Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that gold is increasingly seen as an important monetary asset, a replacement for the USD, while silver plays an essential role in the transformation and electrification of the world economy.

In the latest report on the precious metals market, this expert believes that the recovery of gold and silver prices in the first days of the new year shows that fundamental demand is still very persistent.

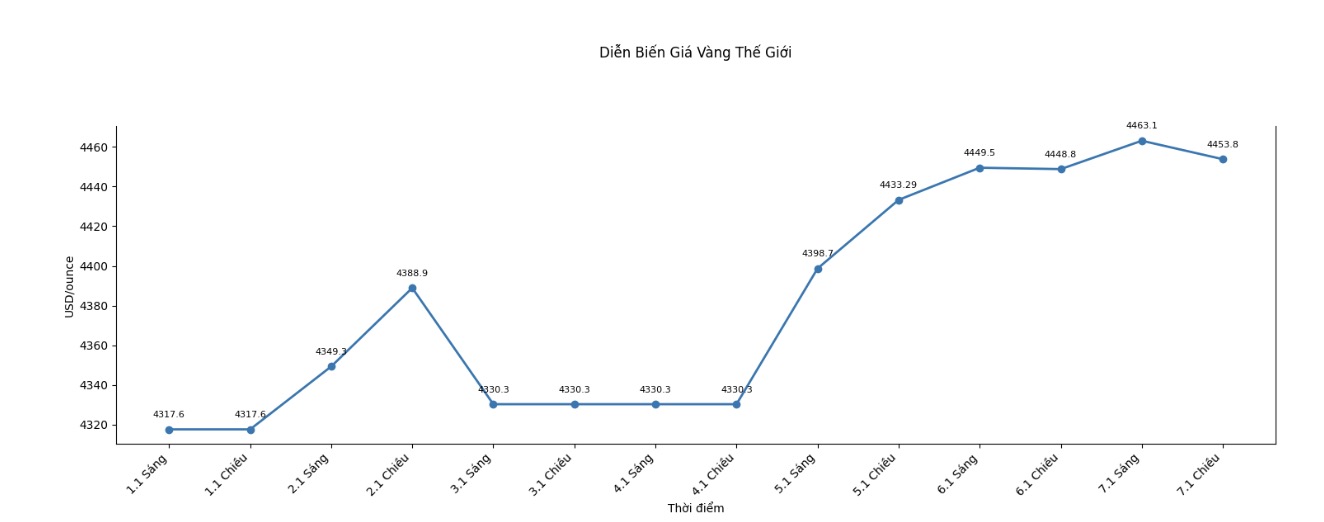

In the last trading week of 2025, both gold and silver were under strong selling pressure as market fluctuations increased, forcing the Chicago Mercantile Exchange (CME) to raise margins for speculators. However, since then, gold prices have recovered almost the entire decline, while silver has regained more than half of its lost share.

On the spot market, gold prices were traded around 4,477.5 USD/ounce, up 0.66% on the day. Spot silver prices reached about 80.24 USD/ounce, up more than 4%.

Following this early upward momentum, it can be seen that the driving forces behind the strong price increase in 2025 are still intact, not exhausted at all" - Mr. Hansen assessed.

From a macro perspective, familiar topics continue to dominate the market, from concerns about currency devaluation, long-term sustainability of public debt, to expectations that policy interest rates will fall in the later stages of the cycle and the USD will weaken. These factors continue to support demand for tangible assets such as gold and silver. "Entering the new year almost does not change the overall investment story," he said.

In a recent interview with Kitco News, Mr. Hansen said that he is optimistic about both gold and silver throughout 2026, although each metal has its own dynamics. He believes that the 5,000 USD/ounce mark is a reasonable target for gold.

According to Mr. Hansen, gold is still in a strong upward trend in the context of the world being shaped by geopolitical fragmentation, fiscal pressure and changes in the monetary union.

Meanwhile, he believes that silver has more potential, although not as a currency like gold. Although speculative demand and investment in silver have increased sharply, silver is still an important industrial metal.

Simply put, there cannot be a metal that is both a currency and directly competes with the industry. The central bank will not store a metal that the manufacturing sector depends on for survival" - Mr. Hansen analyzed. According to him, silver only accounts for a small part of the cost of finished products, but businesses cannot accept the risk of supply shortages.

Considering the gold/silver price ratio, Mr. Hansen said that in history, only when this ratio decreased to around 30 points was silver considered more expensive than gold. The overwhelming increase in silver prices in the past time has pulled this ratio down to about 55 points, the lowest level since April 2013.

Despite maintaining an optimistic view, Mr. Hansen also warned of the risk of volatility in the short term, especially when investment funds are restructuring their portfolios. The nearly 150% increase in silver prices in 2025, along with the 67% increase in gold prices, makes these two metals subject to devaluation.

After a year of strong growth in 2025 and continuing to rise to the top of 2026, index funds are forced to reduce their proportion in the strongest-growing assets and allocate them to weaker sectors. These capital flows are not sensitive to prices, technical, but can still have a significant impact in the short term," he said.

Citing data from Goldman Sachs, Mr. Hansen said that the gold market may face about 5.5 billion USD being sold, and silver about 5 billion USD.

This shows that the risk of short-term volatility in the rebalancing phase, even if there is an adjustment, is likely to stem from technical factors rather than the weakening of fundamentals" - Mr. Hansen concluded.