The precious metal recovered as investors awaited the minutes of the latest meeting of the US Federal Reserve (FED) and the US employment delay report to find clues on the interest rate roadmap.

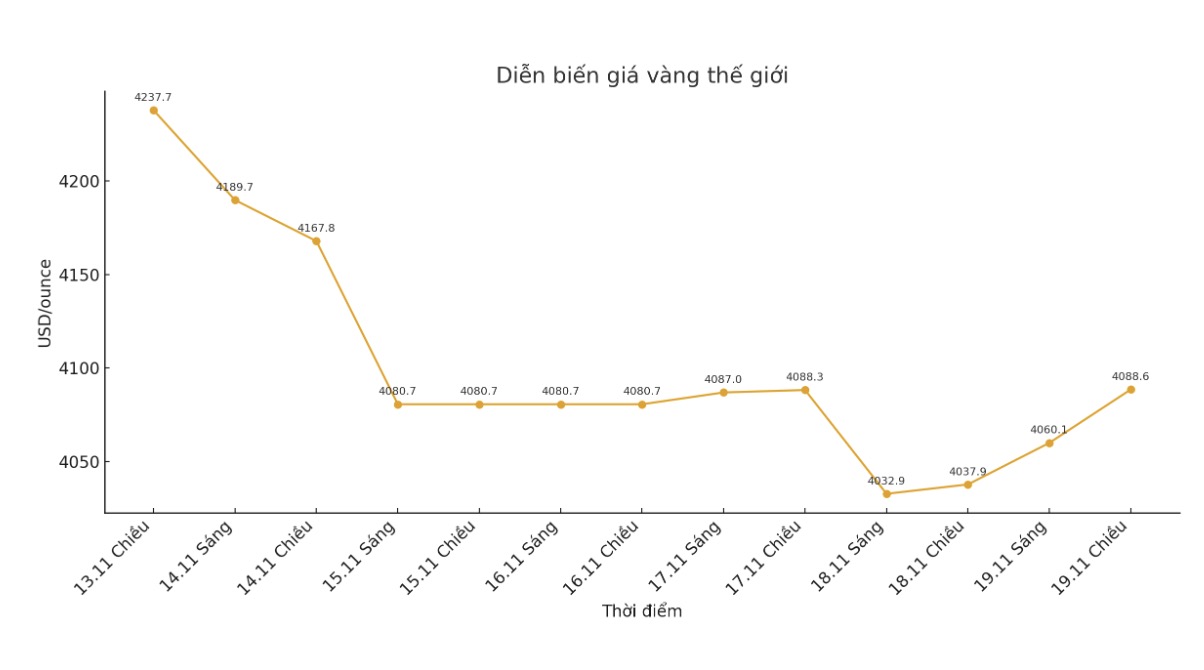

Spot gold prices rose 0.5% to $4,089.59/ounce at 6:33 a.m. GMT. December gold futures on the US exchange increased by 0.6% to $4,090.30/ounce.

Investors are now waiting for the minutes of the latest FED meeting, due to be released on the same day, along with the September non-farm payrolls report due to delays due to the US government's temporary closure.

Economists surveyed by Reuters predict that the report will show US businesses creating 50,000 more jobs in September. Data released on Tuesday showed that the number of Americans receiving unemployment benefits reached a two-month high in mid-October.

The gold rally has been partly held back by a stronger US dollar and doubts about when the Fed could cut interest rates further, said Tim Waterer, chief market analyst at Ho Chi Minh City Trade.

However, a risk-off in the market has kept gold in a favorable position as a safe asset, thereby limiting the decline.

The USD index remains strong against other major currencies. A strong US dollar makes gold more expensive for holders of other currencies.

The global stock market has turned negative this week, with the S&P 500 recording a series of four consecutive sessions of decline due to concerns about the valuation of AI stocks.

Last month, the Fed cut interest rates by 25 basis points, but Chairman Jerome Powell expressed caution about the possibility of another cut this year, partly due to a lack of data.

According to CME Group's FedWatch tool, traders are now assessing the possibility of the Fed cutting interest rates at its December 9-10 meeting at nearly 49%.

Gold - an asset that does not yield - often moves positively in a low interest rate environment and during times of economic instability.

In other markets, spot silver rose 1.3% to $51.33 an ounce; platinum rose 0.5% to $1,542.17; and palladium rose 0.8% to $1,411.86.

See more news related to gold prices HERE...