Domestic silver price

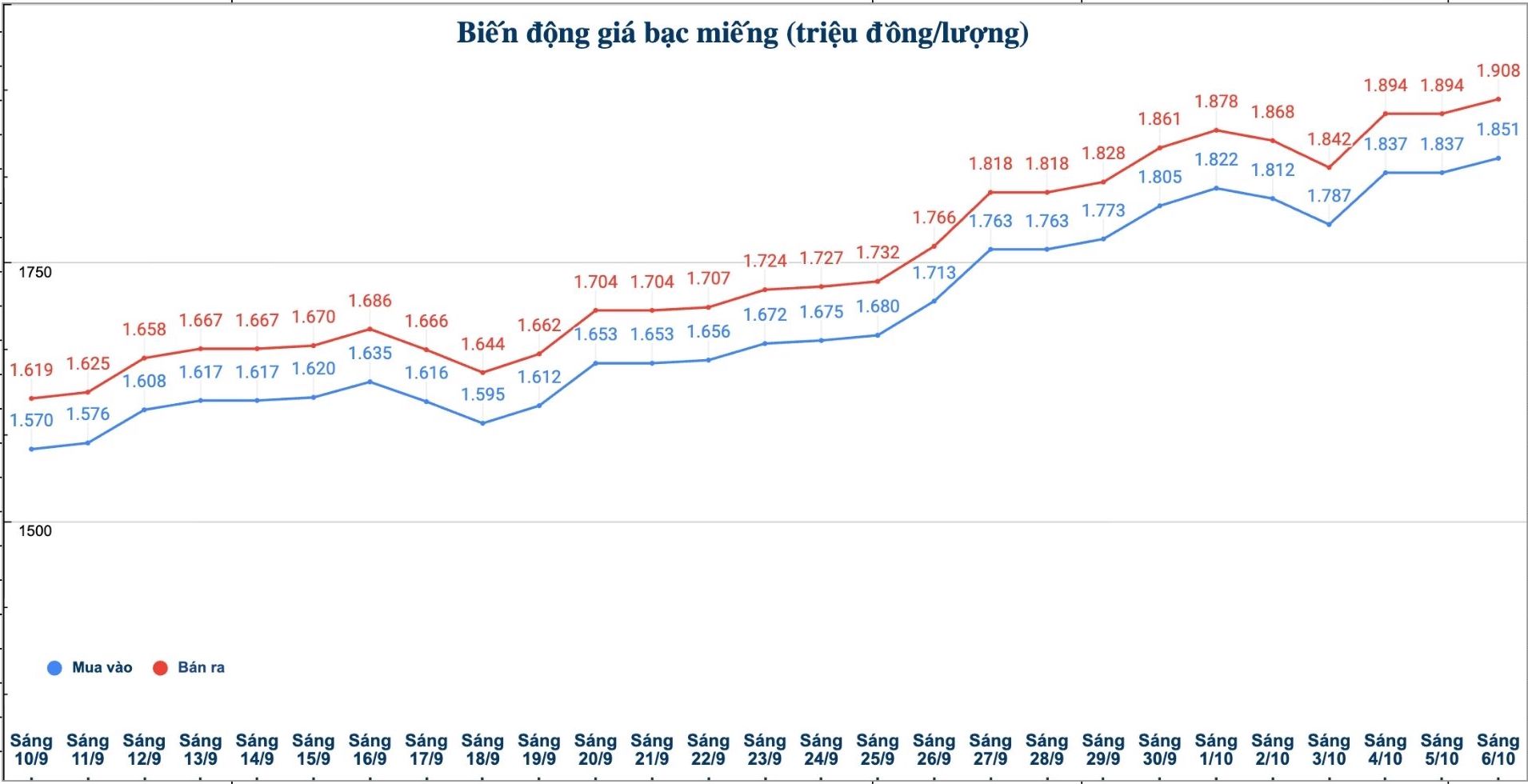

As of 9:40 a.m. on October 6, the price of 999 Phuc Loc 999 gold bars (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Co., Ltd. (Sacombank-SBJ) was listed at 1.866 - 1.911 million VND/tael (buy - sell); an increase of 36,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.851 - 1.908 million VND/tael (buy - sell); an increase of 14,000 VND/tael in both directions compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 49.359 - 50.879 million VND/kg (buy - sell); an increase of 373,000 VND/kg in both directions compared to yesterday morning.

World silver price

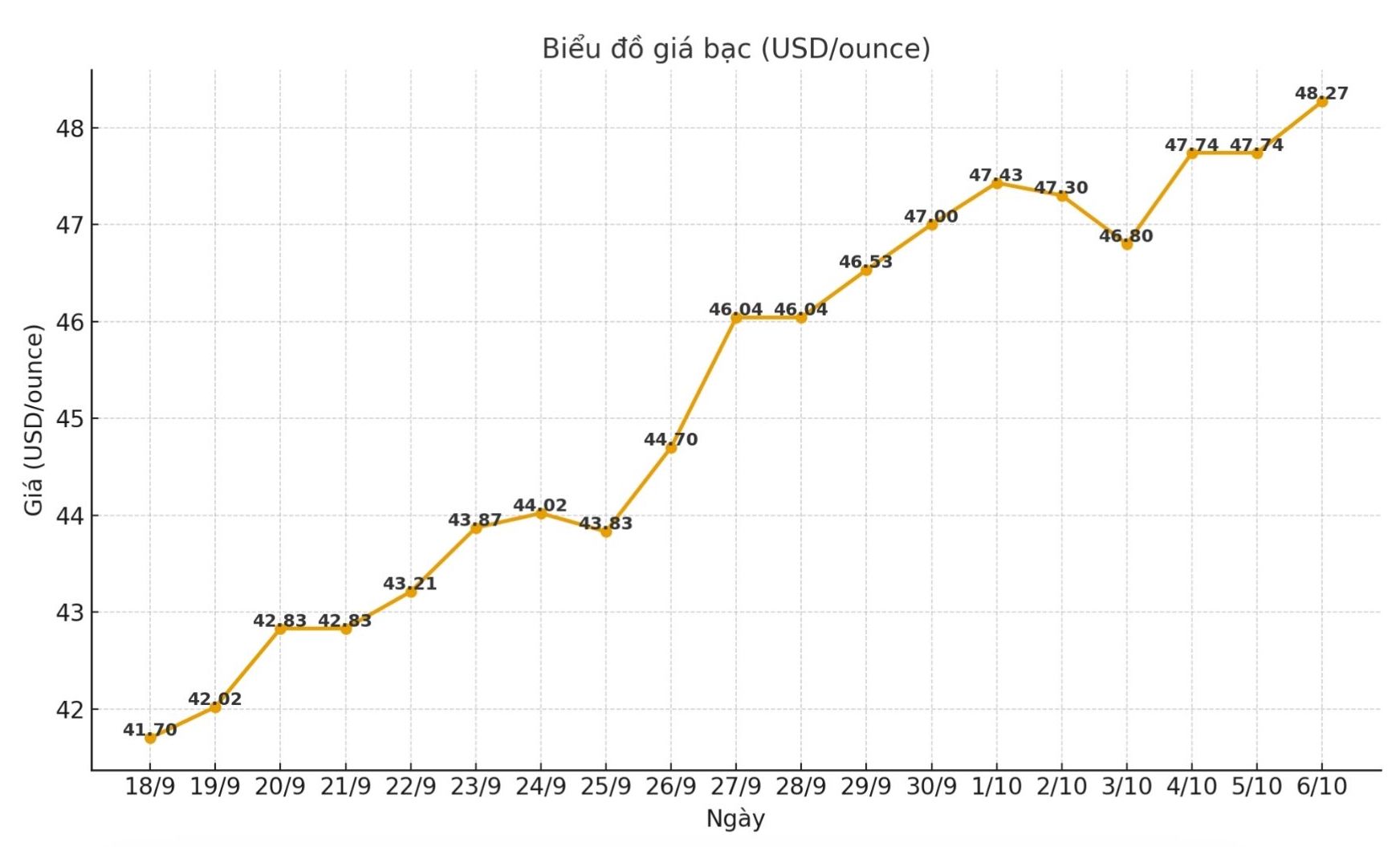

On the world market, as of 9:40 a.m. on October 6 (Vietnam time), the world silver price was listed at 48.27 USD/ounce; up 0.53 USD compared to yesterday morning.

Causes and predictions

Silver prices continued to increase strongly, marking the seventh consecutive week of increase. According to analyst James Hyerczyk, investors are focusing on the resistance level of 49.81 USD/ounce and the psychological mark of 50 USD/ounce - a price area that has not been conquered for many years.

He said that the continued US government's closure has delayed important economic reports, such as the non-farm payrolls and the consumer price index (CPI). The lack of input data makes it difficult for the US Federal Reserve (FED) to make accurate decisions before the meeting on October 29.

"According to the CME FedWatch tool, the market now expects a 97% chance of a 0.25 percentage point rate cut in October and an 85% chance of further cuts in December. This expectation is adding momentum to precious metal prices," said James Hyerczyk.

The expert added that the decline in the USD index shows the pessimism of investors towards policy instability and a lack of economic information. At the same time, the yield on the 10-year US Treasury note fell, creating a favorable environment for non-interest-bearing assets such as gold and silver.

Meanwhile, gold prices increased sharply thanks to the flow of money to safe-haven assets and large sums of capital poured into ETFs. Silver - often seen as a metal that fluctuates in the same direction but is stronger than gold - also benefits from this trend.

Technically, James Hyerczyk believes that silver is still maintaining a strong uptrend. If it breaks above $49.81/ounce, prices could quickly move up to $50/ounce - a level that has not been broken for years. The closest support level is around 44.22 USD/ounce.

"As long as there is no clear reversal signal, small corrections are still considered a buying opportunity" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...