Nhận định trên được Neils Christensen - chuyên gia phân tích của Kitco News đưa ra trong bối cảnh lạm phát tại Mỹ vẫn dai dẳng, khi giá sản xuất tăng cao hơn dự báo trong tháng trước.

According to a statement from the US Department of Labor released last Friday, the overall producer price index (PPI) increased by 0.5% in December, after a 0.2% increase in November. This figure is significantly higher than economists' forecasts, which only expected a 0.2% increase.

In the past 12 months, total wholesale inflation increased by 3.0%, according to the report.

Core PPI – excluding volatile commodities such as food and energy – increased by 0.7% in the past month, much higher than the market's forecast of 0.2%, after the increase in November. Year-on-year core PPI data shows that inflation in the manufacturing sector is gradually "deeply ingrained" in the economy as a whole, with prices increasing by 3.3%, while economists only expect 2.9%.

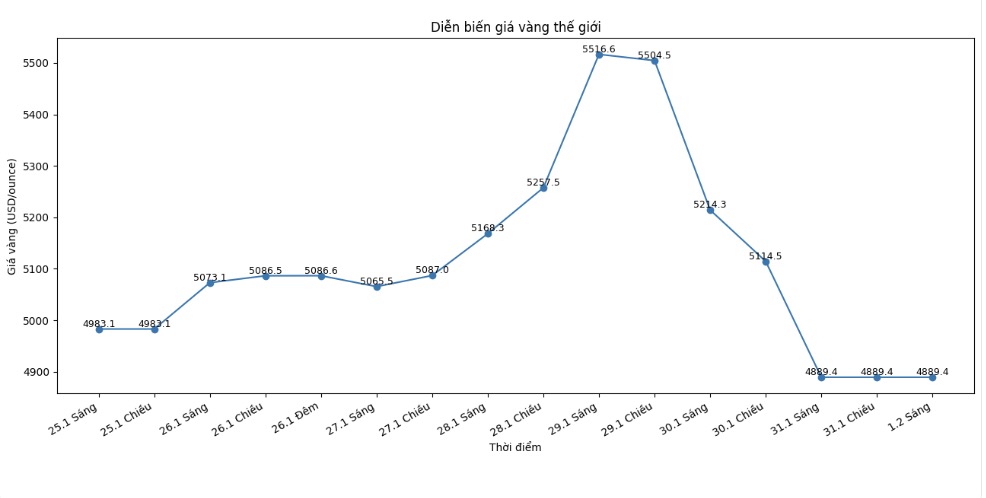

Last week, the gold market had been struggling since Thursday afternoon, and the latest inflation data is adding pressure. Spot gold prices last recorded at 5,035.8 USD/ounce, down more than 6% during the day. Currently, the price is about 10% lower than the historical peak in Thursday's session of 5,600 USD/ounce.

Although the gold market has not reacted much to US interest rates recently, analysts believe that increased inflationary pressure may cause this traditional relationship to return. High production prices may force the US Federal Reserve (Fed) to maintain a neutral monetary policy longer than expected.

Trước đó vào thứ Tư, Fed đã quyết định giữ nguyên lãi suất trong biên độ 3,50% – 3,75% và được dự báo sẽ tiếp tục duy trì lập trường trung lập ít nhất cho đến tháng 6. Chủ tịch Fed Jerome Powell cho biết, các rủi ro lạm phát theo chiều hướng tăng và rủi ro đối với thị trường lao động theo chiều hướng giảm đều đã suy giảm phần nào.

Neils Christensen nhấn mạnh rằng chính sách tiền tệ hiện nay của ngân hàng trung ương đang ở trạng thái phù hợp, cho phép Fed có thêm thời gian theo dõi diễn biến của hoạt động kinh tế trong suốt giai đoạn đến năm 2026.

Trong khi đó, ông Sean Lusk - đồng Giám đốc bộ phận phòng hộ thương mại tại Walsh Trading - cho biết giá vàng và bạc chịu áp lực từ sự hội tụ của nhiều yếu tố bất lợi.

Theo ông Lusk, thời điểm cuối tháng cùng với dữ liệu chỉ số giá sản xuất (PPI) tích cực đã hỗ trợ đồng USD tăng giá, qua đó gây sức ép lên nhóm kim loại quý. Bên cạnh đó, việc ông Kevin Warsh (người được Tổng thống Mỹ Donald Trump cân nhắc đề cử làm Chủ tịch Cục Dự trữ Liên bang Mỹ) được đánh giá là nhân vật có quan điểm “diều hâu” cũng khiến thị trường thất vọng, do trước đó nhiều nhà đầu tư kỳ vọng ông Kevin Hassett – người được xem là ôn hòa hơn – sẽ được lựa chọn. Diễn biến này trở thành cái cớ để giới đầu tư đẩy mạnh chốt lời.

Khi được hỏi về nguyên nhân chính của đợt bán tháo, ông Lusk khẳng định đây là hệ quả từ đà mạnh lên của đồng USD, chứ không phải sự suy yếu nội tại của vàng và bạc.

Today's developments completely revolve around the USD, associated with Mr. Warsh's choice," he said, while saying that expectations of a change in the'goose' direction at the Fed have not come true.

According to Mr. Lusk, the Fed is unlikely to adjust interest rates soon, regardless of who takes on the leadership role. This is what makes the sharp increase in precious metals in the middle of the week unsustainable, while paving the way for a deep correction at the end of the week.

He also noted that, from a technical perspective, the current correction is necessary, even if the market has been pushed too far in terms of supply and demand. However, he noted that the market may maintain an irrational state for a longer time than investors can bear.

However, Mr. Lusk still maintains the view that the long-term trend of gold prices is upward. According to him, in the near future, adjustments are likely to continue to attract buying power, unless a major shock like a strong correction on the stock market appears.

“Biến động đã quá lớn và thị trường rõ ràng đang cần thêm những nhịp điều chỉnh” - ông nói - “Tuy nhiên, tôi cho rằng nhà đầu tư vẫn sẽ mua vào mỗi khi giá giảm”.

According to Mr. Lusk, the most important fundamental driving force is still the fact that governments continue to ease fiscal policy and erode the value of public debt through inflation, and this factor shows no signs of changing.

See more news related to gold prices HERE...