Mr. Darin Newsom - senior market analyst at Barchart.com, frankly stated that the precious metals market is witnessing daily fluctuations of up to hundreds of USD - a rare thing in gold trading history. Notably, not only gold but also silver and copper are falling into a similarly volatile state.

Will gold increase, decrease or move sideways next week? The answer is: maybe all three. It is almost impossible to predict the direction at this time. The general trend is still upward? Yes. Is gold being overbought and vulnerable to a sell-off? Yes," Mr. Newsom said.

According to this expert, the biggest risk to the gold market today comes from political factors. Just a statement or unexpected action from the US President can immediately trigger safe-haven demand, pushing gold prices to fluctuate sharply.

Mr. Newsom expressed skepticism, whether more new information about trade policy will appear this weekend? Or there will be other unexpected geopolitical developments. Besides, there is information related to the US government's activities. "All of this puts the market in an unpredictable state, no different from playing dice" - Mr. Newsom said.

From a cautious perspective, Mr. Adrian Day - Chairman of Adrian Day Asset Management, believes that gold prices are likely to move sideways in the short term.

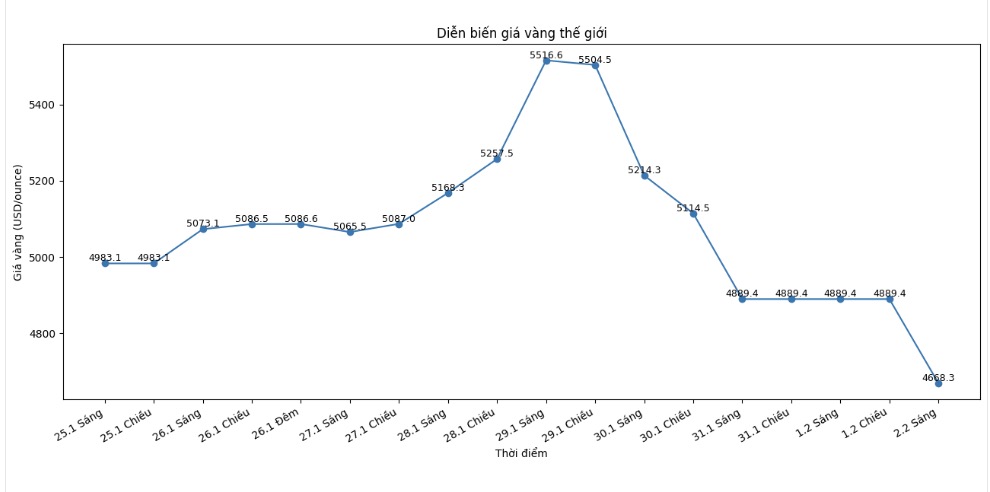

Gold needs to "release its heat" and may fluctuate in the current zone for another week or more" - he said. However, he also noted that the recent strong correction in fact only brought gold prices back to the level of the end of last month, while considering the weekly basis, gold is still trading near the historical peak.

Meanwhile, Mr. Adam Button - Head of Currency Strategy at Forexlive.com, said that "fierce" trading weeks like the recent ones will become increasingly popular as the gold market moves away from a period of smooth price increases with a low amplitude.

Just the level of volatility alone is enough to amaze people" - he said. "The past time has been a very strong but quite "smooth" price increase journey. This week is a reminder that investors can still completely lose money when trading in precious metals.

However, Mr. Button emphasized that the fundamental factors supporting the long-term upward trend of gold have not weakened. In particular, the story of the weakened USD still retains its value.

Will the view of a weaker USD change? I don't think so," he said. "Although the Treasury Secretary once tried to "reduce" that view, it was the US President who publicly mentioned it. And everyone knows, in the end, only the President is the one who decides.

According to Mr. Button, in the context that the US has a president who wants a weaker USD and is disrupting the global order, that is the most important foundation for the long-term strength of gold.

I can't imagine gold prices falling below $4,000/ounce," he added. "If gold returns to the price range starting with the number 3, buying power will appear very strong.

However, he also warned investors to prepare mentally for huge fluctuations in the near future – not only for silver but also for gold.

A period of high volatility is opening up," he emphasized. "Investors are used to the "melting" upward momentum in an environment with little volatility. But history shows that all markets with rising prices usually increase slowly by'hang cuon' and adjust quickly by'hang machine'.

According to Mr. Button, gold has not really undergone such a strong correction phase, partly due to persistent buying power from central banks every time prices fall.

The smooth price increase period has ended. The long-term trend is still upward, but the road ahead will be more bumpy and volatile" - he concluded.

See more news related to gold prices HERE...