Precious metals analysts at Heraeus (a German technology and precious metals corporation) believe that the stock market is plummeting and the growing fear of recession is boosting demand for gold.

In the latest report, analysts at Heraeus said that risk-off sentiment in the market is strengthening the appeal of gold as a safe-haven asset.

Concerns about the risk of recession in the US are returning to the center, as the stock market shows signs of weakening. The S&P 500 index has now fallen 2% since November 5, 2024, when Donald Trump was re-elected President of the United States.

On March 7, hedge funds withdrew capital from individual stocks at the same scale as in March 2020, reflecting a strong risk-off trend" - the report wrote.

Along with that, the curve of the 10-year - 2-year US Treasury yield yield difference reversed at the end of 2024, after maintaining a reversal state since October 2022.

History shows that when this curve reverses, economic recession often occurs within the next 6-12 months, placing the first quarter of 2025 at the beginning of this time frame - the analysis report.

Heraeus said this was clearly demonstrated in its term market position. Experts note: Fund managers maintain a net gold purchase status higher than the 65% of the time since January 2020. Since the beginning of 2025, the total number of open contracts for gold has increased by 10%.

In contrast, open-end silver contracts fell 13% in the last week of February alone, as the US confirmed a delay in taxation on Canada and Mexico, and warned further about global tariffs."

Notably, the shift to gold is happening even as the stock market remains strong for most of 2025 (the price decline begins on February 20).

Although the sell-off in the US stock market is still in its early stages, gold has attracted defensive capital flows.

In January, net capital flows into US gold ETFs reached 1.5 billion USD, while the figure skyrocketed to nearly 8 billion USD in February - the highest level since March 2022.

If economic data continues to weaken and trade tensions escalate, gold will continue to benefit, the report said.

Meanwhile, Jim Wyckoff - senior analyst at Kitco commented that safe-haven demand continues to be high due to concerns about the risk of global trade war, along with signals from optimistic technical charts and expectations of looser monetary policy from the US Federal Reserve (FED), helping to keep precious metal prices stable.

The focus of this week's market is the Federal Open Market Committee (FOMC) meeting, which began on Tuesday morning and ended on Wednesday afternoon with an official announcement and a press conference by Fed Chairman Jerome Powell.

Investors do not expect the Fed to change interest rates at this meeting but will closely monitor every word in the FOMC statement as well as Mr. Powell's statement.

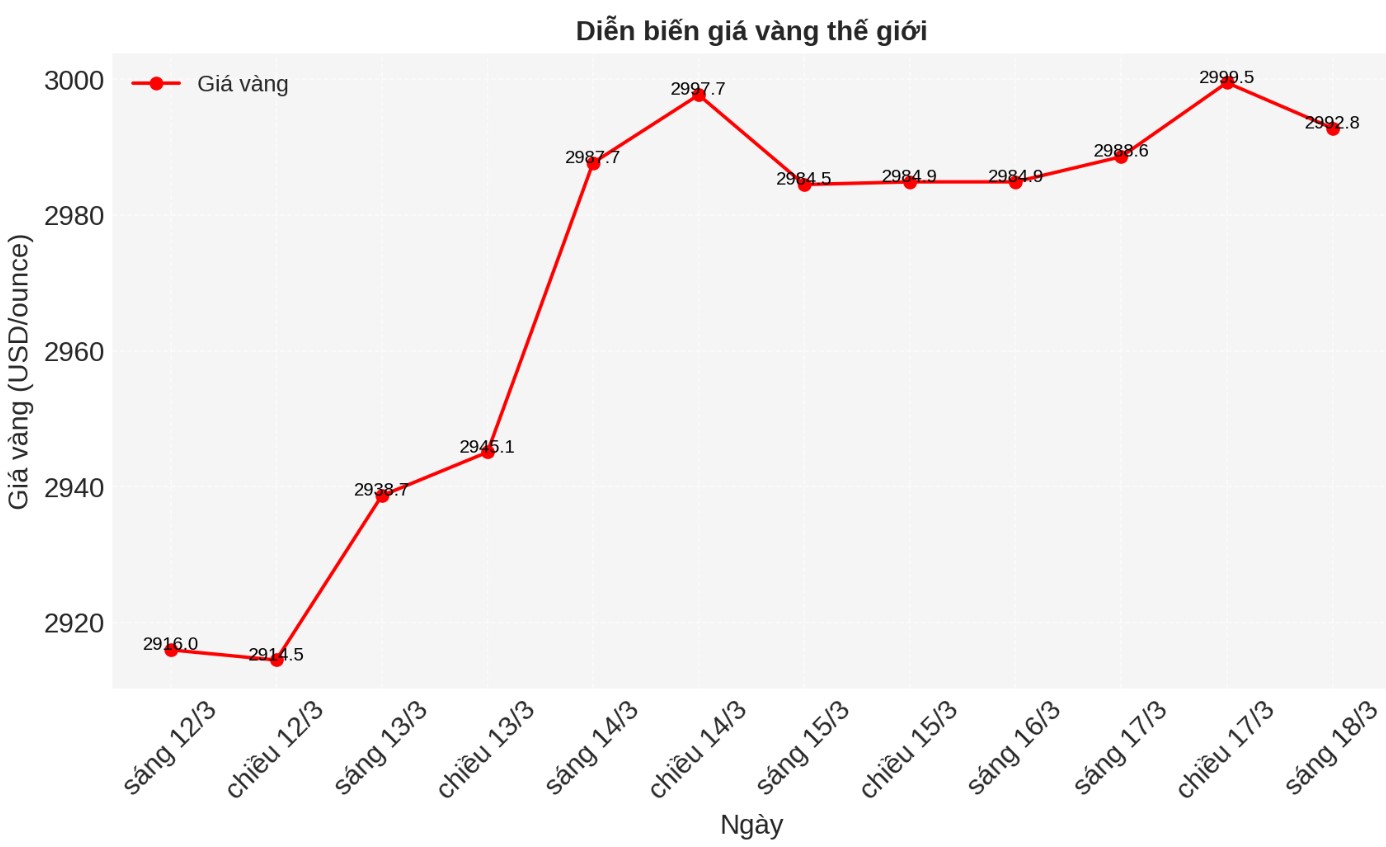

Spot gold tested support at nearly $2,980 an ounce several times on Monday, but remained steady. Meanwhile, many efforts to break above $3,000 an ounce have failed.

As of 0:00 on March 18 (Vietnam time), the spot gold price listed on Kitco was at 2,992.8 USD/ounce.

Important economic data for the week

Monday: US retail sales, Empire State Production Index.

Tuesday: Housing under construction and construction permits in the US, monetary policy decision of the Bank of Japan.

Wednesday: Fed monetary policy decision.

Thursday: Swiss National Bank and Bank of England monetary policy decision, weekly jobless claims in the US, Philly FED manufacturing survey, existing home sales in the US.