Gold prices jumped to an all-time high of 5,626.8 USD/ounce, according to the Comex gold futures contract for April, while silver reached 121.785 USD/ounce, according to the Comex silver futures contract for March at noon on Thursday (Eastern US time - ET).

Senior analyst Jim Wyckoff of Kitco said that the previous upward momentum of the precious metal was supported by safe-haven demand in the context of increasing geopolitical tensions, along with the weakening of the USD index.

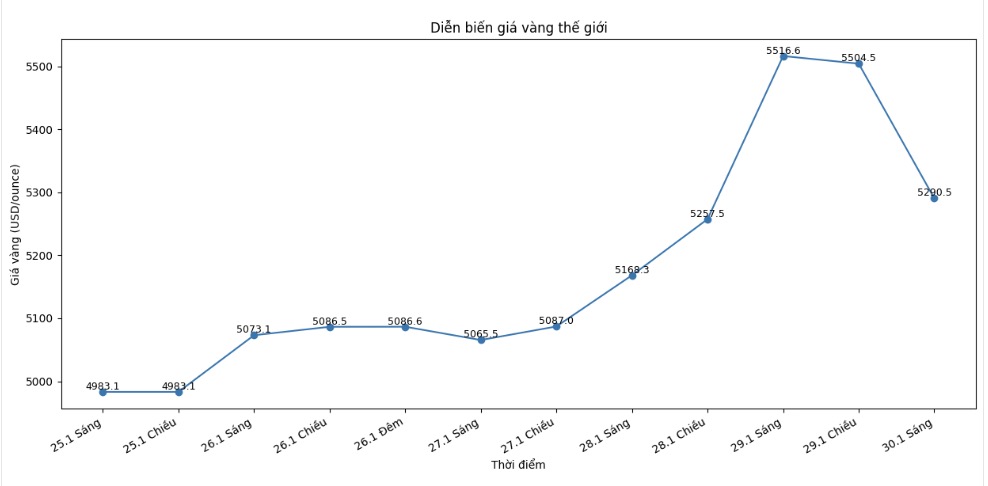

As of near noon, gold for April delivery fell 49 USD to 5,290.6 USD/ounce, while silver for March delivery fell 0.934 USD to 112.54 USD/ounce.

According to Bloomberg, geopolitical tensions in the Middle East are showing signs of escalating, as relevant parties send tougher signals on nuclear issues. This development increases caution in the global financial market, thereby supporting safe-haven demand and pushing crude oil prices up sharply.

Escalating geopolitical tensions pushed crude oil prices to a 6-month high, while triggering a wave of safe-haven buying, bringing gold and silver prices to record highs overnight.

In another development, instability related to the budget issue in the US continues to increase cautious sentiment in the global financial market. Discussions to avoid the risk of disruption of the federal government's operations have not yet reached a final consensus, causing investors to maintain a defensive trend.

The USD index traded slightly down overnight and quickly lost momentum after US Treasury Secretary Scott Bessent affirmed that the Trump administration supported a strong USD policy.

Earlier this week, the USD fell to its lowest level in 4 years after Mr. Trump said he did not object to the weakening of the USD because it benefits US businesses. Mr. Bessent also denied rumors of US intervention in the Japanese currency market.

In India, gold imports are forecast to decrease next year due to record high prices weakening jewelry demand. Gold imports in 2026 may be only 600–700 tons, after decreasing by 11% to 710.9 tons in 2025. Global gold jewelry demand in 2025 also fell to its lowest level in 5 years.

According to senior analyst Jim Wyckoff of Kitco, the April gold futures contract has formed a negative "key reversal" technical pattern on the daily chart. However, this pattern is only confirmed if additional selling pressure appears in the next session. If confirmed, this may be a sign that the market has created a short-term peak.

The next upward target of the buying side is to close above the strong resistance level at 5,626.80 USD/ounce. Meanwhile, the downward target of the selling side is to push prices below the important support level of 5,000 USD/ounce. Close-in resistance levels are 5,400 USD and 5,452.80 USD respectively; close-in support levels are 5,200 USD and the daily bottom is 5,126 USD.

The market ranking according to Wyckoff at 9.0 shows that the upward trend is still very strong, buying power overwhelms selling power and the buying side is holding market control, although some short-term adjustment signals appear.

The March silver futures contract also appeared a "key reversal" technical pattern in a downward direction. If confirmed by subsequent declining sessions, this could be a signal that the silver market is forming a short-term peak.

The upward target of the buying side is to surpass the strong resistance level at 121.785 USD/ounce, while the downward target of the selling side is to pull the price below the important support level of 100 USD/ounce. Close-in resistance levels are 115 USD and 117.50 USD; close-in support levels are 110 USD and 107.5 USD.

The market ranking according to Wyckoff at 9.0 reflects that the upward trend of silver is still very strong in the medium and long term, buyers continue to maintain a large advantage in the market, despite the risk of technical correction in the short term.

In external markets, crude oil prices rose sharply to around 65.75 USD/barrel, the highest level in 6 months. The USD index weakened slightly, while the yield on 10-year US Treasury bonds was at 4.235%.