Domestic silver price

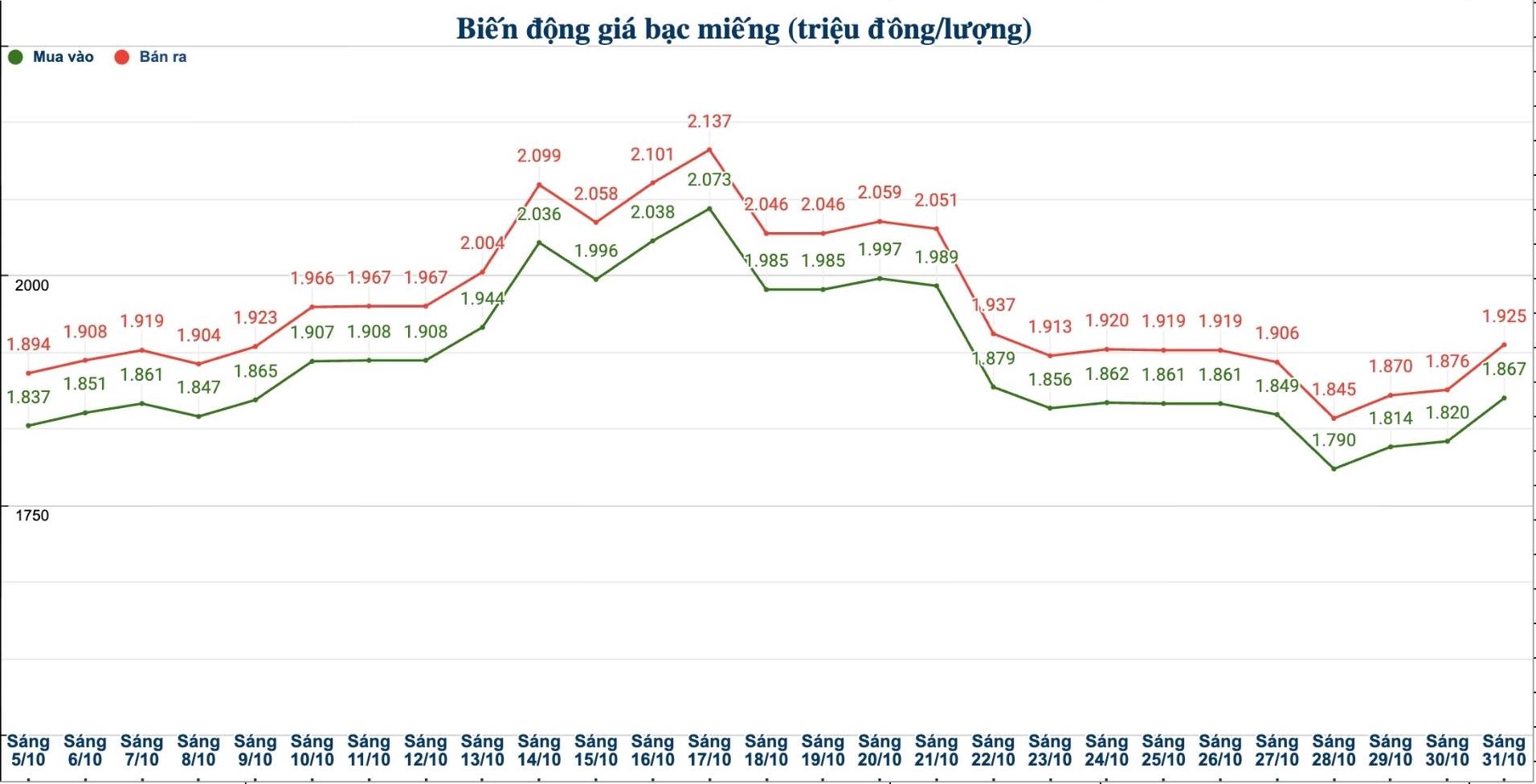

As of 10:15 on October 31, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.873 - 1.915 million VND/tael (buy - sell); an increase of 59,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) at Ancarat Petrochemical Company was listed at 49,196 - 50,616 million VND/kg (buy - sell); an increase of 1.522 million VND/kg for buying and an increase of 1.572 million VND/kg for selling compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at VND1.881 - 1.929 million/tael (buy - sell); an increase of VND54,000/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.867 - 1.925 million VND/tael (buy - sell); an increase of 47,000 VND/tael for buying and an increase of 49,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 49.786 - 51.333 million VND/kg (buy - sell); an increase of 1.253 million VND/kg for buying and an increase of 1.307 million VND/kg for selling compared to yesterday morning.

World silver price

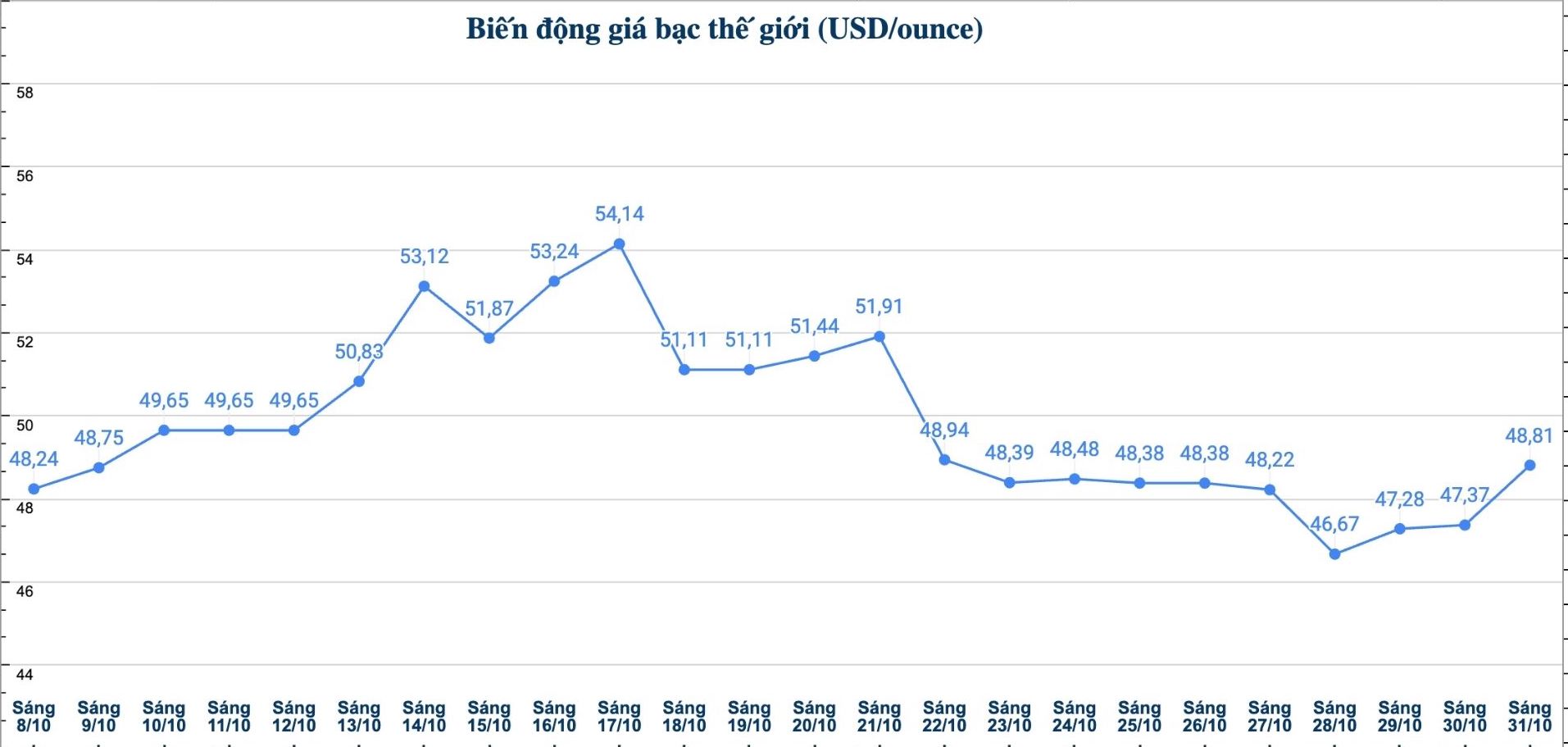

On the world market, as of 10:15 on October 31 (Vietnam time), the world silver price was listed at 48.81 USD/ounce; an increase of 1.44 USD compared to yesterday morning.

Causes and predictions

Silver prices are trading again. According to precious metals analyst Christopher Lewis at FX Empire, the market is currently fluctuating in the range of 47 - 50 USD/ounce, but the increase has shown signs of being exaggerated.

"If prices fall below $45.40/ounce, there is a high possibility of stronger corrections. On the other hand, the $50/ounce zone is still a tough resistance zone and difficult to overcome," he said.

Christopher Lewis stressed that the market should avoid speeding up and lacking a solid foundation, as the current rally has been pushed too far away from reality.

"If prices correct, silver could fall to around $45.40/ounce. If it falls below this threshold, the uptrend will end. In the short term, the possibility of setting a new peak is quite low; instead, prices may increase slightly and then quickly turn down" - the expert said.

Christopher Lewis added that silver prices are still strongly affected by interest rate policy and industrial demand, especially in the fields of electric vehicles and green technology.

"A short-term recovery is possible, but the real uptrend will only be confirmed when prices surpass the $50/ounce threshold," Christopher Lewis said.

See more news related to silver prices HERE...