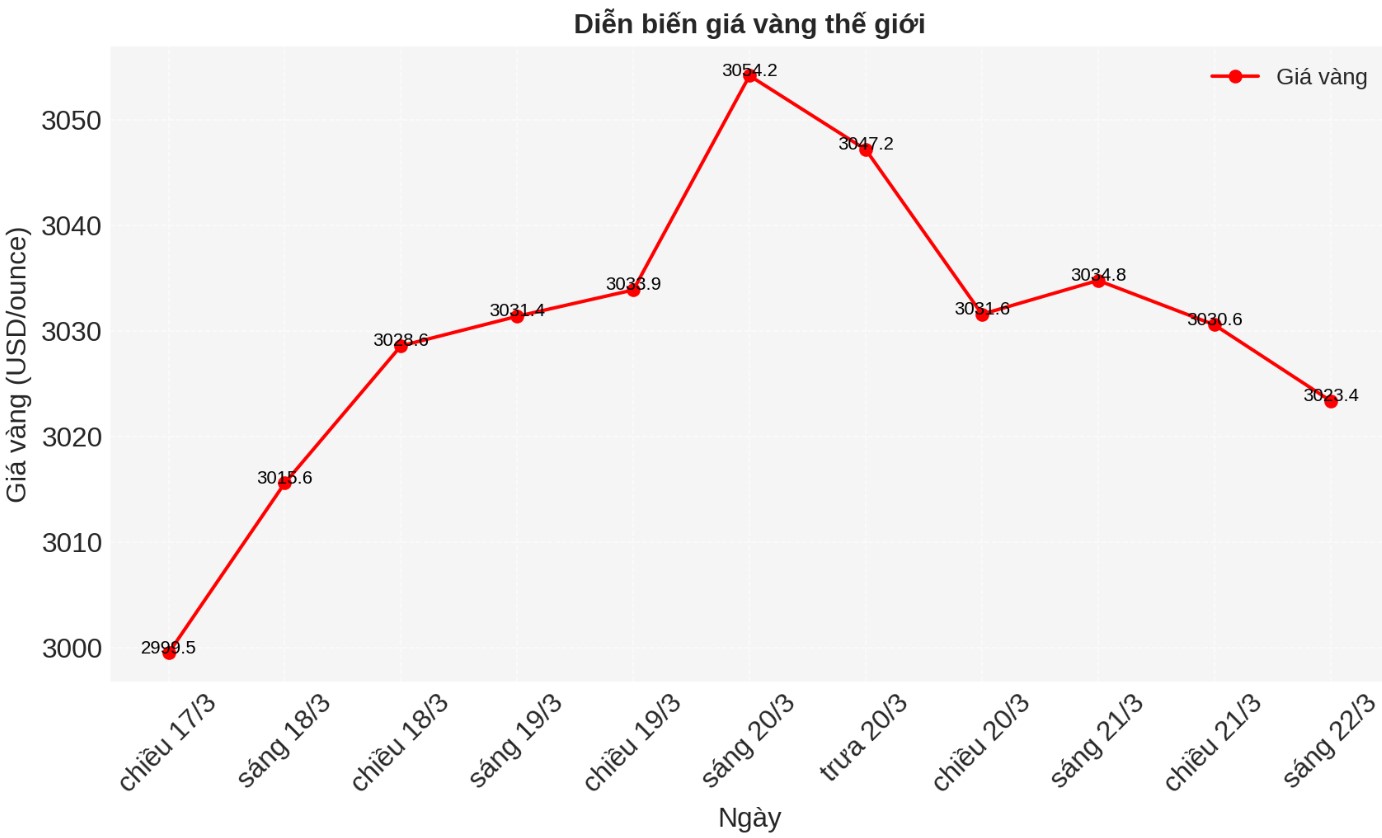

After gold prices hit a record high of over $3,050/ounce, the gold market is currently witnessing a slight profit-taking. Although gold could still hit a new high, one strategist said investors need to be cautious at current prices.

In an interview with Kitco News, Rob Haworth - Senior Strategist at U.S. Bank Wealth Management (USBWM) said its team has discussed gold more in the past 6 months than at any time in history. However, he also said that the risk for gold is not only that market instability must be maintained but also that it must be escalated to support higher gold prices.

Haworth said that with a price of $3,000/ounce, he predicted that the gold market reflected a lot of bad news about the global economy and the USD.

There is reason to say that economic instability will remain high, but at some point it will stabilize. There will be a rebalancing in trade and a decrease in global trade, but markets will adjust.

As we get past the peak of uncertainty, we need to face inflation as a major problem or as a continued weakness of the US dollar, he said.

For gold to maintain prices above current levels, Haworth believes that global interest rates will have to return to nearly zero, which he believes is unlikely.

Although the European Central Bank and the Bank of Canada continue to cut interest rates, other major central banks have switched to a more neutral stance. On Wednesday, the US Federal Reserve (FED) kept interest rates unchanged at around 4.25% and 4.50% when it said it was still concerned about inflation.

On Thursday, the Bank of England, the Swiss National Bank and the Central Bank of Sweden all kept their interest rates unchanged.

Despite paying more attention to gold, Haworth said USBWM is not ready to buy the precious metal.

"The big question for gold is whether this is a risk or an opportunity. We have not changed our decision to invest in gold because the debate on inflation is still unclear. The current level of inflation is still a factor to consider, and our forecast is that inflation will be high, around 3% to 3.5%.

However, I don't think inflation will return to 6% or 9%. This forecast is not favorable for gold compared to other defensive assets," the expert said.

Haworth said he would need to see the threat of a prolonged recession before deciding to invest in gold, which is not his base scenario.

What we are hearing from companies is that there are many delays in short-term plans due to economic instability. We think there is still enough growth in the system to overcome this. The S&P 500's profit forecast for 2025 may need to be adjusted down, but they will still be consistent with solid growth," he said.

In updated economic forecasts, the FED shows little threat of a prolonged recession. The bank has lowered its GDP growth forecast for 2025 to 1.7%, down from the 2.1% forecast in December. At the same time, the central bank increased its inflation forecast to 2.8% this year, from 2.5% previously.

Although USBWM is still hesitant to invest in gold, Haworth said that if they see the right economic conditions, the $3,000/ounce price of gold is not a significant barrier.

The good news is that the price is worryingly higher, but that is not the problem. Instead of looking at prices, the more important question is whether more people will buy gold.

There are many reasons for demand to continue to increase despite prices. Buying gold at $3,000 an ounce is not like buying Cisco at a price-to-income ratio of 100 times in 2000, he added.

Haworth said he expects gold demand from Asia to remain strong as Chinese investors continue to diversify away from the real estate and stock markets.

There is basic demand there because Chinese investors need another savings option, he said.

Although USBWM has no plans to invest in gold, Haworth said the company is focusing on global stocks and has reduced its participation in the US market.