According to Kitco, gold is still an outstanding asset as the global trade war causes the stock market to plummet

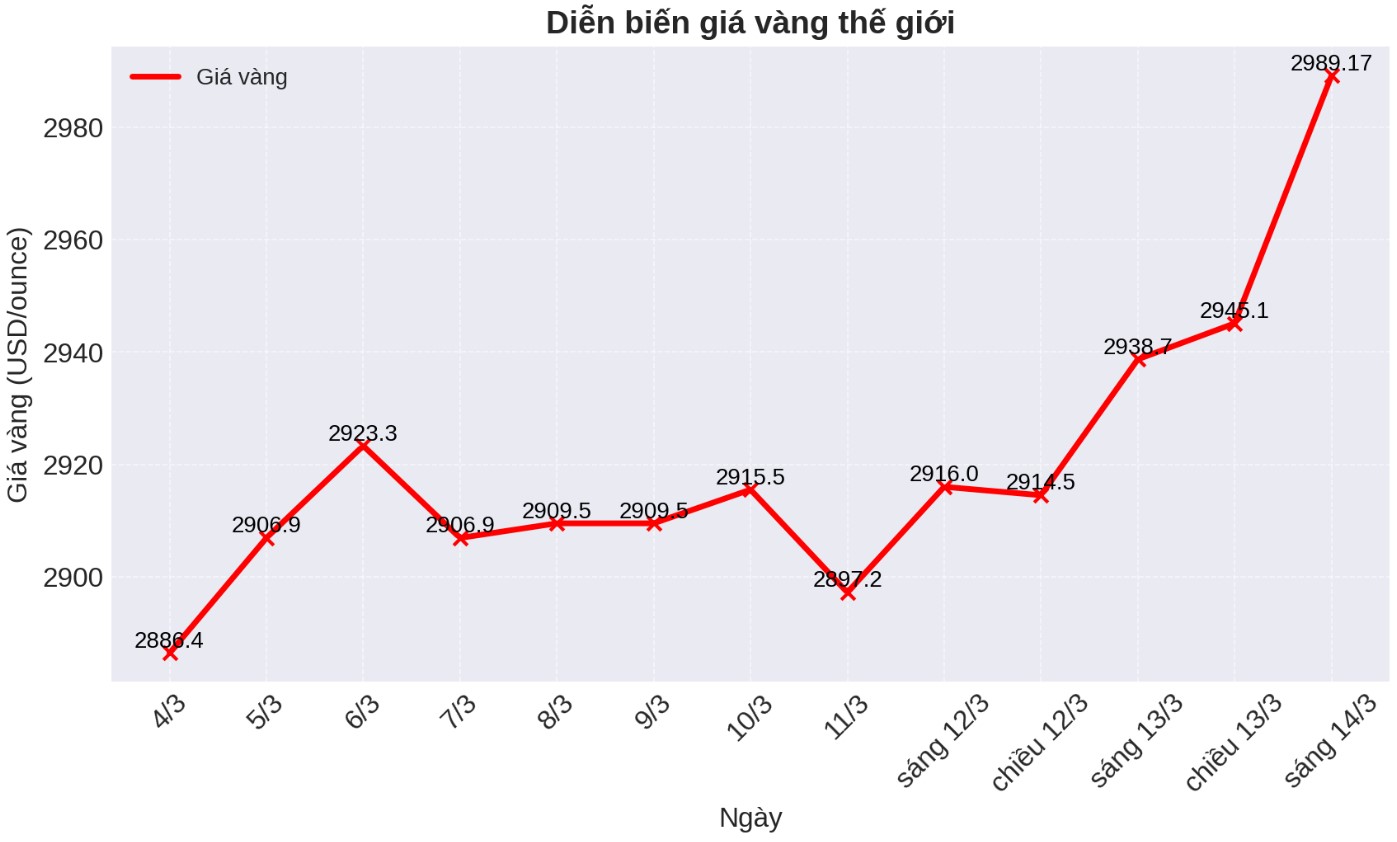

Although gold prices are setting a new record of over $2,989.17 an ounce, Ryan McIntyre, managing partner at Sprott Inc., said the precious metal is not overvalued, as demand for safe-haven assets is rising strongly.

"I think that new stocks are assets that are overvalued when considering many different indicators. When looking at what's happening in the world and comparing risks with potential profits, gold is still the top choice," McIntyre said.

This assessment was made when spot gold prices reached 2,972.1 USD/ounce, up 1.3% on the day. Meanwhile, the S&P 500 continued to decline, trading at 5,572 points, down 0.5% on the day. Since the beginning of the year, gold prices have increased by more than 13%, while the stock index has decreased by nearly 6%.

McIntyre said that not only does the stock market correction boost safe-haven demand for gold, but economic risks are escalating to the national level due to uncontrolled increases in public debt.

"The government can no longer easily rescue banks or technology companies as before, and this is a huge risk," he said.

In addition, the trend ofdeglobalization also exacerbates economic risks, as the world economy faces a new trade war. McIntyre commented that the trend of de- globalization is increasing as many countries prioritize domestic economic interests, affecting global cooperation.

Some experts believe that fiscal policies to control budget deficits can affect market confidence and international trade relations.

In addition to economic instability, McIntyre believes that the trend of de- globilization will also increase inflation, thereby boosting gold and silver prices.

He noted that in the current context, essential resources such as copper and rare earth minerals will belong to the country with the highest bid, making them an effective anti-inflation tool.

"Economic growth depends heavily on technology, so countries will need to store these resources and prices will continue to increase. The race for goods will become increasingly fierce" - he commented.

However, gold and silver still have a special position compared to other commodities thanks to their role in the monetary system. Central banks have purchased more than 1,000 tonnes of gold per year over the past three years, well above the 10-year average.

McIntyre predicts that countries will continue to increase gold reserves as confidence among Western economies is declining. He emphasized that, "Gold is a toi against independent currency because it does not take any geopolitical risks from third parties".

Demand from central banks will create a solid foundation for gold prices, while opening up opportunities for individual investors.

Although gold prices have approached $3,000/ounce, McIntyre said there are still many opportunities to enter the market. He recommends that investors can gradually buy gold as prices adjust, while allocating a portfolio with 75% gold and 25% silver.

"If you buy when prices are adjusted, you will not have to invest all your capital at one time. With this strategy, you will not have to follow the market and in the long term, I believe gold prices will continue to grow strongly" - he said.