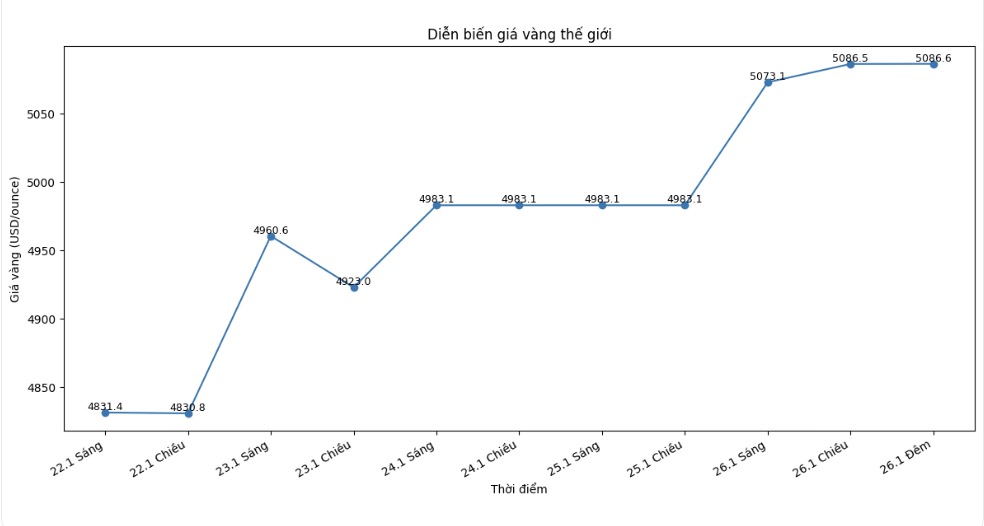

In the trading session on January 26, gold prices exceeded the 5,000 USD/ounce mark, with Comex gold futures for February delivery hitting a record high of 5,107.9 USD/ounce. Silver prices also recorded a new record, when Comex futures for March delivery rose to 110.065 USD/ounce.

According to Bloomberg, the strong increase in precious metals is driven by investors' cautious sentiment in the face of fluctuations in the financial market, especially the trend of withdrawing capital from government bonds and legal tenders. Gold continues to play its traditional role as a safe-haven asset in the uncertain period, when investors seek safety from economic and geopolitical risks.

At the most recent time, February gold futures rose 86.6 USD to 5,066.2 USD/ounce, while March silver futures rose 7.632 USD to 108.935 USD/ounce.

This week, the US Federal Reserve (Fed) and many major central banks around the world will hold monetary policy meetings. The market generally expects central banks to maintain interest rates unchanged, in the context of global economic growth still facing many challenges.

According to analyses, most members of the Federal Open Market Committee (FOMC) have a database to support maintaining current monetary policy. In addition, this week will also release many important economic data, including inflation reports in some major economies and growth data of the euro area, which are expected to provide more signals for policy orientation in the coming time.

On the currency market, the USD Index fell to its lowest level in about four months, as the USD weakened against many major currencies. This development reflects investors' cautious sentiment towards the greenback outlook, amid discussions related to exchange rate stability and monetary policy between major economies.

In another development, positive information related to diplomatic dialogue in Eastern Europe also contributes to improving global market sentiment. According to international sources, the parties involved have made some progress in exchanges and are expected to continue meetings in the near future, although there are still many issues that need to be discussed further.

In the energy sector, natural gas prices in the US soared in a short time due to the impact of colder weather than expected, while before that many investors had bet prices would decrease. This sudden reversal forced selling positions to buy off, creating the phenomenon of "short squeeze" and pushing prices up sharply.

Bloomberg said this is the strongest weekly increase in the history of the US natural gas market, and also shows the increasing level of interconnection between the US and global energy markets. This price increase may put pressure on some import markets, in the context of increased heating demand and supply facing disruption risks due to harsh weather.

Technically, the February gold futures market is maintaining a very strong upward trend. Buyers are aiming for the next target of closing prices exceeding the important resistance zone at 5,250 USD/ounce, while the short-term target of sellers is to pull prices below the support zone of 4,750 USD/ounce.

The nearest resistance levels are at 5,107.9 USD/ounce and 5,200 USD/ounce respectively, while support is at 5,000 USD/ounce and 4,950 USD/ounce. The Wyckoff method assessment at a maximum of 10 points shows that the upward trend is very strong and the buying side clearly dominates.

For March silver futures, the technical trend also leans strongly towards increasing prices. The next target of the buying side is to close above the resistance zone of 125 USD/ounce, while the selling side will have an advantage if the price falls below the support level of 100 USD/ounce.

In the immediate future, the resistance levels are at 110.92 USD/ounce and 112 USD/ounce, while the support zones are 107.5 USD/ounce and 105 USD/ounce. The Wyckoff silver index reached 10 points, reflecting the great strength of the current upward trend.

The world gold and silver market operates through two main mechanisms: the spot market and the futures market. Due to liquidity and position adjustment factors, the December gold futures contract is currently the most actively traded contract on the CME exchange.