price of Kim Phuc Loc 999 silver bars (1 tael) of Saigon Thuong Tin Bank Gold, Silver and Gems One Member Limited Liability Company (Sacombank-SBJ) is listed at the threshold of 2.826 - 2.898 million VND/tael (buying - selling); an increase of 24,000 VND/tael in both directions compared to yesterday morning.

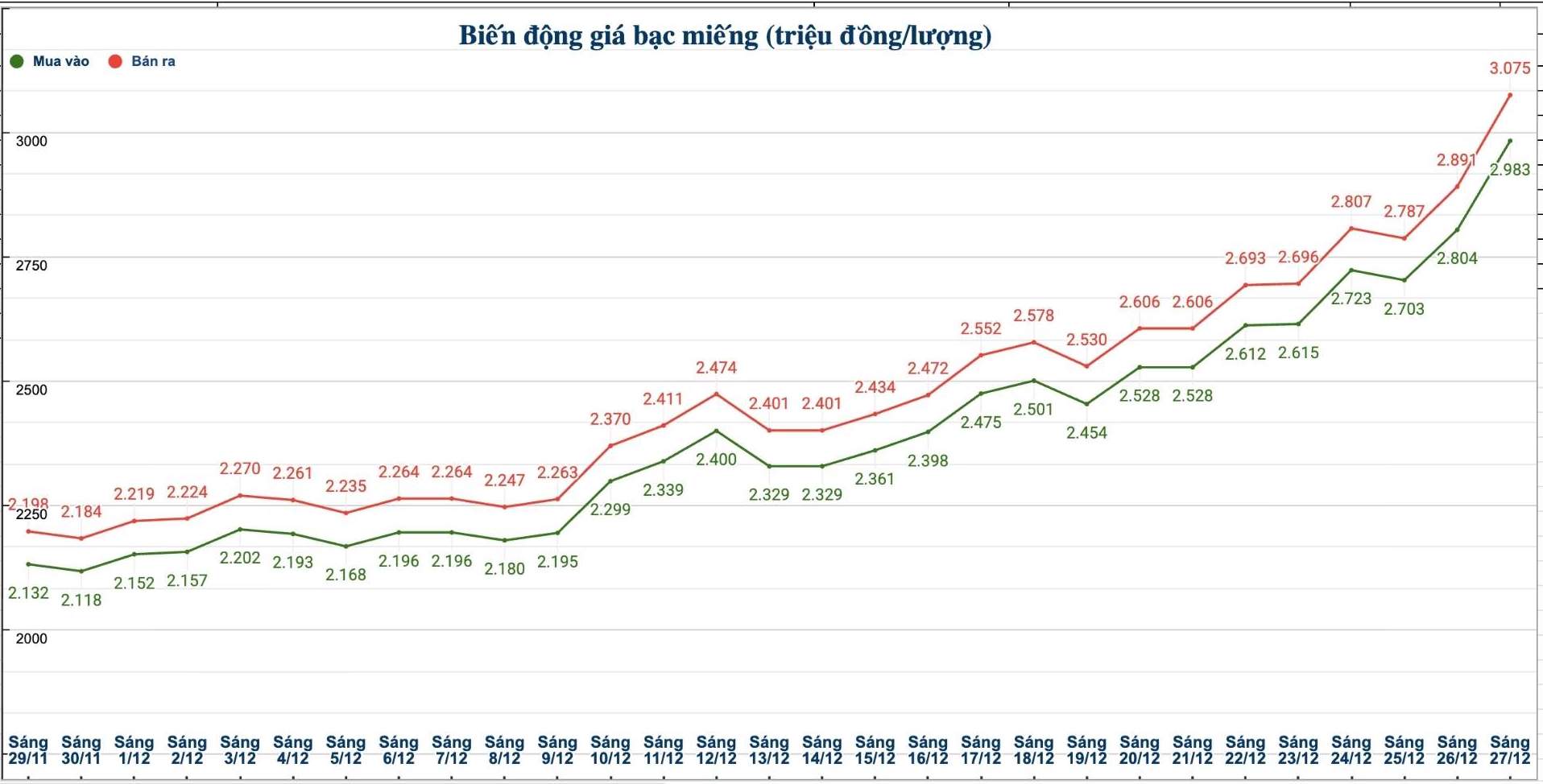

At the same time, the price of 999 silver bars (1 tael) at Phu Quy Jewelry Group was listed at the threshold of 2.983 - 3.075 million VND/tael (buying - selling); an increase of 179,000 VND/tael on the buying side and an increase of 184,000 VND/tael on the selling side compared to yesterday morning.

The price of 999 silver bars (1kg) at Phu Quy Jewelry Group is listed at 79.546 - 81.999 million VND/kg (buying - selling); an increase of 4.773 million VND/kg on the buying side and an increase of 4.906 million VND/kg on the selling side compared to yesterday morning.

World silver prices

On the world market, as of 10:45 am on December 27 (Vietnam time), the world silver price was listed at 78.58 USD/ounce; up 3.89 USD compared to yesterday morning.

Causes and forecasts

Spot silver prices on the international market increased sharply in the last session of the week, when buying pressure overwhelmed in the context of low liquidity due to the holidays.

According to precious metal analyst James Hyerczyk at FX Empire, this upward momentum helps silver move closer to closing a week of positive trading, marking a 5-session winning streak.

Expectations that the US Federal Reserve (Fed) will continue to cut interest rates in 2026, along with geopolitical instability, are strong supporting factors for short-term price movements" - he said.

In the medium and long term, James Hyerczyk said that the silver market is also driven by concerns about supply shortages and the fact that this metal is increasingly considered an essential mineral in industrial policies, especially serving technology production and clean energy.

Compared to the "hot" silver price increase in the late 1970s, James Hyerczyk believes that the current increase has a more sustainable foundation.

Previously, silver prices soared mainly due to speculation and market manipulation by a large group of investors, before collapsing rapidly when trading regulations were tightened. Conversely, the current upward momentum has the participation of more investor groups and organizations, helping the market distribute risks better" - James Hyerczyk said.

However, James Hyerczyk emphasized that the risk of correction is still present, especially when a part of investors use high financial leverage.

In that context, investors need to clearly define their strategy and exit points before participating in the market. Risk management and preparing scenarios for strong fluctuations are considered key factors, especially when prices are in a high zone" - James Hyerczyk recommended.

See more news related to silver prices HERE...